Apr, 25 2025

Apr, 25 2025

Peso-to-Stablecoin Value Calculator

Current Exchange Rates

As reported in latest market data

Official bank rate

Black market rate

Convert Pesos to US Dollars

Results

Banks: $200 max/month at 950 ARS/USD

Black market rate at 1,600 ARS/USD

$200 at official rate vs $0.00 at blue market rate

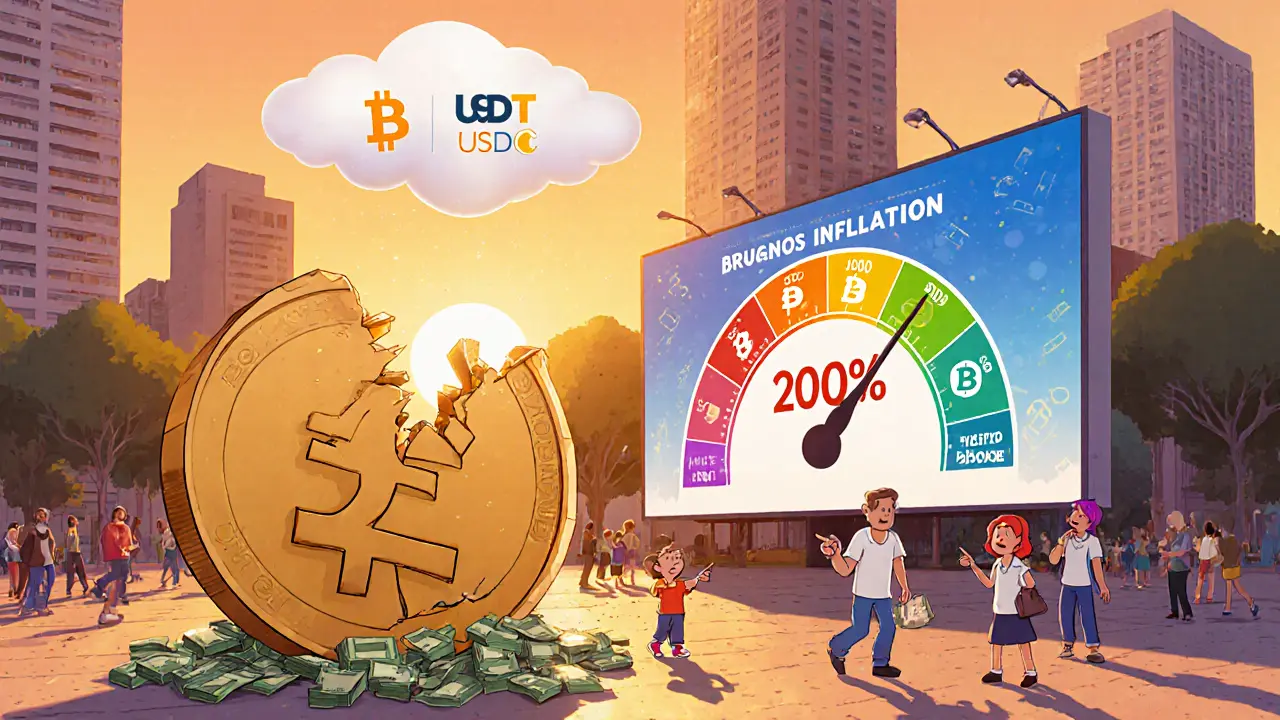

Argentine peso is the official currency of Argentina that has faced severe instability, hyperinflation, and devaluation since 2022. When the peso swings wildly, everyday people look for ways to protect their savings, and that search has turned many eyes toward cryptocurrency adoption. This article pulls together the latest data on inflation, capital controls, and crypto usage to explain why Argentina has become a hotspot for digital money.

Why the Peso Has Lost Its Anchor

In 2023 Argentina recorded a staggering 200% year‑over‑year inflation, a level that pushes basic groceries beyond reach for most families. The central bank has tried to steady the currency by keeping the official dollar band between 948 and 1,475 pesos, yet it spent roughly $1.1 billion in foreign‑exchange interventions last year. Even with these measures, the peso continues to lose value, prompting the United States to discuss swap lines and debt purchases as external stabilizers-options that many locals view with skepticism.

Capital Controls Lock Out the Dollar

Official banks allow only $200 per person per month at the official exchange rate. Anything beyond that pushes citizens into the “blue dollar” market, where the exchange rate can be twice the official price. This restriction creates a huge gap between the amount of foreign currency a person can legally hold and the amount they need to buy everyday goods priced in dollars.

