Oct, 17 2025

Oct, 17 2025

Liquidity Risk Calculator for Micro-Cap Tokens

How to Use This Calculator

Enter the 24-hour trading volume and market cap of a cryptocurrency token to assess liquidity risk. This tool estimates the risk of being unable to sell your tokens when you want to, based on real market data patterns.

Token Market Data

Liquidity Risk Assessment

Ever heard of a crypto that tries to sell you the idea of American craftsmanship? That’s Made in America (MIA) - a token that markets itself as a movement rather than just another digital coin. If you’re scratching your head wondering what it actually is, how it works, and whether it’s worth your attention, you’re in the right place. Below we break down the token’s basics, its tech foundation on Solana, where you can trade it, and what the numbers say about its real‑world traction.

What is Made in America (MIA)?

Made in America (MIA) is a cryptocurrency token that positions itself as a symbol of resilience, innovation and the quality associated with American craftsmanship. The project markets the token as a “movement” rather than a pure financial instrument, claiming to deliver financial freedom and strength to its holders.

Unlike Bitcoin or Ethereum, which were built from the ground up as blockchains, MIA lives on top of another chain - Solana. That means it inherits Solana’s speed and low‑cost transaction model while trying to carve out its own niche through branding.

Technical foundation - why Solana?

Solana is a high‑throughput proof‑of‑stake network capable of processing thousands of transactions per second, with fees often measured in fractions of a cent. By issuing MIA as an SPL token on Solana, the developers avoid the overhead of launching a brand‑new blockchain and can tap into Solana’s existing validator set, developer tools, and wallet ecosystem.

Key technical points:

- Built on Solana’s SPL token standard.

- Uses Solana’s proof‑of‑stake consensus.

- Transaction costs typically under $0.001.

- No publicly disclosed token supply metrics (total, circulating, max).

- No open‑source smart‑contract address or tokenomics whitepaper available.

In short, the token piggybacks on Solana’s infrastructure but offers no extra technical novelty that we can verify.

Market snapshot - where does MIA stand?

As of October 2025, MIA lives in the micro‑cap corner of the crypto universe. On CoinMarketCap it ranks around #8820 with a price of $0.00002892 USD and essentially zero 24‑hour volume. LiveCoinWatch lists it near #7204 with a recent daily high of $0.000060 USD. The discrepancy reflects different data collection times rather than any real market shift.

Liquidity is thin. The token’s only documented exchange listing is on Poloniex, where deposits opened on 31January2025, trading began later that day, and withdrawals followed on 1February2025. A mention of LBank exists, but no confirmed listing details are public.

