Feb, 14 2026

Feb, 14 2026

India doesn’t ban crypto mining outright-but if you’re mining Bitcoin, Ethereum, or any other cryptocurrency here, you’re walking a tightrope. There’s no law that says, "Don’t mine." But the rules that do apply make it nearly impossible to do it legally and profitably. If you think mining crypto in India is like in Kazakhstan or Georgia, think again. The government isn’t stopping you-but it’s making sure you pay dearly for every coin you mine.

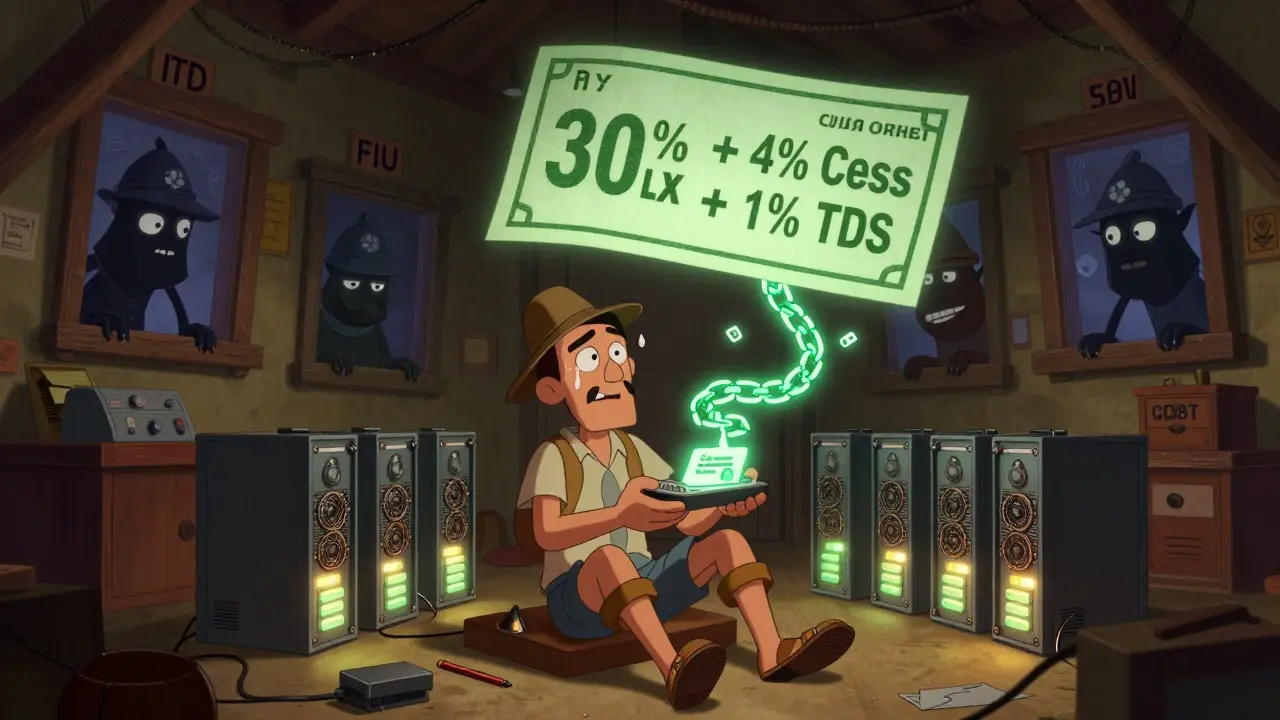

There’s no ban, but there’s a tax trap

Crypto mining in India isn’t illegal. But under the Virtual Digital Asset (VDA) a category defined in Section 2(47A) of the Income Tax Act, 1961, which includes all cryptocurrencies, NFTs, and tokens created via cryptography, every coin you mine is treated as taxable income. And the tax rate? A flat 30%. No deductions. Not even for electricity, hardware, or cooling costs. You mine 1 Bitcoin worth ₹50 lakh? You owe ₹15 lakh in taxes. Period.