Stablecoins Fill the Gap

Stablecoins are digital tokens pegged 1:1 to the US dollar, offering a crypto‑based way to hold dollar value without traditional banking limits. In Argentina, 89% of all crypto activity on centralized exchanges goes toward stablecoin purchases, the second‑highest share in the world after Colombia. The three most popular stablecoins are USDT (Tether), USDC (USD Coin), and DAI.

Spotlight on the Top Stablecoins

| Token | Issuer | Transparency feature | Typical use case in Argentina |

|---|---|---|---|

| USDT | Tether Ltd. | Monthly reserve attestations | Quick conversion from pesos for daily spending |

| USDC | Centre Consortium (Coinbase, Circle) | Real‑time reserve dashboard | Cross‑border remittances |

| DAI | MakerDAO | Collateral composition published on‑chain | Long‑term wealth preservation |

Bitcoin’s Role as a Store of Value

Bitcoin is the first cryptocurrency, often used as a hedge against fiat‑currency inflation. While stablecoins dominate short‑term transactions, Lemon’s data shows that more Argentines now hold Bitcoin than any other crypto‑dollar asset on the platform. Users cite Bitcoin’s scarcity and global recognition as reasons to allocate a portion of savings to the digital gold.

How Local Exchanges Enable Fast Adoption

Lemon is a Argentine cryptocurrency exchange that offers instant peso‑to‑stablecoin conversion. On 14 September 2024, Lemon recorded its highest daily stablecoin volume, a clear reaction to political uncertainty that week. The onboarding process takes under an hour for most users-just an ID scan, a bank‑link, and a few clicks to move pesos into USDT or USDC.

Analytics from the Field

Chainalysis reports that stablecoin usage in Argentina is primarily a hedge against “chronic inflation and capital controls.” The Milken Institute calls crypto a “practical wealth‑preservation tool” as annual inflation regularly tops 100 %. Ignacio Gimenez, business manager at Lemon, notes, “electoral uncertainty is driving Argentines to seek refuge in currencies stronger than the peso, such as the crypto dollar.”

Comparing Crypto to Traditional Options

When you compare the effective cost of holding dollars via the official bank route versus a stablecoin, the difference is stark. The official channel caps you at $200/month at a rate of about 950 ARS/USD, while the blue dollar can be as high as 1,600 ARS/USD. Stablecoins let you bypass both limits: you exchange pesos at the market rate you find on the exchange, then instantly hold a token that tracks the US dollar 1:1. No monthly caps, no paperwork, and transfers settle in seconds.

Regional Context: Argentina in Latin America’s Crypto Landscape

Latin America processes about $1.5 trillion in crypto transactions annually. Brazil leads with $140 billion, followed by Mexico ($71 billion), Venezuela ($44 billion), and Colombia ($44 billion). Argentina sits at $93.9 billion, making it the second‑largest market despite a population only one‑fifth the size of Brazil’s. The common thread across the region is inflation‑driven demand, but Argentina’s spike in stablecoin usage is uniquely tied to its strict capital controls.

Regulatory Moves and Future Outlook

Argentina’s government has introduced a regulatory sandbox and started licensing virtual‑asset service providers (VASPs). This framework gives businesses like Lemon a clearer legal footing while still leaving room for uncertainty. Analysts predict that as long as the peso remains volatile, crypto adoption will keep climbing. Some forecast that Argentina could become a regional hub for crypto infrastructure, spawning more local DeFi projects and even sovereign‑grade token initiatives.

Practical Tips for Argentines Considering Crypto

- Start with a reputable exchange (e.g., Lemon) to move pesos into USDT or USDC quickly.

- Use DAI if you want on‑chain transparency about collateral backing.

- Allocate a small portion of savings to Bitcoin for long‑term protection against inflation.

- Keep an eye on political events; stablecoin volumes often spike around elections.

- Stay updated on regulatory announcements - a new VASP license could affect withdrawal limits.

Conclusion: When Money Gets Unstable, Digital Wins

The Argentine peso’s relentless devaluation has turned crypto from a speculative hobby into a daily financial tool. Stablecoins act as a digital dollar that sidesteps official caps, while Bitcoin offers a hedge for those thinking further ahead. As long as the peso remains shaky, the crypto ecosystem-exchanges, stablecoins, and emerging DeFi services-will keep expanding, reshaping how Argentines save, spend, and send money.

