Feb, 10 2025

Feb, 10 2025

Bitcoin Mining Profitability Calculator

Estimate your potential daily profit by comparing electricity costs across different mining locations. Based on data from the 2021-2022 Chinese mining exodus.

Estimated Daily Profit

Enter values above to see your potential profit.

Key Mining Location Comparison

| Location | Electricity Cost | Regulatory Stability | Infrastructure |

|---|---|---|---|

| Kazakhstan | $0.035/kWh | Neutral (initially) | Industrial power grid |

| Texas, USA | $0.045/kWh | Pro-mining legislation | High-density data centers |

| Russia | $0.055/kWh | Unpredictable | Hydro/nuclear power |

| Iran | $0.06/kWh | High risk | Subsidized but limited |

When China’s regulators started cracking down on crypto mining in early 2021, the industry saw the largest - and fastest - geographical shift in its history. Within months, massive mining farms packed with ASIC machines packed their boxes and set off for new power‑rich homes across the globe. The result? A redistribution of Bitcoin’s hash power that reshaped the network’s risk profile and gave birth to new mining hubs in places like Kazakhstan and Texas.

Why the crackdown mattered

China had been the heart of Bitcoin mining for years, supplying roughly three‑quarters of the world’s hash rate by late 2020. The government’s decision to target miners directly - not just traders - was a first. Provincial bans in Inner Mongolia, Sichuan, and Xinjiang were followed by a national directive that labeled mining as an “energy‑intensive activity”. The policy shift was driven by three main concerns: looming power shortages, the desire to curb financial risk, and the need to meet climate goals. Once the central committees issued the orders, local authorities acted quickly, forcing farms to either shut down or move.

The Great Mining Migration timeline

The relocation unfolded in clear stages:

- Early 2021: Provincial restrictions begin, starting with Inner Mongolia’s ban on new mining projects.

- Mid‑2021: Major farms in Sichuan and Xinjiang dismantle equipment and start shipping ASICs abroad.

- Late 2021: Global hash rate dips temporarily as hardware is in transit.

- 2022 onward: New farms reconnect in foreign jurisdictions, bringing hash rate back and surpassing pre‑crackdown levels.

This pattern highlighted the inherent mobility of Bitcoin mining - the only requirement is electricity and an internet connection.

What Chinese crypto mining exodus refers to the massive relocation of Bitcoin mining operations out of China after regulatory bans in 2021 looks like on the map