On top of that, there’s a 4% cess added to that 30%, bringing your total tax burden to 31.2%. Then there’s the 1% Tax Deducted at Source (TDS) on every sale, swap, or transfer of your mined coins. If you sell half your Bitcoin to pay your electricity bill, 1% of that sale gets taken before you even see the money. And if you use a local exchange like CoinSwitch or ZebPay, they’ll withhold it automatically.

Here’s the kicker: unlike businesses in other countries, Indian miners can’t deduct operational expenses. In the U.S., you write off your ASICs, your power bill, your internet, even your rent if you run a warehouse full of rigs. In India? You can only deduct the original cost of buying the coins. So if you spent ₹2 lakh on a rig and ₹1.5 lakh on electricity over six months, and mined ₹5 lakh worth of ETH-you still pay tax on the full ₹5 lakh. Your ₹3.5 lakh in expenses? Gone. The government doesn’t care.

Who’s watching you? Five agencies, one target

There’s no single crypto regulator in India. Instead, five government bodies are all watching you-and they don’t talk to each other.

- Income Tax Department enforces the 30% tax on mined assets and requires full disclosure in Schedule VDA of your ITR

- Financial Intelligence Unit (FIU-IND) monitors crypto transactions under the Prevention of Money Laundering Act (PMLA), with AI systems tracking wallet movements

- Reserve Bank of India (RBI) has warned against crypto since 2013 and still calls it "high-risk," though it can’t ban it outright after the 2020 Supreme Court ruling

- Securities and Exchange Board of India (SEBI) began monitoring crypto tokens that resemble securities in April 2025

- Central Board of Direct Taxes (CBDT) issued new guidelines in 2025 requiring miners to report mining dates, coin types, and wallet addresses

If you’re mining at home, you might think you’re invisible. You’re not. Project Insight, NMS, and NUDGE-government AI tools-scan blockchain data to match Indian wallet addresses with bank accounts. If your wallet receives 5 ETH in January and your bank account shows a ₹38 lakh deposit in February? You’ll get a notice. No warning. No grace period. Just a demand letter.

What happens if you don’t report?

Penalties aren’t just financial-they’re criminal.

Failure to declare mined crypto income triggers a penalty of 50% to 200% of the unpaid tax. That means if you owe ₹15 lakh and don’t report, you could be slapped with another ₹15 lakh to ₹30 lakh in fines. On top of that, you could face up to 7 years in prison under Section 276CC of the Income Tax Act.

It’s not theoretical. In 2024, the FIU-IND froze 1,200 crypto wallets linked to unreported mining income. In 2025, two major exchanges-Binance and Bybit-were fined over ₹28 crore combined for not reporting Indian user transactions. The message? If you’re mining and using foreign exchanges, you’re still in their crosshairs.

18% GST on every exchange transaction

Since July 7, 2025, all crypto-related services-including buying, selling, swapping, and even staking-are subject to 18% GST. That means if you mine 1 ETH and then use a platform like WazirX to convert it to INR, you pay 18% on the transaction value. If you swap ETH for USDT to avoid taxes? Still taxed. If you use a decentralized exchange like Uniswap? Still taxed. The Indian government doesn’t care if it’s centralized or decentralized. If you’re an Indian resident, you’re liable.

And yes, this applies even if you’re mining on a pool based in the U.S. or Canada. Your wallet address is tied to your PAN number, and the government now cross-checks that with global blockchain data.

Why mining is barely profitable in India

Let’s say you have a single Antminer S21 running 24/7. It uses 3.2 kW per hour. At ₹8 per unit (average commercial electricity rate), that’s ₹25,600 per month just in power. You mine 0.0008 BTC daily. At ₹50 lakh per BTC, that’s ₹40,000 a day, or ₹12 lakh per month.

