Jan, 29 2026

Jan, 29 2026

South Korea doesn’t just regulate cryptocurrency - it controls it. If you’re trying to trade crypto here, you’re not just signing up for an app. You’re walking into one of the strictest, most tightly monitored digital asset markets in the world. No anonymous wallets. No offshore exchanges. No credit card buys. And if you make a profit? You’ll pay 20% in taxes. This isn’t the Wild West of crypto. This is a high-security, bank-linked, government-approved system - and it’s working.

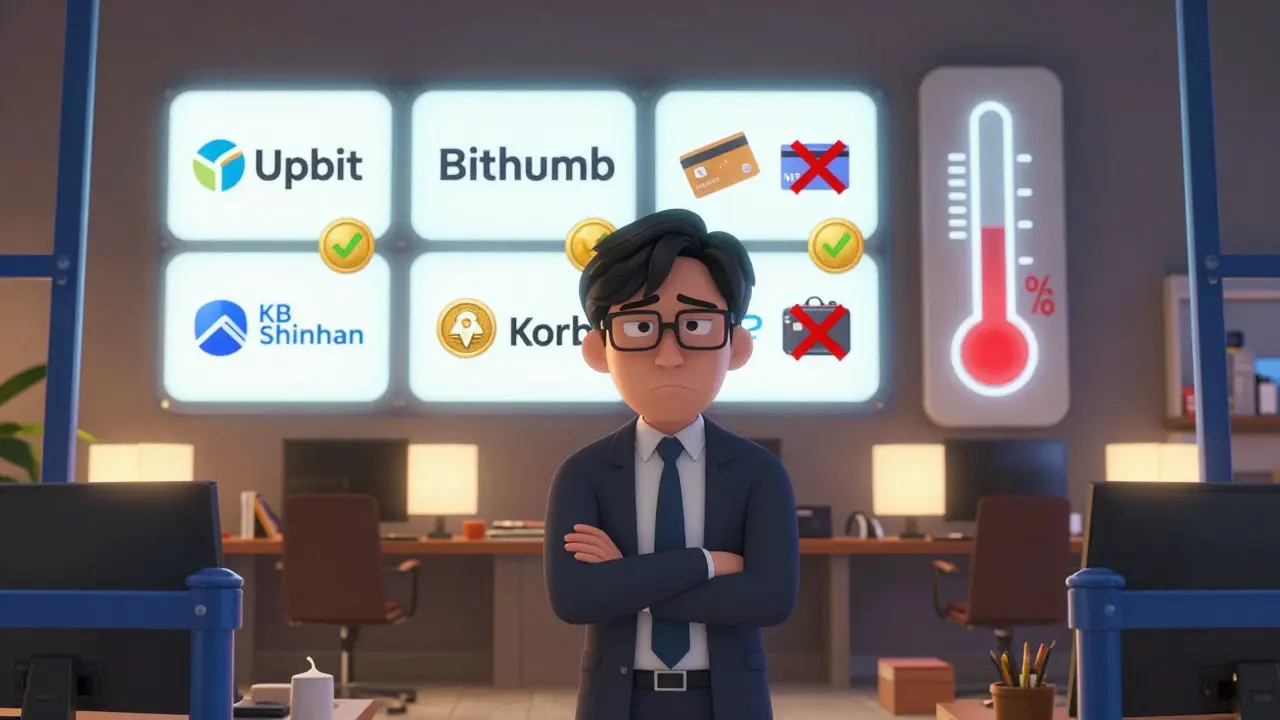

Only Four Exchanges Are Allowed

You can’t just pick any crypto exchange in South Korea. Since March 2021, the Financial Services Commission (FSC) has required every platform to get a license. And only four have passed: Upbit, Bithumb, Coinone, and Korbit. Together, they handle over 95% of all domestic trading volume. The rest? Shut down. Over 200 unlicensed platforms have been forced offline since 2021, according to FSC reports.These four aren’t just big - they’re built differently. Each one must partner with a Korean bank like KB Kookmin, Shinhan, or NH Nonghyup. Why? So your crypto account is tied to your real name. No exceptions. If your bank account says "Kim Ji-hoon," your crypto wallet must too. This real-name verification system, first rolled out in 2018, makes anonymous trading impossible. It’s not just KYC. It’s KYC with your bank’s seal on it.

Your Money Has to Stay Safe - and Insured

Security isn’t optional. Licensed exchanges must keep at least 70% of customer crypto in cold storage - offline, air-gapped, physically locked away. The rest? Held in hot wallets with extra layers of encryption and multi-signature access. But even that’s not enough. Every exchange must carry cyber insurance of at least 1 billion KRW ($750,000). And customer funds must be kept in separate accounts, not mixed with company money.This isn’t theoretical. Since the rules took effect, there hasn’t been a single major hack on any of the four licensed exchanges. Compare that to global platforms like Binance or KuCoin, which lost over $3.8 billion to hacks in 2023-2024, according to Chainalysis. Korean users don’t just trust their exchanges - they expect them to be bulletproof.

You Can’t Buy Crypto with a Credit Card

Forget using your Visa or Mastercard to buy Bitcoin. South Korea bans credit card purchases for crypto entirely. Same goes for international wire transfers. The only way to fund your account? A bank transfer from your verified Korean account. And yes - it has to be the same name, same bank, same ID.This rule kills off offshore arbitrage and makes it harder for money launderers to slip in. But it also limits access. If you’re a foreigner without a Korean bank account? You can’t trade on Upbit or Bithumb. If you’re a local trying to move money fast? You’re stuck waiting for bank processing times - often 1-3 business days. There’s no instant buy button. No PayPal. No Apple Pay. Just your local bank app and patience.

