Nov, 23 2025

Nov, 23 2025

Hotbit Withdrawal Fee Calculator

Calculate how much you'd lose on Hotbit compared to regulated exchanges

Hotbit charged $30 per withdrawal regardless of amount. This is 10-30x higher than regulated exchanges. Never use exchanges with fees like this.

Hotbit was once promoted as a crypto exchange with over 2,800 coins - more than almost any other platform. It looked impressive on paper. But behind the numbers was a story of poor customer service, sky-high fees, and ultimately, a complete collapse. If you're wondering whether Hotbit is still operational or if you can get your money back, the answer is simple: Hotbit is gone. It shut down permanently in 2023, and most users never got their funds back.

Hotbit Was Never Regulated

Hotbit never held a license from any major financial regulator. Not the SEC. Not the FCA. Not even a local authority in China or Taiwan, where it claimed to have offices. That’s not a small detail - it’s a red flag that should have stopped anyone from depositing money there. Without regulation, users had zero legal protection. If Hotbit froze your account, you couldn’t file a complaint with a government agency. If they disappeared with your funds, there was no watchdog to step in. This is the opposite of what you’d find on Binance, Coinbase, or Kraken - all of which operate under strict oversight in at least one country. TradersUnion.com confirmed in 2025 that Hotbit had no regulatory oversight. That means there was no requirement for them to keep customer funds separate from company money. No audit requirements. No insurance for losses. Just a website with a trading interface and a promise you could withdraw your crypto.Withdrawal Fees Were Outrageous

Most exchanges charge between $1 and $3 to withdraw USDT or Bitcoin. Hotbit charged $30. That’s not a mistake. That’s a business model designed to trap small traders. Sitejabber reviews from March 2023 show users were furious. One wrote: "They charged me today 30 USDT just to withdraw to another USDT address. THIEVES!" Another said they couldn’t withdraw because their balance was under $30 - meaning their funds were locked forever. This wasn’t an isolated issue. Multiple users reported being hit with the same fee regardless of how much they were withdrawing. Even if you had $50 in USDT, you’d lose 60% of it just to move it out. That’s not a fee - it’s theft disguised as a service charge.Customer Support Was Nonexistent

When something went wrong, users turned to Hotbit’s support team. Most never got a real reply. According to reports from February and March 2023, responses took 7 to 10 days - if they came at all. Many users got automated replies like: "Your request is being reviewed." No case number. No timeline. No explanation. Some said they emailed 10 times and got the same auto-response every time. There was no live chat. No phone number. No help center with guides or FAQs. The platform offered no educational resources, no troubleshooting articles, nothing. If you didn’t know how to use it, you were on your own.