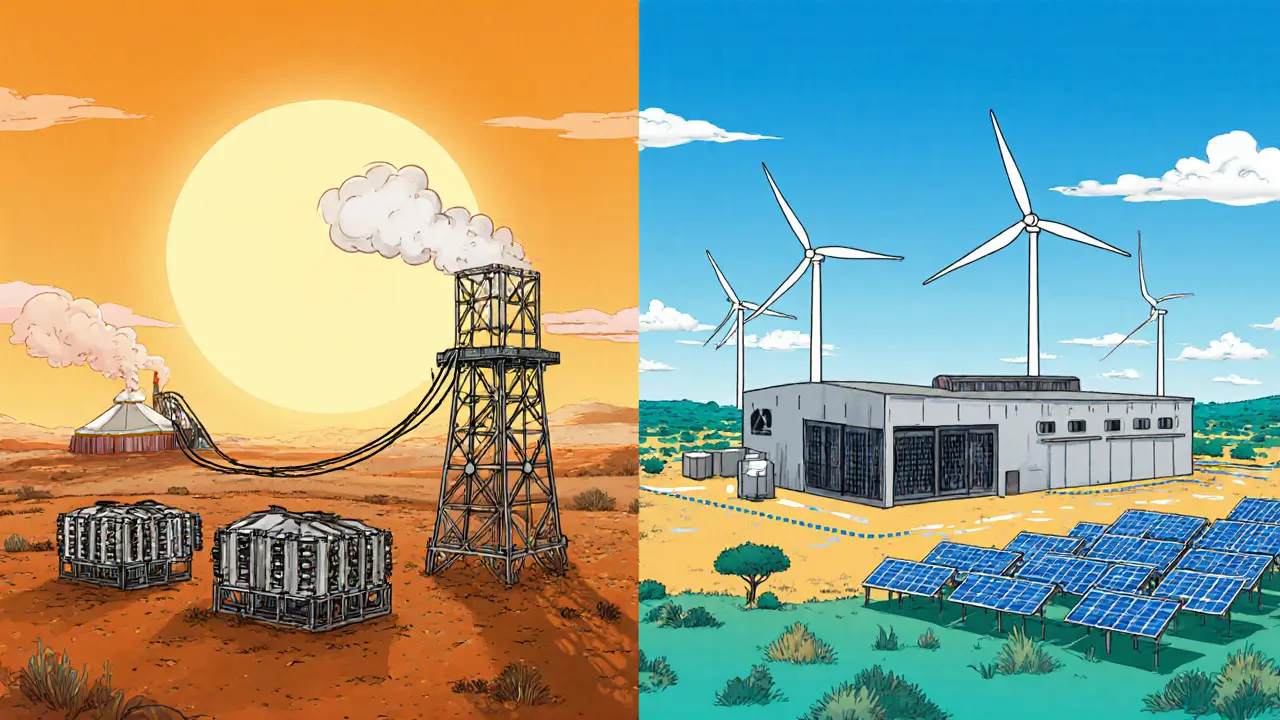

The most dramatic shifts landed in three regions:

- Kazakhstan - a Central Asian nation with cheap coal‑based power and an eager government.

- The United States, especially Texas - a deregulated energy market with abundant wind and solar.

- Other emerging hubs such as Russia, Iran, and Pakistan - each offering a mix of low‑cost electricity and permissive regulations.

Kazakhstan: The top beneficiary

Before the exodus, Kazakhstan contributed about 1.4 % of global Bitcoin hash rate. By April 2021 that share surged to over 8 %, making the country the world’s third‑largest mining power hub, overtaking Russia. Several factors explain the leap:

- Kazakhstan offers abundant coal‑based electricity at roughly $0.03‑$0.04 per kWh, among the cheapest in the world.

- Existing industrial infrastructure allowed miners to plug in ASIC farms quickly.

- The government initially welcomed the influx, seeing it as a boost for the local economy.

Environmentalists raised alarms about the carbon intensity of coal‑powered mining, but the rapid influx also helped stabilize the national grid during peak demand by providing flexible load that could be throttled when needed.

Texas, USA: A second‑largest magnet

Texas quickly became the go‑to state for miners seeking a stable, low‑cost power supply combined with a friendly regulatory stance. The state’s deregulated market lets large‑scale users negotiate directly with power generators, often locking in rates below $0.05 per kWh.

- Renewable mix: Wind and solar together power about 22 % of Texas’ grid, giving miners an increasingly green option.

- Infrastructure: The state is already home to massive data centers, so fiber and gigabit internet are plentiful.

- Legislative support: State lawmakers passed a “pro‑mining” resolution that prevents future bans on crypto‑related energy use.

Today Texas hosts roughly half of the 5.2 GW of new Bitcoin mining capacity installed across the United States, according to industry reports from Galaxy Digital a research firm that tracks crypto‑asset market trends.

Other notable destinations

While Kazakhstan and Texas absorbed the bulk of the hardware, other regions also saw meaningful inflows:

- Russia - boasts a mix of hydro, natural gas, and nuclear power, with hash rate share climbing to about 6.8 % by 2022.

- Iran - offers subsidized electricity, attracting miners despite sanctions‑related banking challenges.

- Pakistan - low‑cost diesel generators and a growing interest in blockchain technology made it a niche landing spot for smaller farms.

Each of these regions shares two common attractions: cheap energy and a regulatory environment that, for the moment, permits large‑scale mining.

What drives miners’ location decisions?

Three core variables guide the move:

| Factor | Why it matters | Typical value in top destinations |

|---|---|---|

| Electricity cost (USD/kWh) | Mining margins are highly sensitive to power price. | Kazakhstan $0.04, Texas $0.05, Russia $0.06 |

| Regulatory stability | Unpredictable bans can shut down farms overnight. | Pro‑mining policies in Texas, neutral stance in Kazakhstan. |

| Infrastructure capacity | Enough grid bandwidth and cooling to run dozens of megawatts. | Industrial power grids in Kazakhstan, high‑density data‑center hubs in Texas. |

Beyond cost, miners also look for places where they can offer demand‑response services - turning machines off during grid stress - which can earn extra revenue and improve relations with local utilities.

Impact on the Bitcoin network

The migration had an immediate effect on hash rate. As ASICs traveled, a temporary dip of about 10 % showed up in the network’s total computing power around October 2021. Once farms re‑powered in their new homes, the hash rate recovered and eventually grew past pre‑crackdown levels, reaching new all‑time highs in 2023.

