Oct, 23 2025

Oct, 23 2025

Compliance Risk Assessment Tool

Assess Your Multi-Exchange Strategy

Enter your trading parameters to evaluate compliance risk according to the latest regulatory standards.

Compliance Risk Assessment

Recommendation:

When traders hop across cryptocurrency exchange a platform that lets users buy, sell, or trade digital assets they’re often looking for better prices, deeper liquidity, or fewer trading limits. The flip side is that the same network of exchanges also serves as a shortcut around geographic blocks, sanction lists, and Know‑Your‑Customer (KYC) requirements. Understanding how this crypto exchange evasion works can keep you on the right side of the law while still letting you capture legitimate arbitrage opportunities.

Why people jump between exchanges

There are three main motivations:

- Liquidity hunting: No single platform holds every token in the quantities you need. By spreading orders across several venues you reduce slippage.

- Regulatory arbitrage: Some jurisdictions ban specific tokens or impose daily transaction caps. Moving funds to a friendlier exchange sidesteps those rules.

- Speed and cost: Instant‑settlement services on newer platforms can be cheaper than legacy venues that take days to clear.

When these motives intersect with weak compliance, the same technique becomes a tool for illicit actors.

Legitimate multi‑exchange strategies

Professional traders often build a “exchange stack” that includes:

- A large, regulated hub (e.g., Coinbase, Kraken) for fiat on‑ramps and KYC‑verified accounts.

- One or two high‑volume order‑book exchanges (e.g., Binance, Bybit) for tight spreads.

- A niche platform that lists low‑cap altcoins not yet available on the majors.

This architecture lets you move funds quickly while keeping a clear audit trail for tax and compliance purposes. Most reputable services provide transaction‑history downloads, which you can feed into accounting tools.

Illicit evasion methods

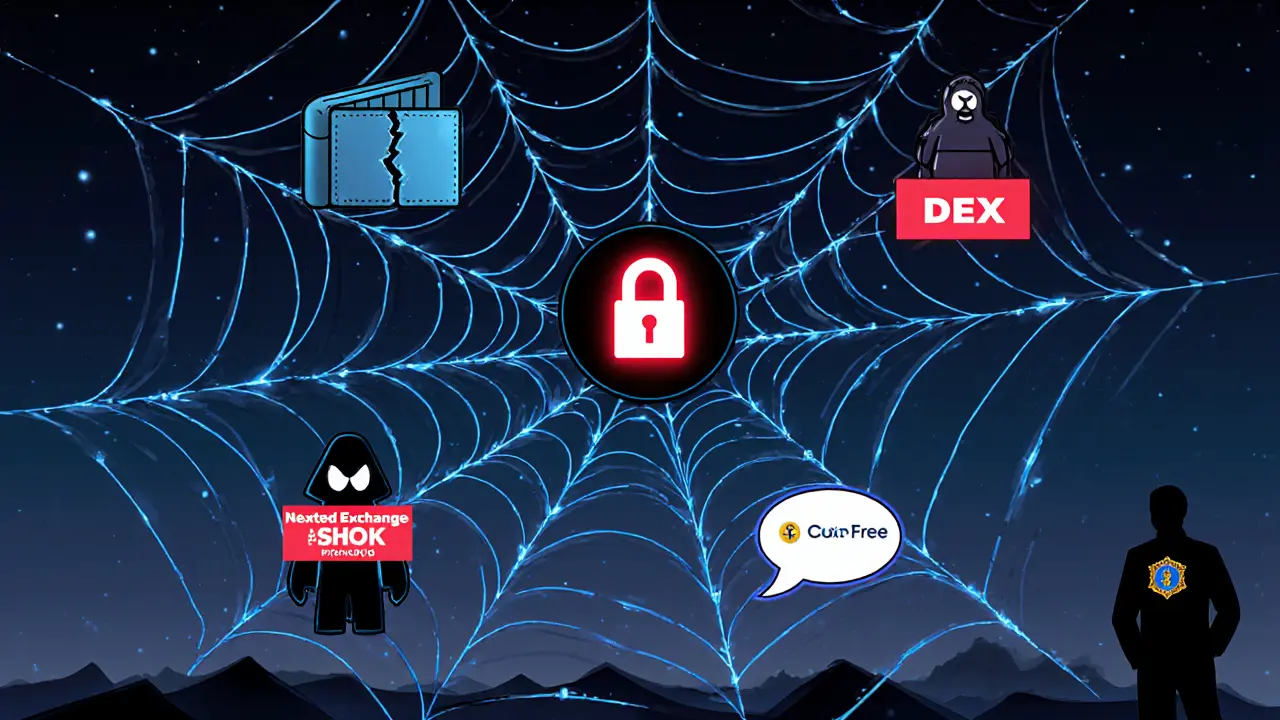

Regulators have identified at least eight tactics criminals use to dodge sanctions. The most common are:

- Compromised wallets: Hackers steal private keys from KYC‑cleared users, then funnel the loot through a chain of clean wallets on multiple exchanges.

