Jan, 18 2025

Jan, 18 2025

Singapore Crypto License Calculator

Determine Your Singapore Crypto License

Calculate which Singapore license you need based on your business model and monthly transaction volume.

If you’re eyeing Singapore as a launchpad for a crypto business, you’ll quickly discover that the city‑state’s rules are both rigorous and innovation‑friendly. Understanding the Singapore crypto regulations is the first step to avoiding costly penalties and building trust with investors.

Why Singapore Became a Crypto Hub

Singapore’s strategic location, transparent legal system, and tech‑savvy workforce attract fintech firms worldwide. The government’s goal? Encourage digital‑asset growth while keeping the financial system safe. The result is a set of rules that balance risk management with a clear path for market entry.

Key Regulators and Legal Foundations

Monetary Authority of Singapore (MAS) is the country’s central financial regulator, tasked with supervising banks, insurers, and now, crypto service providers. It issues licenses, enforces anti‑money‑laundering (AML) standards, and publishes guidance that shapes the entire crypto ecosystem. The two cornerstone statutes are the Payment Services Act (PSA), enacted in 2020, which created a unified licensing regime for all payment‑related activities, including crypto exchanges and wallet providers. Complementing the PSA, the Financial Services and Markets Act (FSMA) was originally passed in 2022 but only in June 2025 did it fully apply to digital token service providers (DTSPs). This law expands MAS’s reach to any firm offering token services from Singapore, even if its customers are overseas.

How Crypto Assets Are Classified

MAS calls cryptocurrencies “Digital Payment Tokens (DPTs).” Under the PSA, DPTs are treated as a separate asset class, distinct from e‑money or securities. However, when a token is used in a public offering, it may fall under the Securities and Futures Act (SFA), triggering additional disclosure duties.

Licensing Tiers: What You Need to Know

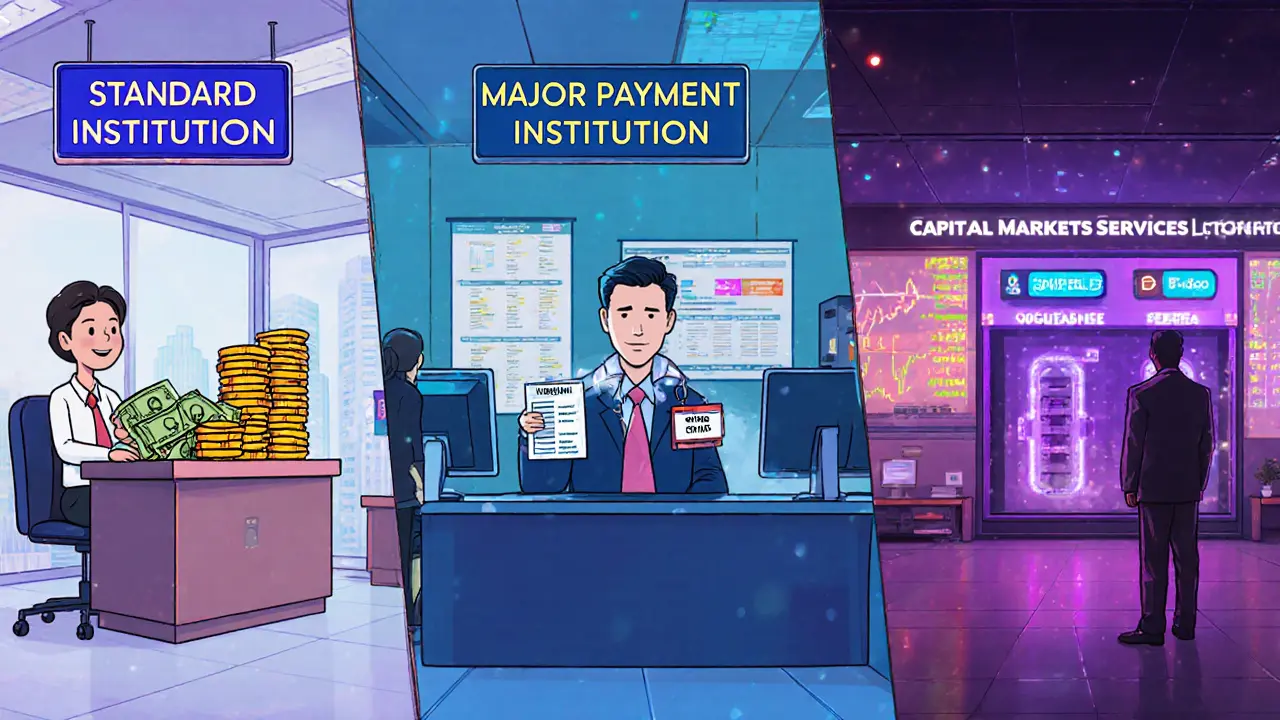

Singapore’s licensing framework is tiered to match the size and risk profile of crypto operations. The three main categories are:

- Standard Payment Institution (SPI) License - designed for firms handling up to SGD 3 million in monthly transaction volume. Requires a minimum capital of SGD 100 000, basic AML controls, and quarterly reporting.