From a decentralization perspective, the shift was beneficial. Concentration dropped from a single‑country dominance (>75 %) to a more distributed landscape where the top three countries each hold less than 30 % of the total. This reduces the risk of a coordinated shutdown and improves network resilience.

Local economic and energy market effects

Destination countries felt both upside and downside:

- Kazakhstan saw a surge in industrial electricity demand, prompting new power‑plant projects and higher grid utilization rates.

- Texas attracted significant capital investment for new mining facilities, creating jobs in construction, maintenance, and engineering.

- Environmental groups flagged the increased carbon footprint in coal‑heavy regions, while renewable‑rich areas like Texas highlighted the potential for greener mining.

Overall, the influx spurred grid upgrades and, in some cases, encouraged utilities to explore renewable‑fuelled mining contracts.

Looking ahead - what the next migration could look like

Industry analysts agree that the 2021 exodus set a template for future moves. If another major jurisdiction imposes strict energy caps or bans, miners will likely repeat the same pattern: evaluate power cost, regulatory risk, and infrastructure readiness, then relocate to the most attractive spot.

Current trends suggest continued growth in North America and Central Asia. The United States is seeing more state‑level incentives, while Kazakhstan is diversifying its energy mix to address carbon concerns. In the meantime, new players such as Canada’s Alberta province and Western Europe’s Iceland are gaining attention for their low‑cost, renewable power.

For anyone following Bitcoin’s security, the key takeaway is that the network’s hash power is becoming more globally balanced, making it harder for any single government to exercise outsized influence.

Key takeaways

- The 2021 crackdown triggered the largest cross‑border shift of mining equipment in crypto history.

- Kazakhstan and Texas together captured more than half of the relocated hash rate.

- Electricity cost, regulatory certainty, and grid capacity are the three decisive factors for miners.

- Decentralization improved, and local economies in host regions received both economic boosts and environmental scrutiny.

- Future migrations will follow the same formula, keeping the Bitcoin network adaptable.

Why did China target Bitcoin miners instead of just traders?

Chinese officials were more worried about the massive electricity consumption and the strain on the power grid than about speculative trading. By shutting down miners, they could quickly reduce industrial load and align with their climate and energy‑security goals.

How quickly can an ASIC farm be moved from one country to another?

Because ASIC rigs are modular, a well‑organized operation can dismantle, load, ship, and restart a 10‑MW farm within 2‑3 months. The bottleneck is usually customs clearance and the time needed to secure stable electricity contracts at the destination.

What makes Kazakhstan so attractive for Bitcoin mining?

Kazakhstan offers some of the world’s cheapest coal‑generated electricity, a permissive regulatory stance, and existing industrial power lines that can handle megawatt‑scale loads. These factors together lower operating costs dramatically.

Is mining in Texas more environmentally friendly than in Kazakhstan?

Texas benefits from a larger share of wind and solar on its grid, which can offset a portion of the mining energy mix. However, the overall carbon impact still depends on how much miners rely on natural‑gas‑fired plants versus renewables.

Will future regulatory crackdowns cause another big migration?

History shows miners react quickly to policy risk. If another major economy imposes strict energy caps or bans, we can expect another wave of relocation to regions offering low‑cost, stable power and clear regulatory guidance.

Mike GLENN

February 10, 2025 AT 17:35The story of the 2021‑2022 mining exodus is a perfect illustration of how quickly a global industry can reshuffle when policy walls go up. When the Chinese regulators announced their crackdown, miners didn’t just sit around waiting for a bailout; they grabbed their ASIC crates and started planning freight routes almost overnight. The most obvious factor was electricity cost, because a single megawatt of power can eat up half of a miner’s profit margin in a high‑price market. Kazakhstan’s coal‑heavy grid offered sub‑$0.04‑kWh rates, which made the relocation almost a no‑brainer for anyone looking to stay afloat. At the same time, Texas presented a different but equally attractive proposition: a deregulated market where large users can lock in cheap rates and a growing share of wind and solar that promised a greener face for mining. The logistical challenge of moving thousands of ASICs across continents was massive, yet most operators managed to get their hardware back online within three months, thanks to modular designs and experienced freight forwarders. This rapid redeployment forced the global hash rate to dip by roughly ten percent in the autumn of 2021, a blip that the network absorbed without any major security incidents. Once the machines settled in their new homes, the hash rate not only recovered but soon surpassed the pre‑crackdown peak, showing that the supply of compute power is truly mobile. From a decentralization standpoint, the shift was a blessing because it diluted the former Chinese dominance that had concentrated more than three‑quarters of the network’s power in a single jurisdiction. Today, the top three countries each hold less than thirty percent, meaning a coordinated shutdown would require cooperation across multiple sovereigns. The economic impact on host regions has been mixed; Kazakhstan saw a surge in industrial electricity demand and new plant construction, while Texas attracted billions in capital investment and created thousands of jobs. Environmental groups, however, raised alarms about the carbon intensity of coal‑fired plants in Kazakhstan, prompting some miners to explore demand‑response programs that can shut down rigs during peak grid stress. Meanwhile, Texan legislators have passed “pro‑mining” resolutions to protect the industry from future bans, illustrating how policy can shape the geography of hash power. Looking ahead, we can expect the same playbook to repeat if another major economy imposes strict energy caps – miners will scout for cheap, stable power and a friendly regulatory environment. In that sense, the 2021‑2022 migration set a template that will likely guide the next wave of relocations, keeping the Bitcoin network both resilient and adaptable. So whether you’re a miner, an investor, or just a curious observer, the takeaway is clear: power costs, regulatory certainty, and infrastructure capacity will continue to be the three pillars that determine where the next hashing giants set up shop.

