Margin Trading Crypto: How Leverage Works and Why It Can Destroy Your Account

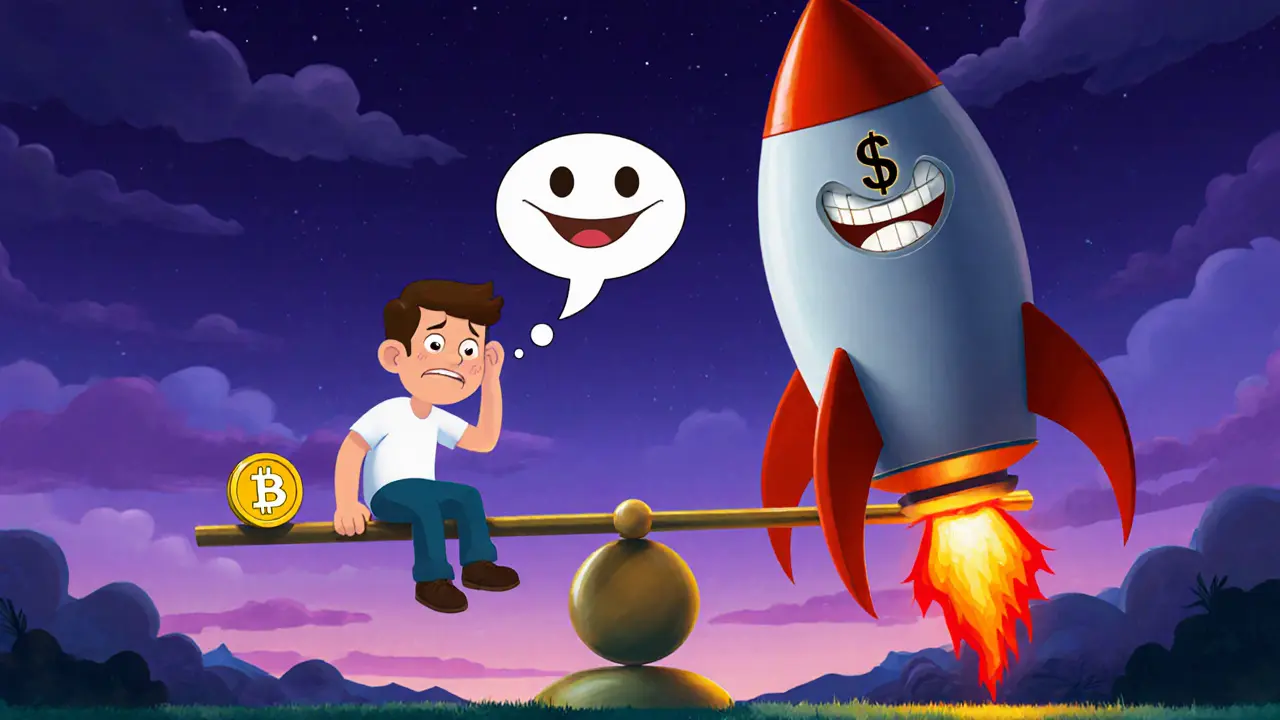

When you engage in margin trading crypto, a practice where traders borrow funds from an exchange to increase their position size beyond their actual capital. Also known as crypto leverage trading, it turns small price moves into big wins—or even bigger losses. It’s not magic. It’s math. And most people don’t understand the math until they’ve lost everything.

Crypto leverage, the amount of borrowed money used in a trade, is what makes margin trading both tempting and dangerous. You might see a 10x or even 100x leverage option on some exchanges, and it sounds like free money. But leverage doesn’t just multiply gains—it multiplies your risk of liquidation risk, the moment your position is automatically closed because your account balance falls below the minimum required to hold the trade. One sudden drop in Bitcoin, one failed altcoin pump, and you’re wiped out. No warning. No second chance.

What separates the traders who survive from those who vanish? It’s not luck. It’s understanding crypto margin, the actual amount of your own funds you put up as collateral to open a leveraged position. If you put in $1,000 and use 10x leverage, you’re controlling $10,000. But if the market moves just 10% against you, you lose your entire $1,000. And if it drops 11%? You’re not just out of your money—you owe the exchange more. That’s the hidden trap: you can lose more than you deposit.

Most beginners jump into margin trading because they see someone else make a quick profit. But they never see the 20 other people who lost their accounts that same day. The real edge isn’t in picking the next moonshot. It’s in managing your position size, setting stop-losses that actually work, and knowing when to walk away. The exchanges don’t care if you win or lose. They just want you to trade. And they make money whether you win or get liquidated.

You’ll find posts here that break down how leverage actually works behind the scenes, why 90% of new traders get wiped out within weeks, and what real risk management looks like—no fluff, no hype. We cover real cases, real losses, and real strategies used by people who’ve been through it. You won’t find a single post telling you to "go all in on BTC with 50x leverage." You’ll find the truth: that the safest traders are the ones who use the least leverage, not the most.

Understanding Leverage in Crypto Trading: How It Works and Why Most Beginners Lose Money

Leverage in crypto trading lets you control large positions with little capital, but it multiplies both gains and losses. Learn how it works, why most beginners lose money, and how to trade it safely.