Why do Argentines prefer stablecoins over the US dollar?

Stablecoins let users hold a dollar‑pegged asset without the $200 monthly cap imposed by banks and without dealing with the blue‑dollar premium. Transactions settle instantly and can be moved across borders with minimal fees.

Is Bitcoin a safe hedge against Argentina’s inflation?

Bitcoin’s limited supply and global acceptance make it a reliable long‑term store of value. However, its price can be volatile, so most users allocate only a modest portion of their portfolio to it.

How quickly can I convert pesos to a stablecoin?

On platforms like Lemon, the process takes under an hour: register, verify ID, connect a bank account, and execute the conversion. Funds appear in the stablecoin wallet instantly.

What regulatory risks should I watch for?

Argentina is still shaping its crypto rules. New licensing requirements or tax changes could affect how exchanges operate or how gains are reported. Stay informed through official announcements and reputable news sources.

Can I use crypto for everyday purchases?

Yes. Many merchants accept USDT or USDC via QR‑code payments, and platforms like Mercado Pago are integrating crypto wallets for direct payments, eliminating the need for conversion back to pesos.

Cynthia Chiang

April 25, 2025 AT 16:15Living through the peso's roller‑coaster can feel like trying to catch a train that never stops moving. I’ve talked to dozens of families who say their wages evaporate before they even reach the grocery aisle. When the official dollar band feels like a joke, people start looking for anything that holds value longer than a week. Stablecoins and Bitcoin have become the new safety‑nets, and that’s not just hype; the data shows a 70% jump in crypto wallet openings last year. It’s understandable that you’d feel frustrated; the government’s controls make everyday budgeting feel like a high‑stakes game. The “blue dollar” premium is a brutal reminder that the official rate is a mirage. By moving pesos into USDT or USDC on platforms like Lemon, users can sidestep the $200 monthly cap that banks impose. That ability to convert instantly means you can buy food, pay rent, and keep a digital dollar that isn’t eroding daily. Some argue that stablecoins are just a bridge, but for many they’re the bridge to financial freedom. Bitcoin, despite its swings, offers a long‑term hedge that has attracted a growing slice of the Argentine crypto pie. It’s also worth noting that the country’s regulatory sandbox is still in its infancy, so the legal landscape feels like quicksand. Yet the entrepreneurial spirit in Buenos Aires keeps pushing new DeFi projects forward. In the end, the crisis has forced innovation, and the community is learning fast how to protect their savings. If you’re watching the markets and feel the peso slipping, you’re not alone-millions are navigating the same storm. Stay informed, keep your options open, and remember that community support can be a powerful tool in these turbulent times.

Hari Chamlagai

April 27, 2025 AT 17:40The Argentine crisis illustrates a classic case of monetary collapse, where sovereign debt, fiscal deficit, and political instability converge. When a state loses credibility, its citizens naturally gravitate toward assets with provable scarcity. Crypto, especially Bitcoin, fulfills that role by offering algorithmic scarcity unmarred by policy whims. Stablecoins, while tethered to fiat, provide a programmable conduit to bypass capital controls, effectively decentralizing monetary sovereignty. In essence, the market self‑corrects, rewarding those who adapt to the erosion of the peso.

Isabelle Graf

April 29, 2025 AT 19:04Honestly, the whole "crypto savior" narrative feels overblown. Most folks just want a stable way to pay the bills, not a techno‑utopian dream.

Jessica Cadis

May 1, 2025 AT 20:29From a cultural standpoint, Argentines have always found creative ways to sidestep restrictive policies; think of the informal loan networks that predate the internet. This adaptability now shows up in the crypto space, where community forums share tips on getting the best rates. It’s not just about technology-it's about preserving daily life.

Jason Zila

May 3, 2025 AT 21:54Looking at the data, the surge in stablecoin volume aligns tightly with election cycles, suggesting political risk is a major driver. Moreover, the average transaction size has risen, indicating that users are not just dabbling but moving substantial savings. The interplay between regulatory announcements and market spikes is a pattern worth monitoring. If the government eases capital controls, we might see a temporary dip in crypto activity.

Deborah de Beurs

May 5, 2025 AT 23:18Let’s cut the crap-people are tired of watching their money disappear faster than a TikTok trend. The peso’s decline isn’t just numbers on a chart; it’s families forced to choose between medicine and reheated pizza. Crypto platforms like Lemon have turned the tables, giving everyday users a weapon against the system. If you’re still using a bank to hide cash, you’re basically feeding the monster that’s ruining your wallet. So grab a stablecoin, and stop being a silent victim.

