Aug, 30 2025

Aug, 30 2025

UBXS Token Investment Calculator

This calculator shows potential returns and risks based on UBXS token data from the article (as of October 2025). Remember: UBXS is a high-risk speculative asset with thin liquidity and unfulfilled roadmap promises.

Investment Summary

Important Warning: UBXS has experienced a 98% price drop from ATH and has thin liquidity. The project has missed key milestones with minimal community engagement.

Ever stumbled upon a crypto that claims to bridge the gap between bricks‑and‑mortar real estate and digital finance? That’s the promise behind UBXS token, a token you’ll hear about when browsing niche blockchain projects. If you’re curious whether it lives up to the hype or just another echo in the crowded crypto space, this guide breaks it down in plain English.

When you hear about UBXS Token is a BEP‑20 utility token launched by Bixos on the Binance Smart Chain, think of it as a digital voucher that the Bixos team hopes will one day smooth real‑estate deals, cut fees and add liquidity to property markets. The token’s ticker is UBXS and it lives exclusively on the Binance Smart Chain, meaning you’ll need a BSC‑compatible wallet like MetaMask (configured for BSC) or Trust Wallet to hold it.

Bixos is a blockchain company that positioned itself as a pioneer in real‑world asset tokenization. Their whitepaper, released in early 2022, paints a picture of a $100trillion real‑estate market waiting to be digitized. The company’s roadmap promised platform integrations, a mobile app, and a token‑driven marketplace - ambitions that, three years on, remain largely unfulfilled.

Technical Basics

Binance Smart Chain (BSC) is a high‑throughput blockchain built by Binance, compatible with the Ethereum Virtual Machine and known for low transaction fees. UBXS inherits BSC’s speed and cost advantages, but also shares its reliance on the Binance ecosystem.

BEP‑20 is a token standard on BSC, analogous to ERC‑20 on Ethereum, defining how tokens can be transferred, approved, and interacted with. UBXS follows this standard, so any BSC wallet or DEX that supports BEP‑20 can handle it.

Another core concept is Real Estate Tokenization - the process of representing property ownership or revenue streams as blockchain tokens. UBXS aims to be a utility token that powers this tokenization, offering fee discounts for participants in the property market.

Key Specifications

| Attribute | Value |

|---|---|

| Symbol | UBXS |

| Chain | Binance Smart Chain (BEP‑20) |

| Total Supply | 100,000,000 UBXS |

| Circulating Supply | 23,627,206 UBXS |

| Market Cap | $162,100 (approx.) |

| Current Price | $0.0075 |

| All‑Time High | $0.5662 |

| Primary Trading Pair | UBXS/BNB |

Price History & Market Sentiment

UBXS launched at a modest price and peaked at $0.5662, only to tumble nearly 99% from that high. As of October2025 the token trades around $0.0075, a fraction of its former glory. Technical indicators reinforce a bearish outlook: the 14‑day Relative Strength Index (RSI) sits at 30.9, signaling oversold conditions but also weak momentum. Both the 50‑day and 200‑day Simple Moving Averages (SMA) sit well above the current price ($0.0140 and $0.0190 respectively), a classic sign that the token is trading below its longer‑term trend.

Volume tells a similar story. Daily trading volume hovers near $38,900, with the UBXS/BNB pair accounting for roughly half of all activity. Such thin liquidity means even modest trades can cause noticeable price swings, raising the risk of slippage for anyone looking to buy or sell sizable amounts.