But here’s the math:

- Income: ₹12,00,000

- Tax (30% + 4% cess): ₹3,74,400

- TDS (1% on sale): ₹12,000

- 18% GST on exchange conversion: ₹2,16,000

- Electricity: ₹2,56,000

- Equipment depreciation (not deductible): ₹0

Net after all costs and taxes? ₹3,37,600. And that’s before your rig breaks down, which it will within 18 months. You spent ₹4 lakh on the miner. You’ll never recoup it. You’ll never get a tax break for it. And if you sell it later? You’ll pay tax again on the sale.

Compare that to mining in Texas, where electricity is ₹3.50 per unit and you can deduct every dollar spent. Or in Kazakhstan, where miners get subsidized power. In India, you’re paying more in taxes than you’re earning in profit.

The future: More rules, not fewer

India is moving toward full global alignment. By April 2027, it will adopt the OECD’s Crypto-Asset Reporting Framework (CARF). That means every Indian miner-even those using offshore pools-will have to report all mining activity to the government. Your home rig? Your pool in Estonia? Your cloud mining contract in Singapore? All must be disclosed.

There’s also talk of a new law in 2026 that could classify mining as a "regulated financial activity," requiring licenses. No one knows what that will look like. But given how the government has acted so far, it won’t be easy.

The Supreme Court’s 2020 decision that blocked the RBI’s crypto ban gave miners temporary breathing room. But it also confirmed the government’s right to ban crypto outright. The Finance Ministry’s 2025 discussion paper on a "comprehensive crypto framework" didn’t promise protection-it asked for input on how to restrict mining further.

What should you do if you’re mining in India?

If you’re already mining:

- Keep every receipt: equipment, electricity bills, pool fees, gas for your generator.

- Report every coin you mine in Schedule VDA of your ITR. Include the date, coin name, value in INR, and wallet address.

- Don’t assume anonymity. Blockchain is public. Your bank account isn’t.

- Use only FIU-IND registered exchanges. Unregistered ones like Huobi or BitMEX are red flags.

If you’re thinking about starting:

- Don’t. Unless you have a business license, a team of accountants, and ₹10 crore in capital, it’s not worth it.

- Consider mining elsewhere. Many Indian miners now run rigs in Georgia, Kazakhstan, or Paraguay-and wire profits back home. But even then, you still owe tax in India.

The bottom line? Crypto mining in India isn’t banned. But it’s designed to fail. The tax system, enforcement tools, and regulatory chaos make it nearly impossible to profit legally. If you’re still mining, you’re not an innovator-you’re a risk-taker betting against the system. And the system is winning.

Is crypto mining legal in India in 2026?

Yes, crypto mining is not explicitly illegal in India. However, it is heavily regulated under the Virtual Digital Asset (VDA) framework. All mined cryptocurrencies are treated as taxable income, with a 30% flat tax, 4% cess, and 1% TDS applied. No operational expenses can be deducted, making most mining operations unprofitable.

Do I have to pay tax on mined crypto even if I don’t sell it?

Yes. Under Indian tax law, the moment you mine a cryptocurrency, it becomes taxable income at its fair market value in INR on the day it’s received. You don’t need to sell it. The tax is triggered by the act of mining itself.

Can I deduct my electricity and hardware costs from my mining income?

No. Indian tax law only allows you to deduct the cost of acquiring the cryptocurrency (e.g., if you bought it). Costs like electricity, mining rig purchases, cooling, internet, and pool fees are not deductible. This makes India one of the few countries in the world that taxes mining income without allowing expense deductions.

What happens if I mine crypto but don’t report it?

You risk severe penalties. The Income Tax Department uses AI tools like Project Insight and NUDGE to track crypto transactions linked to Indian bank accounts and PAN numbers. Penalties for non-reporting range from 50% to 200% of the tax due, and you could face up to 7 years in prison. The FIU-IND has already frozen over 1,200 wallets for unreported mining income.

Are foreign crypto exchanges allowed to operate in India?

Foreign exchanges can operate in India only if they register with the Financial Intelligence Unit (FIU-IND). Binance, Bybit, and others are now registered, but they must comply with strict reporting rules. Unregistered platforms like Huobi or BitMEX are targeted for enforcement. Indian users using unregistered platforms are still liable for tax and may be flagged.