Altcoins Are Scarce - and That’s Intentional

Korean exchanges list between 200 and 300 cryptocurrencies. Binance? Over 600. Coinbase? More than 250. But Korean regulators don’t just care about security - they care about risk. New tokens must pass strict reviews before being listed. Exchanges can’t just add whatever’s trending. If a coin lacks a clear use case, transparent team, or audited code, it gets rejected.That’s why you won’t find obscure memecoins or low-liquidity tokens on Upbit. Traders complain about it - a lot. On Reddit’s r/KoreaCrypto, users regularly post: "Why isn’t $PEPE on here?" or "I found a new AI project - but it’s not listed in Korea." The answer? Regulators won’t allow it. The trade-off? Less speculation, less pump-and-dump chaos. But also fewer opportunities.

Taxes Are Coming - and They’re Heavy

Starting January 1, 2025, any crypto profit over 2.5 million KRW ($1,800) in a year will be taxed at 20%. That’s not a small number. It’s one of the highest crypto tax rates in the world. And it’s not just Bitcoin. It applies to every trade - even swapping ETH for SOL counts as a taxable event.Exchanges are required to report your transaction history to the National Tax Service. You can’t hide behind privacy coins or DeFi bridges. If you made a profit, the government knows. And if you don’t report it? You’re looking at fines or even criminal charges. Many traders are scrambling to calculate their gains, use loss-harvesting strategies, or consider moving part of their portfolio offshore - though that’s legally risky.

DeFi and Web3 Are Blocked - On Purpose

Trying to connect your MetaMask wallet to Uniswap or Aave? Good luck. Korean banks and internet providers actively block access to many decentralized finance platforms. Why? Because they can’t verify who’s behind the transactions. DeFi doesn’t have KYC. It doesn’t have a company. It doesn’t have a bank partner. That makes it a regulatory nightmare.Some tech-savvy users use VPNs to bypass these blocks, but doing so violates bank terms of service. If your bank catches you sending money to a DeFi protocol, they can freeze your account. The FSC has made it clear: they want crypto to be regulated, not decentralized. So if you’re into DeFi, you’re either trading on foreign platforms (and risking your funds) or you’re out of luck.

Who Benefits? Who Gets Left Behind?

The system works well for everyday traders who want safety. A 2024 survey of 1,200 Korean crypto users found 87% were satisfied with security - far higher than the global average of 62%. People sleep better knowing their funds are locked in cold storage and backed by insurance.But it’s brutal for startups. Setting up a licensed exchange costs over 500 million KRW ($375,000) just for ISMS certification - not counting legal fees, bank partnerships, or staff. Only deep-pocketed companies like Dunamu (Upbit’s parent) can afford it. That’s why no new exchange has entered the market since 2021.

Some experts call this the "gold standard" for investor protection. Others say it’s stifling innovation. Alex Kim, a blockchain consultant, warns: "Korea’s rules are pushing talent and capital to Singapore and Hong Kong." And there’s truth to that. Korean developers are building Web3 tools - but they’re doing it from abroad.

What’s Next? CBDCs and More Rules

The government isn’t slowing down. In 2025, South Korea will launch a pilot for its own Central Bank Digital Currency (CBDC). That’s not just a digital won - it’s a direct challenge to private crypto. If the government can offer a safer, faster, tax-compliant digital currency, why would anyone need Bitcoin?Stablecoins like USDT and USDC now need monthly audits and 100% reserve backing. And the FSC says more rules are coming. Expect tighter limits on leverage, stricter reporting for NFT trades, and possibly caps on how much crypto one person can hold.

One thing’s clear: South Korea isn’t trying to ban crypto. It’s trying to own it. To control it. To make it as safe as a savings account - but still profitable. Whether that’s a model the world follows… or one it avoids - is still up for debate.

Can foreigners trade crypto in South Korea?

No, not easily. To trade on licensed Korean exchanges like Upbit or Bithumb, you need a Korean bank account linked to your real name. Foreigners without residency or a local ID can’t complete the verification. Some use Korean friends’ accounts, but that’s against the rules and risks account freezes or legal trouble.

What happens if I trade on an unlicensed exchange in Korea?

It’s illegal. Unlicensed exchanges are shut down by authorities. If you’re caught using one, your bank account could be flagged, and you may lose access to your funds. There’s no legal recourse if the exchange gets raided or disappears. You’re on your own.

Do I have to report small crypto profits under 2.5 million KRW?

No, you don’t have to pay tax on profits below 2.5 million KRW per year. But exchanges still report all transactions to the tax office. If your total gains cross that threshold, even by a few thousand won, you’ll owe 20% on the entire amount - not just what’s over the limit.

Can I use a VPN to access international crypto exchanges from Korea?

Technically yes, but it’s risky. Your Korean bank may detect unusual activity and freeze your account. You also lose the legal protections of Korean exchanges - no insurance, no KYC, no recourse if you get hacked. Many users do it anyway, but it’s not recommended for large sums.

Why are there so few coins on Korean exchanges?

Regulators require each new coin to pass a safety review - checking for scams, anonymous teams, or weak code. Most new tokens fail. This keeps the market stable but limits choice. Traders get security, but miss out on early-stage projects. It’s a trade-off between safety and opportunity.

Is crypto mining legal in South Korea?

Yes, but it’s not practical. High electricity costs and strict energy regulations make large-scale mining unprofitable. Small miners using home rigs exist, but they’re rare. The government doesn’t ban it - it just makes it too expensive to compete with China or the U.S.

Can I transfer crypto from a Korean exchange to a wallet outside Korea?

Yes, but only after you’ve completed full verification. You can withdraw to any external wallet - but the exchange will log the destination address. If you send funds to a flagged or suspicious address, your account may be frozen. Don’t try to move large amounts to unverified wallets.