Hailey M.

May 8, 2025 AT 00:43Totally get the frustration, and honestly the crypto scene feels like a lifeline right now 😅. The speed at which you can convert is insane, and it’s saved me from those endless bank queues. Just remember to keep your private keys safe, or all that drama could flip on you.

DeAnna Brown

May 10, 2025 AT 02:08Crypto is the new Argentine hustle, plain and simple.

Nick O'Connor

May 12, 2025 AT 03:32Indeed, the inflation numbers are staggering, the dollar gap widens daily, and the populace seeks alternatives, all while the government scrambles for solutions.

Irish Mae Lariosa

May 14, 2025 AT 04:57The argument that stablecoins are merely a stopgap ignores the structural deficiencies of Argentina’s monetary framework, which has for years been riddled with inconsistent policy, misguided subsidies, and opaque central bank interventions. While many celebrate the technological novelty of USDT or USDC, they overlook that these tokens merely replicate the dollar’s role without addressing the underlying issue of trust in any domestic institution. Moreover, the reliance on foreign‑issued assets introduces a new vector of vulnerability: regulatory crackdowns abroad could instantly freeze the very lifeline Argentines depend upon. Additionally, the environmental and security concerns associated with the broader crypto ecosystem cannot be dismissed as peripheral. In short, embracing stablecoins without a concomitant strategy for economic reform is akin to putting a band‑aid on a broken dam.

Shane Lunan

May 16, 2025 AT 06:22I hear you, but the reality on the ground is people need immediate solutions, not academic debates. The speed and accessibility of stablecoin transfers have made a tangible difference in daily budgeting. And while regulatory risks exist, they’re a secondary concern compared to the daily hunger.

Bruce Safford

May 18, 2025 AT 07:47Don’t be naive; the “immediate solutions” narrative is often a front for hidden agendas pushing foreign tech into our economy. Every time a new crypto service spikes, there’s a quiet push from overseas lobbying groups looking to capitalize on our crisis. The data shows sudden surges in wallet registrations right after certain diplomatic talks. If you ignore the geopolitical strings, you’re just a pawn in a larger game. Stay skeptical of any “solution” that comes without full transparency.

Blue Delight Consultant

May 20, 2025 AT 09:11Contemplating the Argentine monetary turbulence invites a broader reflection on the nature of value itself. When sovereign fiat loses its anchorage, society instinctively seeks instruments perceived as immutable. Digital assets, by virtue of their algorithmic underpinnings, fulfill that psychological need for constancy. Yet, the ethical dimension of such migration warrants scrutiny, as it may exacerbate socio‑economic divides. Ultimately, the discourse should balance innovation with inclusivity.

Wayne Sternberger

May 22, 2025 AT 10:36To all navigating these unsettling times, a measured approach is advisable. Diversify across several stablecoins to mitigate platform‑specific risks. Keep thorough records for any future tax obligations. And remember, community knowledge bases can provide practical guidance.

Kyla MacLaren

May 24, 2025 AT 12:01I’ve seen friends successfully set up wallets with minimal fuss, and the process isn’t as intimidating as it seems. Just follow the step‑by‑step guides on reputable exchanges. Sharing experiences can help everyone feel more confident.

Michael Grima

May 26, 2025 AT 13:25Oh great, another “crypto miracle” to save us from inflation-because digital tokens have never been volatile before. Sure, USDT is “stable,” until the issuer decides otherwise. Let’s just hope the next regulatory crack doesn’t yank the rug out from under us.

Della Amalya

May 28, 2025 AT 14:50The peso’s decline is a tragedy that reads like a modern Greek play, with citizens cast as desperate protagonists. Crypto emerges as the unlikely deus ex machina, offering a glimmer of agency amid chaos. However, like any hero, it comes with flaws-security lapses, regulatory shadows, and the ever‑present market swings. Balancing hope with caution is essential. In the end, it’s the collective will to adapt that will shape the outcome.

shirley morales

May 30, 2025 AT 16:15Pathetically, many still cling to outdated banking myths, ignoring the superior efficiency of decentralized finance. The crypto elite have long recognized the inherent superiority of digital assets over fiat. If you’re not on board, you’re simply lagging behind the inevitable evolution of money.