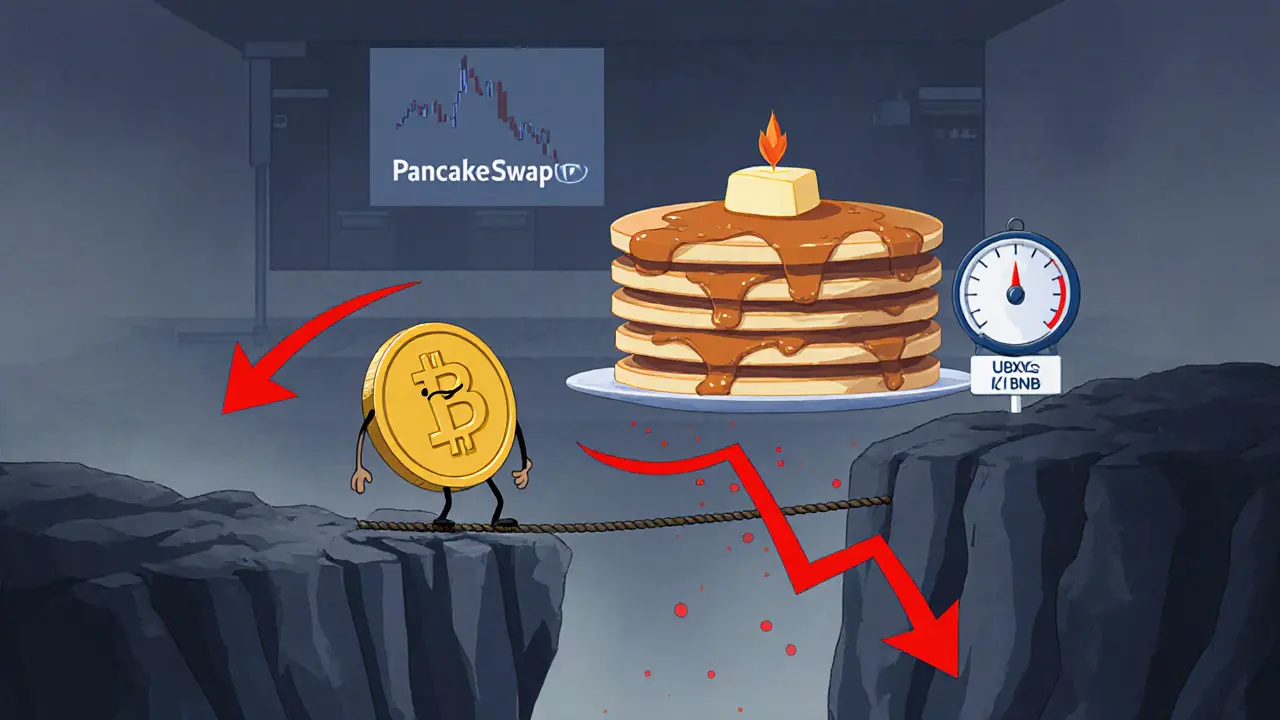

Where Can You Trade UBXS?

The token is listed on five exchanges: Bilaxy, Gate.io, PancakeSwap (two liquidity pools), and MXC. PancakeSwap, the dominant BSC‑based DEX, hosts the bulk of the trading activity, especially through the UBXS/BNB pool. The limited exchange presence underscores UBXS’s niche status - it’s far from the multi‑exchange listings enjoyed by top‑tier tokens.

Tokenomics & Utility

UBXS’s utility hinges on two mechanisms:

- Fee Discounts: The token promises lower transaction fees for real‑estate buyers, sellers and agents who use UBXS as payment.

- Burn & NFT‑Bond Integration: Tokens spent on NFT‑Bond purchases are burned, reducing circulating supply over time.

In addition, Bixos announced a separate governance token - BXS - intended to give holders voting rights in a DAO‑LLC structure. To date, BXS has seen almost no activity, and the dual‑token model remains largely theoretical.

Community, Support & Development Activity

Community enthusiasm appears to be fading. The official Telegram channel peaked at 1,247 members in early 2023 but now averages fewer than a dozen daily messages. Reddit threads and Binance forums contain mostly skeptical comments, with users pointing out broken links between the promised real‑estate platform and the actual product.

Development updates have stalled. The Bixos GitHub shows no commits since June2022, and the company’s Twitter feed dropped from 15 tweets per week in 2022 to just two in 2023. Support response times hover around 72hours, according to user surveys, indicating a lack of dedicated customer service.