- Non‑compliant exchanges: Platforms based in sanction‑hotspot countries (e.g., Russia, North Korea) often ignore OFAC U.S. Office of Foreign Assets Control, the agency that enforces economic sanctions rules. They become exit nodes for dirty money.

- Nested exchanges: These act as middlemen, holding your deposit and executing trades on a back‑end exchange. Because the nested layer rarely asks for KYC, the original source blurs.

- Decentralized exchanges (DEXs): Decentralized exchange a peer‑to‑peer trading platform that runs on smart contracts without a central intermediary let users swap tokens without any registration, making it near‑impossible for authorities to freeze accounts.

- Coin‑swap services: Unregulated instant‑messenger bots swap crypto for cash or other crypto without a signup step, effectively acting as a cash‑in, cash‑out tunnel.

- Tokenized sanctions‑evasion assets: Tokens like A7A5, a ruble‑backed digital asset, are issued on obscure blockchains to move value under the radar.

Each method adds a layer of opacity, making the money trail look like a tangled spider web.

Regulatory response and high‑profile cases

U.S. authorities have started cracking down on the ecosystem. In March 2025 the OFAC designated Grinex a cryptocurrency exchange created specifically to facilitate sanctions evasion as a sanctioned entity after its links to the Garantex fallout became public. Within days, the Secret Service seized assets and forced the exchange to halt operations, yet a clone quickly re‑emerged under a different name, showing how agile these networks can be.

The Securities and Exchange Commission (SEC) has also warned that many platforms behave like traditional exchanges and therefore must register. In a 2025 hearing, Chair Gensler declared, “the vast majority of crypto tokens are securities,” putting additional pressure on opaque venues.

Compliance checklist for legitimate traders

Even if your goal is pure arbitrage, you should treat every exchange as a potential regulatory risk. Follow this quick cheat‑sheet:

- Verify that the exchange is KYC Know‑Your‑Customer verification, a process that confirms a user’s identity and AML‑registered in your jurisdiction.

- Maintain a separate ledger for each venue. Export CSVs weekly and reconcile them against your bank statements.

- Run a sanctions screen on every counter‑party address using a tool that cross‑references OFAC, EU, and UK sanction lists.

- Set daily transaction caps that are well below the limits imposed by any single exchange. This reduces the chance of triggering a freeze.

- Use hardware wallets for long‑term storage. Only keep the amount you need for day‑trading on the exchange.

- Stay aware of “nested exchange” services - if a platform claims to trade on your behalf without showing the underlying exchange, demand transparency before depositing funds.

Security risks and user vulnerabilities

Every additional hop introduces new attack surfaces:

- Custody risk: A nested exchange holds your funds in pooled accounts, meaning a single hack can wipe out all user balances.

- Legal exposure: Using a sanctioned platform can land you on a watch list, even if you were unaware of the exchange’s status.

- Phishing: Fraudsters impersonate support teams of obscure exchanges to steal credentials.

In 2024, a ransomware gang moved $12 million through three layers of nested exchanges before law‑enforcement could trace the final address. The lesson? The more layers you add, the harder it becomes to defend each one.

Detection and prevention methods

Legitimate exchanges employ a suite of tools that you can mimic:

- Transaction monitoring: Real‑time flagging of unusually large or rapid trades.

- Address screening: Automatic checks against sanctioned‑entity lists before allowing a withdrawal.

- Blockchain analytics: Services like Chainalysis or CipherTrace can trace funds across multiple hops and flag “mixing” behavior.

If you notice any exchange offering instant swaps without any verification, treat it as a red flag. The lack of an audit trail means you have little recourse if the platform disappears.

Future outlook - an arms race

Regulators are moving from reactive to proactive stances. By late 2025, the U.S. Treasury announced a joint task force with the EU to share real‑time sanctions lists with major crypto custodians. At the same time, developers are building “compliance‑by‑design” smart contracts that can automatically reject transactions tied to black‑listed addresses.

Criminals, however, are already experimenting with privacy‑preserving layers like zk‑rollups that hide transaction details while still moving value across exchanges. The battle will likely intensify, and the safest strategy for traders is to keep compliance front‑and‑center, even when the market tempts you to cut corners.

Quick reference checklist

| Criterion | What to look for | Red flag |

|---|---|---|

| KYC/AML policy | Clear documentation, third‑party verification | No identity checks, vague terms |

| Regulatory registration | Registered with local financial authority or SEC | Operating from sanction‑hotspot country |

| Custody model | Non‑custodial or insured custodial wallet | Nested exchange with pooled accounts |

| Transparency | Publicly available audit reports, blockchain explorer links | Instant swap service, no transaction trace |

Is it illegal to use multiple exchanges for arbitrage?