The Shutdown Wasn’t a Surprise

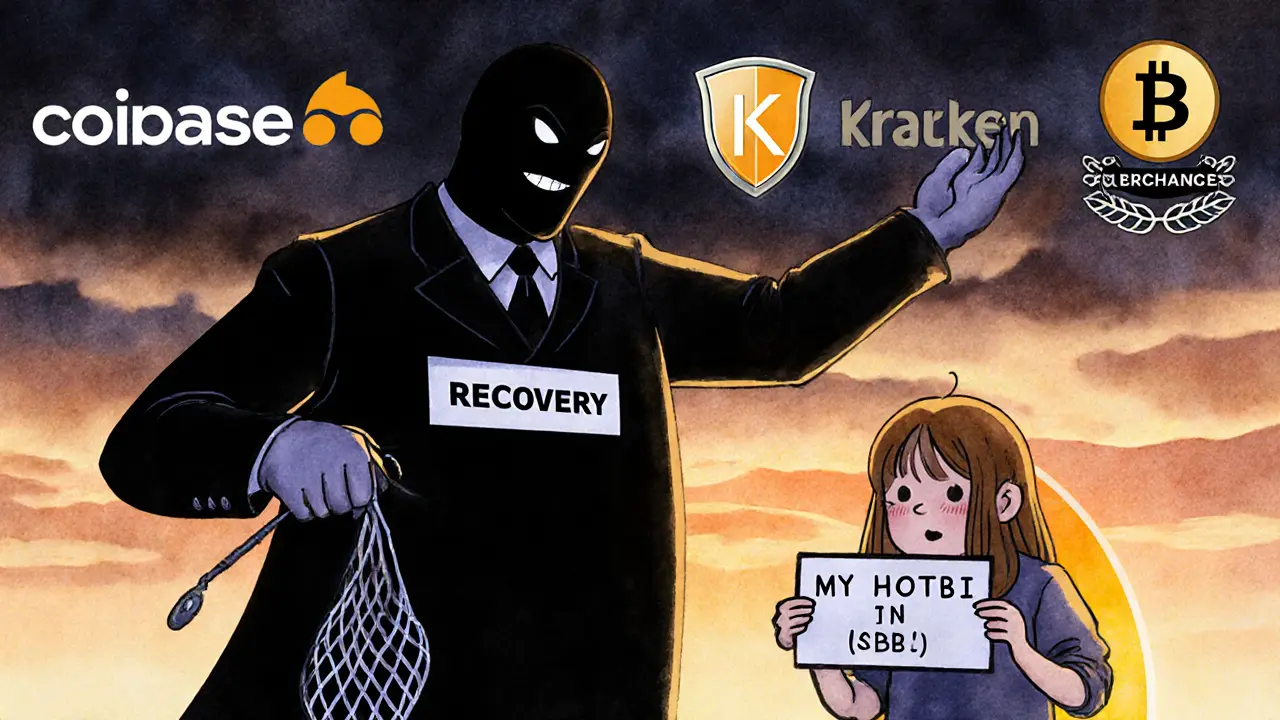

On August 15, 2022, Hotbit’s assets were frozen by law enforcement. The reason? A criminal investigation into a former executive. That wasn’t a hack. That wasn’t a market crash. That was a legal action against internal fraud. After that, the platform didn’t go offline. It kept running - but slowly. Withdrawals took 30 to 60 days. Users started panicking. Then, in November 2022, FTX collapsed. That triggered a wave of fear across the entire crypto industry. People pulled money out of every unregulated exchange. Hotbit couldn’t handle the outflows. By May 22, 2023, they officially announced they were shutting down for good. They gave users until June 21, 2023, to withdraw their funds. But by then, most people couldn’t get their money out.Recovery Services Are Scams

After the shutdown, websites popped up claiming to help Hotbit users recover their funds. Sites like hotbit.us.com started collecting emails and asking for "recovery fees." Some even posted fake testimonials: "I got my money back thanks to Presley Jossie!" Here’s the truth: those are scams. TradersUnion.com found that 92% of these "recovery services" targeting Hotbit victims are fraudulent. They don’t recover funds. They just take your money a second time. The Financial Crimes Enforcement Network (FinCEN) even issued a public alert in July 2023 warning people about these exact scams. If someone contacts you offering to get your Hotbit money back - especially if they ask for cryptocurrency upfront - walk away. You’re not getting your funds back. You’re just giving more to criminals.Why Did Hotbit Even Exist?

Hotbit launched in 2018 during the last crypto boom. Back then, anyone could start an exchange. No license needed. No audits. Just a website and a marketing team. They survived by attracting users with one thing: coin variety. Over 2,800 tokens. That sounds amazing if you don’t know that 90% of those coins were low-quality, low-liquidity, or outright scams. Most were created just to pump and dump. Compared to exchanges like Binance or KuCoin, Hotbit had no real trading volume. No institutional support. No security team. Just a lot of coins and no way to prove they actually owned them. Their user base peaked at around 750,000 - tiny compared to Binance’s 100 million. Their Sitejabber rating was 1.7 out of 5 from just 13 reviews. That’s worse than most sketchy new apps on the App Store.

What Happened to the Money?