Competitive Landscape

UBXS isn’t the only player trying to tokenize property. RealT tokenizes U.S. real‑estate on Ethereum, processing over $30million in transactions annually. LAND represents virtual land in Decentraland, enjoying a vibrant marketplace and strong community support. Both competitors have far higher liquidity, clearer regulatory compliance, and active development roadmaps - factors that UBXS currently lacks.

Regulatory Outlook

Real‑estate tokenization sits in a regulatory gray zone. In the United States, the SEC has issued 17 warning letters to similar projects for potential securities law violations. The EU’s MiCA framework, effective 2024, classifies utility tokens like UBXS under stricter compliance rules, potentially increasing operational costs for the Bixos team.

Pros, Cons & Bottom‑Line Assessment

- Pros:

- Low transaction fees on BSC.

- Clear utility narrative (real‑estate fee discounts, token burn).

- Available on multiple BSC‑compatible wallets.

- Cons:

- Severe price depreciation (‑98% from ATH).

- Thin liquidity; high slippage.

- Unrealized roadmap milestones; no real‑world integrations.

- Minimal community activity and stale development.

- Regulatory uncertainty for real‑estate token projects.

Given the stark gap between the $100trillion market claim and a $162k market cap, the token appears vastly over‑valued on paper and under‑delivered in practice. For most investors, especially those new to crypto, the risk likely outweighs any speculative upside.

How to Proceed if You’re Still Interested

- Set up a BSC‑compatible wallet (MetaMask or Trust Wallet) and add the BSC network (RPC: https://bsc-dataseed.binance.org/, ChainID: 56).

- Purchase a small amount of Binance Coin (BNB) to cover transaction fees.

- Navigate to PancakeSwap, select the UBXS/BNB pool, and swap BNB for UBXS - start with an amount you can afford to lose.

- Monitor the token’s price, volume, and community updates weekly. Use CoinGecko or CoinMarketCap for real‑time data.

- Consider diversifying into more established real‑estate token projects if your goal is exposure to property markets.

Key Takeaways

- UBXS Token is a BEP‑20 utility token on Binance Smart Chain, built by Bixos to enable cheap real‑estate transactions.

- Market cap is around $162k, circulating supply ~23.6M, and price sits near $0.0075.

- Technical analysis shows bearish momentum; liquidity is thin across only five exchanges.

- Roadmap promises remain unfulfilled; community engagement is declining.

- Regulatory scrutiny and competition from projects like RealT make UBXS a high‑risk speculative asset.

Frequently Asked Questions

What is the main purpose of UBXS Token?

UBXS is intended to act as a utility token that lowers transaction fees for real‑estate deals and fuels a token‑based property marketplace envisioned by Bixos.

Is UBXS mineable?

No. UBXS is a pre‑minted BEP‑20 token; you acquire it on exchanges or via swaps, not through mining.

Which wallets support UBXS?

Any wallet that works with Binance Smart Chain - MetaMask (with BSC network added), Trust Wallet, and Binance Chain Wallet are the most common choices.

Where can I trade UBXS?

UBXS is listed on Bilaxy, Gate.io, MXC and primarily on PancakeSwap (BSC DEX) via the UBXS/BNB pair.

Is UBXS a good long‑term investment?

Given its steep price decline, low liquidity, missed development milestones, and regulatory risks, most analysts consider UBXS a high‑risk speculative token rather than a solid long‑term hold.

Bobby Lind

August 30, 2025 AT 17:09Wow, UBXS really tries to bridge bricks‑and‑mortar with blockchain, and that’s an ambitious vision! The low BSC fees are a nice perk, and if the team can pull off real‑estate tokenization, we could see reduced transaction costs for buyers and sellers alike. Keep an eye on their roadmap, and don’t forget to set aside a tiny amount for gas!