- Major Payment Institution (MPI) License - for businesses exceeding SGD 3 million per month. Demands at least SGD 250 000 in capital, sophisticated risk‑management systems, annual independent audits, and a dedicated compliance officer based in Singapore.

- Exempt Payment Service Provider - applies to narrowly defined low‑risk activities (e.g., certain custodial services). Operators must still notify MAS and adhere to activity‑specific caps.

For platforms that match or trade tokens on a regulated market, a Capital Markets Services (CMS) License is required. This aligns crypto exchanges with traditional securities exchanges, ensuring they meet robust capitalization and governance standards.

| License | Monthly Volume Threshold | Minimum Capital | Key Compliance Obligations |

|---|---|---|---|

| Standard Payment Institution (SPI) | ≤ SGD 3 M | SGD 100 000 | Basic AML/KYC, quarterly reporting, internal controls |

| Major Payment Institution (MPI) | > SGD 3 M | SGD 250 000 | Advanced risk management, annual audit, Singapore‑based compliance officer |

| CMS License (for exchanges) | Varies (market‑making activities) | Depends on business model, typically ≥ SGD 500 000 | Investor protection rules, segregation of client assets, ongoing market supervision |

The 2025 Regulatory Overhaul

June 30 2025 marked a watershed moment. The FSMA’s digital‑token regime required every DTSP operating from Singapore to obtain a license-no grace period, no exceptions. Firms that failed to comply were ordered to cease operations immediately and faced hefty fines. The new regime also introduced stricter capital buffers, mandatory appointment of a local compliance officer, and annual third‑party audits.

Why such a hard line? MAS wants to eliminate regulatory arbitrage. By extending jurisdiction to offshore‑serving providers, Singapore ensures that any entity benefitting from its stable legal environment also shoulders the same consumer‑protection responsibilities.

Anti‑Money‑Laundering Rules: The Crypto Travel Rule

MAS Notice PSN02 - Crypto Travel Rule obliges crypto platforms to collect and share detailed sender‑and‑receiver information for transactions above SGD 1,000 (or equivalent in foreign currency). This mirrors the FATF Travel Rule for fiat transfers. The process involves:

- Gathering full name, address, and national ID of both parties.

- Recording the transaction hash, amount, and timestamp.

- Transmitting the data to the counter‑party’s service provider within a stipulated timeframe (usually 24 hours).

Failure to comply can trigger AML investigations, freezing of assets, and substantial fines. Many platforms adopt automated compliance tools that integrate directly with MAS’s reporting API to stay on the safe side.

Stablecoin Framework - What’s Allowed?

Singapore’s stablecoin guidelines sit alongside its broader crypto rules. Issuers must:

- Maintain a 1:1 reserve backing, audited quarterly.

- Obtain a specific stablecoin licence under the PSA.

- Publish clear redemption procedures and ensure real‑time auditability.

These measures aim to prevent the “run” scenario that plagued some unregulated tokens in 2022. As a result, several major global stablecoin projects have chosen Singapore as their regional headquarters.

Practical Checklist for Crypto Start‑ups

Before you file any paperwork, run through this quick sanity check:

- Identify your core service - payment, exchange, custody, or token issuance.

- Map your expected monthly transaction volume to the appropriate license tier.

- Ensure you have at least the minimum capital in a Singapore‑based bank.

- Appoint a qualified compliance officer who resides in Singapore.

- Implement KYC/AML workflows that satisfy PSN02 (Crypto Travel Rule).

- Prepare for an annual audit by a MAS‑approved auditor.

If any item feels vague, consider hiring a local consultancy that specializes in MAS licensing - the cost of a misstep far outweighs the advisory fee.

Future Outlook: Where Is Regulation Headed?

MAS has signaled that the framework will stay agile. Upcoming focus areas include:

- Regulating decentralized finance (DeFi) protocols that offer lending or yield farming services.

- Introducing sandbox extensions for blockchain‑based identity solutions.

- Potentially tightening rules on crypto‑linked derivatives to protect retail investors.

Staying informed means subscribing to MAS updates, attending the annual FinTech Festival, and watching for amendments to PSN02 and the PSA.

Key Takeaways

Singapore’s crypto regulations combine clear licensing pathways with strict AML and consumer‑protection standards. The 2025 overhaul makes compliance non‑negotiable, but it also grants firms a stable, internationally respected operating environment. Get your license right, embed robust compliance early, and you’ll be well positioned to tap into Asia’s fastest‑growing digital‑asset market.

Do I need a license if I only serve overseas customers?

Yes. Since June 2025, the FSMA requires any digital token service provider operating from Singapore to be licensed, even if all users are abroad.

What is the minimum capital for a Major Payment Institution?

MAS mandates at least SGD 250 000 in paid‑up capital for an MPI license, plus additional reserves based on risk profile.

How does the Crypto Travel Rule affect small exchanges?

Even small platforms must capture sender and receiver details for transactions over SGD 1,000. Automated KYC tools can streamline this process.

Can I issue a stablecoin without a PSA licence?