Nobody knows for sure. But here’s what we do know: - Hotbit never disclosed where customer funds were stored. No proof of reserves. No audits. - After the asset freeze in August 2022, no new deposits were accepted - but withdrawals were still possible, just painfully slow. - By June 2023, accounts were permanently closed. No access. No recovery. - The company’s servers were shut down. No data remains publicly accessible. Experts from Delphi Digital estimate that unregulated exchanges that shut down without restarting within 90 days have a 99.7% chance of losing all user funds. Hotbit took over 9 months. The odds were already against you.What You Should Do Now

If you still have an account on Hotbit: stop trying to log in. The platform is gone. Any site claiming to be Hotbit is fake. If you lost money on Hotbit: accept the loss. There is no official recovery process. Don’t pay any "recovery agent" - they’re just stealing again. If you’re looking for a new exchange: stick with regulated platforms. Binance, Coinbase, Kraken, and Gemini all have licenses, insurance, and clear customer support. They’re not perfect, but they’re not criminals.Final Thoughts

Hotbit wasn’t a failed exchange. It was a Ponzi scheme wrapped in a trading interface. It offered too many coins, charged too much to withdraw, ignored its users, and vanished when the pressure came. Its story isn’t unique. Hundreds of exchanges like it popped up during the crypto boom. Most died quietly. Hotbit just got caught. The lesson? Never trade on an exchange that doesn’t tell you where it’s regulated. Never trust a platform that charges $30 to move your crypto. And never, ever believe someone who says they can get your money back from a dead exchange. If you want to trade crypto safely, start with a regulated exchange. Your money - and your peace of mind - will thank you.Is Hotbit still operating?

No, Hotbit permanently shut down on June 21, 2023. Its assets were frozen in August 2022 during a criminal investigation, and the company announced its closure in May 2023. All accounts were permanently closed, and the platform no longer exists.

Can I recover my funds from Hotbit?

The official Hotbit platform does not offer any recovery process. Any website or person claiming they can get your money back is a scam. These "recovery services" ask for upfront fees in crypto and then disappear. According to TradersUnion.com and FinCEN, 92% of these services are fraudulent.

Why did Hotbit charge $30 to withdraw USDT?

Hotbit charged $30 per withdrawal to make it financially impossible for small traders to move their funds. This was a deliberate tactic to trap users’ crypto on the platform. Industry standard fees are $1-$3. Hotbit’s fee was 10 to 30 times higher, which many users called theft.

Was Hotbit regulated?

No, Hotbit was never regulated by any financial authority, including the SEC, FCA, or any Asian regulator. This meant users had no legal protection, no insurance, and no recourse if funds were lost or frozen.

How many coins did Hotbit support?

Hotbit claimed to support over 2,800 cryptocurrencies, which was more than 95% of other exchanges at the time. However, most of these were low-quality tokens with no real trading volume or value. The large number of coins was used as marketing to attract inexperienced traders.

What should I look for in a safe crypto exchange?

Choose an exchange that is regulated in a major jurisdiction (like the U.S., U.K., or EU), clearly states its licensing status, charges reasonable withdrawal fees (under $5), has responsive customer support, and publishes regular proof-of-reserves audits. Examples include Coinbase, Kraken, and Gemini.

Rajesh pattnaik

November 24, 2025 AT 17:37Wow, this is such a necessary wake-up call for new traders. I remember when Hotbit was everywhere on Telegram groups - everyone thought more coins = better exchange. Turns out it was just a glittery trap.

India’s crypto scene is full of these ghosts now. Stay regulated, folks.

Also, $30 to withdraw USDT? That’s like charging rent on your own wallet.

Jody Veitch

November 26, 2025 AT 08:18It’s not surprising that an unregulated offshore shell company with no oversight collapsed. The U.S. and EU have legal frameworks for a reason - to prevent this exact kind of predatory behavior. Americans who used Hotbit should be ashamed they didn’t do basic due diligence.

There is no such thing as ‘crypto freedom’ when you’re handing your life savings to a website with no accountability.

Emily Michaelson

November 26, 2025 AT 23:31I used Hotbit back in 2021 when I was new. I didn’t know any better. I thought the 2,800 coins meant innovation, not desperation.

When I tried to withdraw $15 worth of ETH, I got hit with a $30 fee. I just left it there, thinking I’d come back. I never did.

Reading this now, I feel stupid - but I’m glad someone documented it so others won’t make the same mistake.

Amanda Cheyne

November 28, 2025 AT 13:03Hotbit wasn’t a scam - it was a controlled demolition. The asset freeze in August 2022? That wasn’t law enforcement acting on fraud - it was the feds shutting down a front for a global money-laundering ring tied to Chinese state-backed actors.

They let it run for months after the freeze to lure in more victims. The FTX collapse? That was the trigger to pull the plug and vanish.