Scott McCalman

February 17, 2025 AT 02:35Did you even realize that the whole “China crackdown” was basically a circus of policy overreach? 😱 The miners just packed up their gear and fled like it’s a Black Friday sale on ASICs. 💥 You can thank cheap coal in Kazakhstan and the Texas oil‑and‑gas‑friendly vibe for saving their wallets. 📈 The market bounced back faster than a rubber ball on a trampoline! 🎢

PRIYA KUMARI

February 23, 2025 AT 11:35The data in the article is oversimplified and ignores the environmental devastation caused by the surge in coal‑fired mining. Kazakhstan’s cheap power comes at the price of massive CO₂ emissions, and the piece glosses over the harm to local air quality. Moreover, the claim that decentralization improved is a smear; you’ve just shifted the concentration from one authoritarian regime to another with weak governance. This isn’t a win for anyone but the big mining corporations.

Jessica Pence

March 1, 2025 AT 20:35One thing to note is that the migration also pushed many small‑scale operators into the US market, which could boost local tech jobs. also the shift has forced regulators to think about how to balance energy demand with crypto growth.

johnny garcia

March 8, 2025 AT 05:35From a philosophical perspective, the relocation underscores the inherent fluidity of decentralized consensus mechanisms 🧠. When external constraints alter the economic calculus, the network self‑optimizes by redistributing computational resources to the most efficient jurisdictions 🌐. This adaptive behavior reinforces the robustness of Bitcoin’s security architecture, even as geopolitical landscapes evolve 🌍.

Andrew Smith

March 14, 2025 AT 14:35It's fascinating to see how quickly the industry pivoted and found new homes, showing real resilience. The influx of mining rigs into Texas and Kazakhstan has already sparked infrastructure upgrades that could benefit other sectors too. Let's keep an eye on how these regions manage the environmental challenges while growing their tech ecosystems.

Ryan Comers

March 20, 2025 AT 23:35USA will dominate mining and the rest will just follow our lead! 🇺🇸

Prerna Sahrawat

March 27, 2025 AT 08:35The narrative presented in the article, while factually accurate, fails to capture the nuanced interplay between geopolitics and technological migration, a discourse that warrants a more erudite treatment. One must consider the sociopolitical ramifications of transposing an industry rooted in the digital ether onto the terrestrial scaffolding of a nation’s energy grid. The indiscriminate glorification of “cheap electricity” glosses over the ethical quagmire of exploiting fossil‑fuel subsidies in developing economies. Moreover, the portrayal of decentralization as a simplistic metric belies the deep‑seated power dynamics that persist beneath the surface. It is incumbent upon analysts to dissect not merely the statistical outcomes but also the cultural reverberations that accompany such massive relocations. Only through such a multilayered examination can we truly appreciate the transformative impact of this exodus on the global crypto landscape.

Joy Garcia

April 2, 2025 AT 18:35While some celebrate the so‑called “American mining boom,” one must ask who really profits when the grid’s carbon footprint balloons behind a veil of patriotism. The mainstream narrative conveniently ignores the clandestine deals between power utilities and mining conglomerates, a dance that benefits the elite while the average citizen bears the hidden costs. Remember, every time a new rig lights up, a silent pact is forged to keep the truth buried under layers of glittering hype.