Arbitrage itself isn’t illegal, but you must respect each exchange’s KYC/AML rules and any sanctions that apply to the assets you move. Skipping verification or trading on a sanctioned platform can lead to fines or account bans.

What’s the difference between a nested exchange and a regular exchange?

A nested exchange holds your funds and then executes trades on a separate, often larger, exchange on your behalf. The user rarely sees the underlying venue, which can hide compliance gaps. A regular exchange lets you trade directly on its own order book.

How can I tell if an exchange is sanctioned by OFAC?

Check the official OFAC sanctions list or use a compliance‑screening tool. If the exchange appears on that list, any transaction involving it is prohibited for U.S. persons.

Are decentralized exchanges safe to use?

DEXs remove the need for a central party, which can be good for privacy, but they also lack recourse if something goes wrong. You’re fully responsible for securing your private keys and verifying contract code.

What tools help monitor cross‑exchange activity?

Blockchain analytics platforms (e.g., Chainalysis, CipherTrace) and portfolio trackers that import API data from each exchange can highlight unusual patterns and flag potential compliance breaches.

John Dixon

October 23, 2025 AT 08:34Oh, absolutely-bypassing every KYC rule, hopping across shady exchanges, and ignoring sanctions is just a delightful weekend hobby, isn’t it!!!

Brody Dixon

October 24, 2025 AT 13:23It’s good that you’re looking into legit ways to diversify your order flow; keeping a clear audit trail will save you headaches later.

Mike Kimberly

October 26, 2025 AT 19:06When one considers the architecture of a multi‑exchange strategy, the first principle that emerges is transparency; every transfer should be traceable through verifiable logs.

Regulators worldwide have converged on the notion that KYC and AML processes are not optional, but foundational safeguards.

Consequently, a trader who distributes assets across three or more venues must maintain synchronized ledgers to reconcile balances daily.

Failure to do so not only increases the risk of inadvertent non‑compliance but also erodes confidence among counterparties.

Moreover, the liquidity‑seeking motive, while legitimate, can unintentionally expose the user to price manipulation if the order size dwarfs the market depth on a given platform.

By allocating portions of the trade to a high‑volume exchange such as Binance, the slippage can be minimized, yet the trader must still respect the exchange’s withdrawal limits.

In parallel, the regulatory arbitrage angle demands vigilance; jurisdictions differ in how they classify tokens, and a token deemed permissible in one country may be outright banned in another.

Therefore, before moving a substantial position, it is prudent to consult the latest sanction lists published by OFAC, the EU, and other relevant authorities.

From a compliance‑by‑design perspective, integrating blockchain analytics tools like Chainalysis directly into the trading workflow provides near‑real‑time alerts for suspicious patterns.

These platforms can flag instances where funds traverse nested exchanges, a red flag that warrants immediate review.

Security, too, cannot be an afterthought; hardware wallets should store the long‑term reserve, while hot wallets on exchanges hold only what is needed for daily operations.

In practice, this segregation reduces exposure in the event of a breach on any single exchange’s infrastructure.

Tax reporting benefits from this disciplined approach as well, since clear inbound and outbound transaction records simplify the preparation of Form 8949 and related schedules.

Finally, continuous education is essential; the regulatory landscape evolves rapidly, and staying informed through reputable sources can prevent inadvertent violations.

In sum, a well‑structured multi‑exchange strategy balances profitability with rigorous compliance, thereby safeguarding both the trader’s assets and reputation.

angela sastre

October 27, 2025 AT 23:10If you’re using a DEX, remember you’re fully responsible for your private keys-lose them and the funds are gone for good.

Patrick Rocillo

October 29, 2025 AT 03:13Yo, juggling three exchanges is like spinning plates-keep them flying and you’ll reap the profits 😎🔥.

Aniket Sable

October 30, 2025 AT 07:16Bro, just make sure each exchange you use has proper KYC, otherwise you might end up in trouble later.

Santosh harnaval

October 31, 2025 AT 11:20Check the exchange’s registration status before depositing large amounts.

Claymore girl Claymoreanime

November 1, 2025 AT 15:23While your exhaustive treatise on compliance is commendably verbose, the reality remains that most retail traders lack the resources to implement such a Byzantine framework, rendering your checklist more academic than actionable.

Will Atkinson

November 2, 2025 AT 19:26Indeed, the allure of “creative arbitrage” is tempting!!!, yet the legal ramifications are far from a trivial side‑effect; proceed with caution!!!

Joseph Eckelkamp

November 3, 2025 AT 23:30One could argue that the very notion of “responsibility for private keys” is a philosophical reflection on personal sovereignty-except when the ledger is immutable and the loss is irreversible!!!