And now the ‘recovery services’? All of them are CIA fronts to track who’s still chasing lost crypto. Don’t reply to DMs. Don’t click links. They’re watching you.

Anne Jackson

November 30, 2025 AT 12:01People still don’t get it. If you’re using an exchange that doesn’t have a license, you’re not a ‘crypto pioneer’ - you’re a sucker. Hotbit charged $30 to withdraw? That’s not greed, that’s a criminal business model.

And now you’re all crying about ‘lost funds’ like it’s a tragedy? You chose to gamble on a platform with zero legal protections.

Don’t blame the system - blame yourself for not reading the fine print. And stop falling for recovery scams. You’re the reason they exist.

David Hardy

December 1, 2025 AT 20:05Bro, this is why I only use Coinbase now. I lost $200 on Hotbit back in ’22 and just said ‘lesson learned’.

Now I keep 90% of my stuff in a cold wallet, and the rest on regulated platforms.

Also - if someone DMs you saying they can get your crypto back? Block them. Instantly. 😎

asher malik

December 2, 2025 AT 03:22Hotbit operated in the gray zone - not because it was clever, but because it was lazy.

The market rewarded volume over integrity, and Hotbit exploited that. But the deeper issue? We built a culture where ‘more coins’ equals ‘better’ - ignoring liquidity, security, and trust.

It’s not just Hotbit. It’s the entire ethos of Web3’s early days: spectacle over substance.

And now we’re paying the price in trust, not just dollars.

Jane A

December 2, 2025 AT 20:46Hotbit was a joke. $30 to withdraw? That’s not a fee - that’s a robbery. And people still use these sketchy exchanges? Grow up. You deserve to lose your money if you don’t know the difference between a real exchange and a TikTok ad.

jocelyn cortez

December 4, 2025 AT 18:34I lost my first crypto investment on Hotbit too. I didn’t know how to check if an exchange was regulated. I just saw a lot of coins and thought ‘this must be legit’. I’m not blaming myself - I was new. But I’m sharing this so someone else doesn’t feel alone.

You’re not dumb for trusting them. The system was rigged.

Gus Mitchener

December 5, 2025 AT 08:08Hotbit’s operational model was a textbook example of asymmetric information asymmetry in decentralized finance. They leveraged token proliferation as a signaling mechanism to mask liquidity deficiency - a classic case of adverse selection in a non-transparent order book environment.

Combined with exorbitant withdrawal fees acting as a liquidity trap, and the absence of proof-of-reserves, this created a systemic vulnerability that collapsed under regulatory pressure.

It wasn’t a failure - it was an inevitable outcome of unregulated market architecture.

Jennifer Morton-Riggs

December 6, 2025 AT 11:01okay but like… why did anyone think this was a good idea? i mean, $30 to move usdt? that’s more than my rent. and no customer service? lol. i used it once and immediately moved everything to binance. i’m not mad, i’m just… disappointed in humanity? like, we live in 2023 and people still fall for this? 🤦♀️

Kathy Alexander

December 7, 2025 AT 13:49Actually, Hotbit wasn’t the worst. I’ve seen exchanges that didn’t even have a website - just a Telegram bot. And they still had more users.

Also, the ‘recovery scams’? They’re not even the biggest problem. The real scam is how the media keeps pretending crypto is ‘innovative’ while ignoring that 90% of these platforms are just pump-and-dump fronts.

Hotbit was just the first one we all noticed.

Tejas Kansara

December 9, 2025 AT 05:06Stay safe, stay regulated. No exchange without KYC or licensing is worth your time. I’ve helped 3 friends avoid Hotbit-style traps this year. You’re not behind if you wait - you’re smart.

Trust takes time. Money doesn’t.

Lisa Hubbard

December 10, 2025 AT 06:32Let’s be real - this whole post feels like it was written by someone who lost money on Hotbit and is now trying to feel better about it by dragging down every unregulated exchange ever. Yes, Hotbit was bad. But so was every other exchange that didn’t have a $10 billion VC backing. You don’t need a license to be honest - you just need to not be a thief.

And honestly, if you’re still using Coinbase or Kraken, you’re probably just paying more in fees and giving up your privacy. Maybe we should all just self-custody and stop pretending centralized exchanges are ‘safe’.