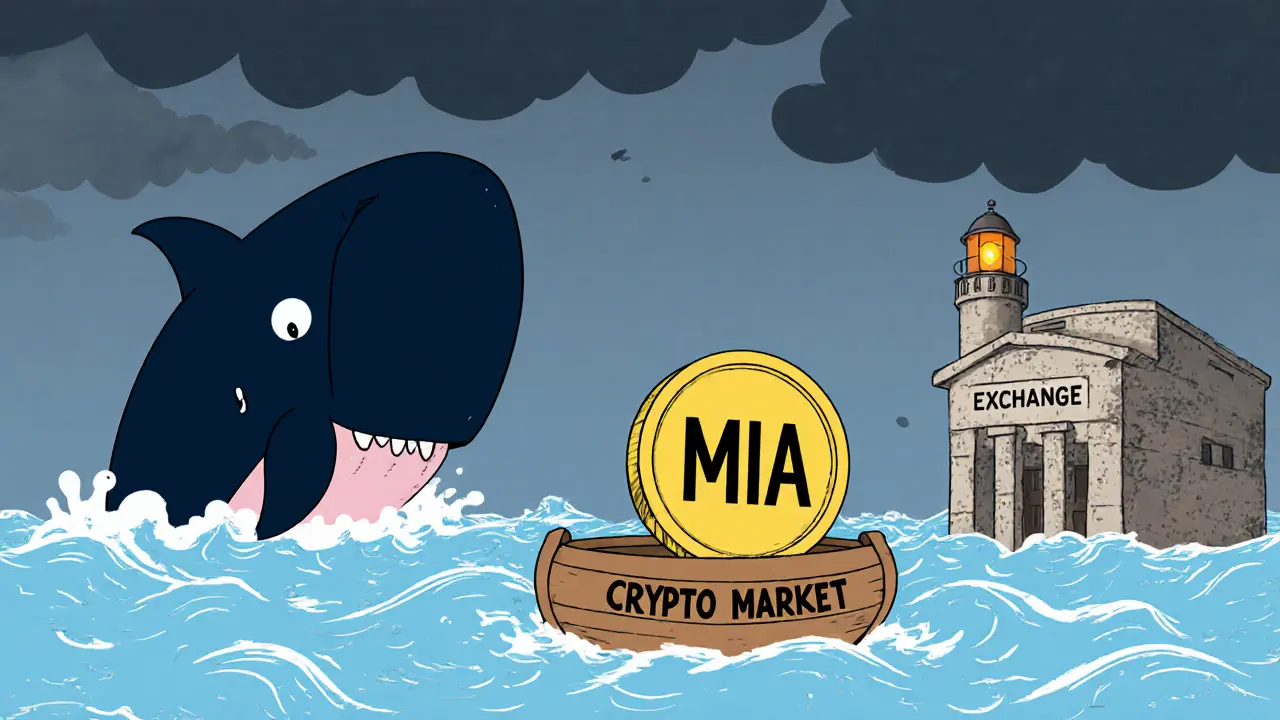

Because trading volume is effectively nil, price moves are highly volatile and can be manipulated by a handful of whales. For anyone considering buying, the risk of being stuck with an illiquid asset is a real concern.

How to acquire and store MIA

If you still want to hold MIA, the steps are straightforward but limited:

- Create an account on Poloniex (or any exchange that eventually lists the token).

- Deposit USDT into your exchange wallet.

- Find the MIA/USDT trading pair and place a market or limit order.

- Withdraw the tokens to a Solana‑compatible wallet for better control.

Solana wallets that support SPL tokens include Phantom, Solflare, and hardware options like Ledger (when configured for Solana). No official wallet recommendation is published by the project, so use the wallet you trust for other Solana assets.

Branding vs. utility - what does MIA actually do?

The token’s narrative leans heavily on patriotic messaging: “embodies the strength, innovation, and pride of American craftsmanship.” However, concrete utility is missing. There are no listed merchant partners, DeFi integrations, staking rewards, or governance mechanisms.

In the crypto world, a token’s value usually comes from one (or more) of the following:

- Technology that solves a problem.

- Active community that drives network effects.

- Clear on‑chain use cases (payments, governance, NFTs, etc.).

- Liquidity on multiple exchanges.

MIA checks none of those boxes based on publicly available information. The “movement” angle may attract a niche group that resonates with the American‑made branding, but without on‑chain activity the token remains more of a symbol than a functional asset.

Comparison with other Solana‑based tokens

| Feature | Made in America (MIA) | Typical Successful Solana Token |

|---|---|---|

| Market Cap Rank | #8820 (CoinMarketCap) | #200‑#800 |

| 24‑h Volume | ≈$0 | $10M‑$200M |

| Exchange Listings | Poloniex (maybe LBank) | Multiple CEX & DEX (Binance, Coinbase, Serum, Raydium) |

| Utility | Branding only | Staking, DeFi, NFTs, governance |

| Community Presence | None documented | Active Telegram/Discord, Reddit, Twitter |

The table shows that MIA sits at the far end of the spectrum. If you’re hunting for a Solana token with real activity, look elsewhere.

Risk assessment - should you consider MIA?

Here’s a quick cheat‑sheet to help you decide:

- Liquidity risk: Near‑zero volume means you may not be able to sell when you want.

- Transparency risk: No disclosed team, roadmap, or token supply data.

- Regulatory risk: Micro‑cap tokens often attract scrutiny for lack of compliance.

- Potential upside: If the project suddenly gains a community or partnership, price could spike dramatically - but that’s speculative.

For most investors, especially those new to crypto, the cons outweigh the slim upside. Treat MIA as a speculative curiosity rather than a core holding.

Future outlook - where might MIA go?

Without new development updates, community growth, or exchange listings, the token’s trajectory looks bleak. Historically, only a small fraction of micro‑cap coins survive beyond two years. Many fade into “dead coins” that still exist on a blockchain but have no market or users.

Possible scenarios:

- Stagnation: Remains listed on Poloniex with negligible activity.

- Delisting: If Poloniex drops the pair due to low volume, the token could become effectively inaccessible for most traders.

- Rebranding or partnership: A surprise alliance with a patriotic brand or a community movement could inject new liquidity, but there’s no sign of that happening.

Keep an eye on the project’s official channels (if any) for announcements, but set realistic expectations.

Frequently Asked Questions

What blockchain does MIA run on?

MIA is an SPL token on the Solana blockchain, meaning it uses Solana’s proof‑of‑stake consensus and benefits from its fast, cheap transactions.

Where can I buy Made in America (MIA) tokens?

The only confirmed venue is the Poloniex exchange via the MIA/USDT pair. A potential listing on LBank has been mentioned but not verified.

Is there any staking or yield program for MIA?

No official staking, yield farming, or liquidity‑mining program is documented. The token’s utility is limited to its branding narrative.

What wallets support MIA?

Because MIA lives on Solana, any Solana‑compatible wallet works - popular choices are Phantom, Solflare, and Ledger (when set up for Solana).

Is MIA a good long‑term investment?