No. Stablecoin issuers need a specific licence under the PSA, plus proof of 1:1 reserve backing and regular audits.

What are the penalties for operating without a licence?

MAS can impose fines up to 10% of annual turnover, order a shutdown, and pursue criminal charges against directors.

Pierce O'Donnell

January 18, 2025 AT 10:14Sure, Singapore's crypto rules are 'innovation‑friendly,' but they feel more like a bureaucratic maze.

Kaitlyn Zimmerman

February 5, 2025 AT 07:34Singapore has become a natural magnet for fintech because the government backs digital‑asset projects with clear guidelines. The MAS licensing tiers let startups pick a path that matches their size without drowning in red tape. If you’re planning a token launch, start by mapping your monthly volume to the SPI or MPI thresholds outlined in the PSA. Remember that the compliance officer must be based locally, which helps build trust with regulators and investors alike.

Chris Morano

February 23, 2025 AT 04:54It’s encouraging to see a framework that tries to protect users while still letting innovators thrive. The travel rule may seem strict but it aligns Singapore with global AML standards. Keeping the capital requirements modest for small firms is a sensible compromise. Overall the approach feels balanced and supportive of sustainable growth.

Bobby Lind

March 13, 2025 AT 02:14Wow, the detail in the licensing table is impressive, and the tiered capital thresholds give clear signposts, especially for newcomers,! It’s also great that the stablecoin guidelines require 1:1 reserves, which adds a layer of safety,! With the travel rule in place, platforms can demonstrate transparency, and that builds confidence across the ecosystem,!

Marina Campenni

March 31, 2025 AT 00:34I understand that navigating MAS requirements can feel overwhelming at first, but many founders find that the clarity actually reduces long‑term risk. Seeking advice from a local consultancy often pays off, as they can streamline the application process and ensure you meet the AML obligations. The community is quite supportive, and sharing experiences can help everyone stay compliant.

Miguel Terán

April 17, 2025 AT 21:54Singapore’s regulatory landscape for digital assets reads like a tapestry woven with ambition and caution. The Monetary Authority of Singapore has deliberately crafted a regime that resembles a well‑tuned orchestra where each instrument knows its part. By introducing the Payment Services Act, MAS created a unified stage for payment institutions, crypto exchanges, and custodians alike. The subsequent amendment via the Financial Services and Markets Act extended the spotlight to digital token service providers operating from the island. This expansion ensures that even firms whose customers reside overseas cannot hide behind jurisdictional loopholes. The licensing tiers-Standard Payment Institution, Major Payment Institution, and the Capital Markets Services license-act as stepping stones that match a company’s scale with its regulatory obligations. A modest startup can launch under the SPI framework with a modest capital base, while larger players graduate to MPI and must install sophisticated risk controls. The requirement for a locally resident compliance officer serves as a human anchor, reminding firms that accountability remains rooted in Singapore’s legal soil. Anti‑money‑laundering measures such as the Crypto Travel Rule echo global standards, demanding that transaction data above a modest threshold be shared between service providers. This data‑sharing mandate, while adding operational overhead, also fortifies the ecosystem against illicit flows. Stablecoin issuers, too, are not left to their own devices; they must secure a 1:1 reserve and undergo periodic audits, a safeguard that mitigates the risk of a sudden loss of confidence. The 2025 overhaul, which removed grace periods, signaled MAS’s commitment to eliminating regulatory arbitrage. Firms that ignored the deadline faced swift shutdowns and hefty penalties, reinforcing the message that compliance is non‑negotiable. Yet, this rigor does not stifle innovation; rather, it provides a stable foundation upon which creative financial products can be built. Entrepreneurs who embed compliance early often discover that the process uncovers operational inefficiencies that, once addressed, improve overall business health. Looking ahead, MAS’s interest in regulating DeFi protocols and blockchain identity solutions suggests that the regulatory framework will continue to evolve in step with technological advances. For anyone considering Singapore as a launchpad, the mantra remains clear: understand the licensing tiers, secure the required capital, appoint a qualified compliance officer, and align your AML practices with MAS expectations. By doing so, you position your venture at the crossroads of regulatory certainty and market opportunity.

Shivani Chauhan

May 5, 2025 AT 19:14That was a thorough walk‑through, thanks for laying it all out. I’m curious about how the compliance officer’s responsibilities differ between an SPI and an MPI. Does the officer need to hold any specific certifications, or is the requirement purely residency‑based? Also, for a small token project that expects to stay under the SGD 1,000 travel‑rule threshold, is the reporting burden still significant? Any tips on lightweight KYC tools that play nicely with MAS’s API would be appreciated.

Schuyler Whetstone

May 23, 2025 AT 16:34Honestly this whole KYC obsession is just another way for big banks to keep the little guys in check, and it’s ridiculous.

David Moss

June 10, 2025 AT 13:54One could argue that the strict travel‑rule is a covert funnel feeding data to shadowy entities, but the authorities claim it’s all about security-still, the lack of transparency fuels suspicion; perhaps we’ll never know who’s really watching.