Given its near‑zero liquidity, lack of transparency, and absence of utility, MIA is considered high‑risk and more of a speculative token than a solid long‑term hold.

Bobby Lind

October 17, 2025 AT 08:12If you're eyeing Made in America (MIA), here's the quick rundown: it lives on Solana, so transactions are cheap, lightning‑fast, and it masquerades as a patriotic movement, not a tech breakthrough, and the branding leans heavy on American‑made pride, while the actual utility remains, well, nonexistent, meaning you're mostly buying a sentiment, not a service, and the only exchange you can find it on is Poloniex, with almost zero volume, so expect wild price swings, and remember that liquidity is practically non‑existent, making an exit tricky, plus there's no disclosed supply or team, which raises red flags for risk‑aware investors, so treat it like a novelty rather than a core holding.

Katharine Sipio

October 19, 2025 AT 20:53While the token’s theme is certainly bold, a prudent approach would involve reviewing the limited exchange listings and the absent tokenomics before allocating any capital, as these factors are essential for informed decision‑making.

Shikhar Shukla

October 22, 2025 AT 10:00The absence of a publicly audited smart‑contract address, combined with the lack of a transparent roadmap, constitutes a serious oversight; without verifiable data, any claim of durability remains speculative at best.

Chris Morano

October 24, 2025 AT 23:06Both the branding and the technical foundation are clear, yet the market activity tells a different story.

Ikenna Okonkwo

October 27, 2025 AT 11:13Indeed, the token’s limited visibility on exchanges like Poloniex suggests that any potential upside is constrained by liquidity, and without community incentives, sustaining interest will be an uphill battle.

Jessica Cadis

October 30, 2025 AT 00:20The MIA project tries to ride the flag of American ingenuity, but without concrete use‑cases it feels more like a marketing stunt than a serious financial instrument.

Deepak Kumar

November 1, 2025 AT 13:26Let me break down what you should consider before diving into MIA. First, understand that Solana’s low fees are a boon for any SPL token, but that advantage is moot if the token itself has no demand. Second, examine the liquidity; with near‑zero 24‑hour volume, you could easily get stuck holding tokens you can't sell. Third, note the lack of a disclosed supply – without knowing how many tokens exist, you can't assess scarcity or inflation risk. Fourth, check the exchange listings; at present, only Poloniex is confirmed, and even that may delist due to inactivity. Fifth, consider the community size – there are virtually no active Telegram or Discord channels, which limits organic growth. Sixth, think about regulatory exposure; micro‑cap tokens often attract scrutiny for inadequate compliance measures. Seventh, weigh the branding narrative; patriotic messaging may attract a niche audience, but without on‑chain utility, it won't sustain long‑term value. Eighth, evaluate alternative SOL‑based tokens that offer staking, DeFi integrations, or NFT ecosystems – they provide tangible use‑cases and broader market support. Ninth, set a clear risk tolerance; if you can afford to lose the entire investment, treating MIA as a speculative curiosity might be acceptable. Tenth, keep an eye on any future announcements – a partnership with a recognizable brand could shift sentiment dramatically. Eleventh, always use a reputable wallet like Phantom or Ledger for storage to protect your private keys. Twelfth, consider diversifying your portfolio to avoid overexposure to any single micro‑cap. Thirteenth, stay updated on exchange delisting notices, as loss of listing can effectively freeze assets. Fourteenth, remember that crypto markets are volatile; any sudden price surge could be a pump‑and‑dump scheme. Finally, if you decide to buy, limit your position to a small percentage of your overall crypto holdings and monitor the market closely for any signs of activity.

Cecilia Cecilia

November 4, 2025 AT 02:33Liquidity is essentially non‑existent.

lida norman

November 6, 2025 AT 15:40That's why I feel a pang of excitement every time I glance at the price chart – it's like watching a moth flutter near a flame, hoping for a spark! 😊

But seriously, the hype may be more about nationalism than tech.

Matthew Theuma

November 9, 2025 AT 04:46Honestly the token feels like a novelty item, 🍕 you can hold it, but there's not much else to do with it.

Maybe it's a collector's piece for those who love the “Made in America” slogan.

Carolyn Pritchett

November 11, 2025 AT 17:53What a waste of gas… or rather, what a waste of SOL. Talk about a meme that never got funny.

Sara Stewart

November 14, 2025 AT 07:00From a risk‑management perspective, the token’s thin order book classifies it as a high‑beta asset; the volatility premium may attract speculative traders, but the absence of on‑chain utility and limited exchange exposure drastically elevate systemic risk, making it unsuitable for portfolio core holdings.

Laura Hoch

November 16, 2025 AT 20:06While the cautionary notes are valid, it's also worth reflecting on why some investors are drawn to symbols of national pride; the emotional resonance can sometimes outweigh pure fundamentals, yet prudent investors should balance sentiment with concrete data to avoid being swept by hype.