DeAnna Brown

August 30, 2025 AT 19:55This feels like the classic hype‑driven project that promises to revolutionize an entire industry, yet stalls on every key milestone. The US market alone has already seen solid players delivering real‑estate token solutions, and UBXS is still chasing shadows. Their tokenomics sound good on paper, but the thin liquidity and lack of real‑world integrations scream unfulfilled ambition. If they don’t accelerate development soon, the community will move on, and the token will become another footnote in crypto history.

Kaitlyn Zimmerman

August 30, 2025 AT 22:42For anyone looking to understand UBXS beyond the marketing fluff, here are a few concrete points. First, the token lives on Binance Smart Chain, which gives you cheap transfers but also ties the project to Binance’s ecosystem and its regulatory outlook. Second, the current circulating supply of roughly 23.6 million tokens means any large purchase will noticeably shift price due to the shallow order books on PancakeSwap. Third, the promised fee‑discount mechanism has never been demonstrated on a real property transaction, so it remains theoretical.

Fourth, the competition is fierce: projects like RealT on Ethereum already have audited smart contracts and live property listings, while Decentraland’s LAND token dominates virtual real‑estate with an active marketplace. Fifth, the regulatory environment is tightening; the SEC has warned similar tokenization schemes for potentially violating securities laws, and the EU’s MiCA framework now classifies utility tokens under stricter rules.

Sixth, community health is a good proxy for future development-UBXS’s Telegram chatter has dwindled to single‑digit daily messages, and their GitHub shows no commits since mid‑2022. Seventh, the dual‑token model (UBXS + BXS) creates additional complexity without clear governance, making it harder for token holders to influence direction. Eighth, liquidity pools on PancakeSwap are thin; a 10‑percent trade can cause slippage well above 5 percent, which erodes any short‑term trading advantage.

Ninth, the token’s price trajectory showed a dramatic drop from an all‑time high of $0.5662 to under a cent, reflecting both market sentiment and the lack of substantive progress. Tenth, the team’s communication frequency dropped dramatically after 2022, indicating possible resource constraints.

Eleventh, if you still want exposure to tokenized property, consider diversifying into more established platforms that already have audited assets, legal backing, and active development. Twelfth, always treat any investment in a speculative token like UBXS as high‑risk, allocating only capital you can afford to lose.

Finally, stay vigilant about updates from the Bixos team, but keep expectations realistic given the current state of affairs.

Ikenna Okonkwo

August 31, 2025 AT 01:29Reflecting on the broader narrative, the idea of tokenizing physical assets is philosophically appealing because it democratizes access. However, the execution hinges on trust, legal clarity, and solid infrastructure-areas where UBXS still appears fragile.

Pierce O'Donnell

August 31, 2025 AT 04:15UBXS looks like a dead project.

Vinoth Raja

August 31, 2025 AT 07:02From a technical standpoint, UBXS being a BEP‑20 token means it inherits BSC’s gas‑efficiency, but the liquidity depth on PancakeSwap is practically negligible. When you initiate a swap, the AMM’s constant‑product formula (x·y=k) amplifies price impact, leading to slippage that can exceed 10 % on modest trade sizes. Moreover, the token burn mechanism tied to NFT‑Bond purchases is vague; without transparent on‑chain metrics, it’s hard to validate any supply‑reduction effect. In short, the token’s architecture is sound, yet the market dynamics and absent use‑case integrations render it ineffective for real‑world asset transfer.

Shikhar Shukla

August 31, 2025 AT 09:49From a compliance perspective, UBXS raises several red flags. The absence of a registered legal entity in a jurisdiction with clear securities regulations makes it vulnerable to enforcement actions. Additionally, the lack of audited smart contracts contravenes best practices recommended by industry standards such as the OpenZeppelin framework. Investors should therefore exercise heightened caution.

Deepak Kumar

August 31, 2025 AT 12:35While the regulatory concerns are valid, it’s important to remember that many innovative projects started in a legal gray zone before achieving compliance. The community can still play a constructive role by encouraging the Bixos team to publish third‑party audits and to engage with legal advisors. If they manage to secure a partnership with a reputable real‑estate firm, the utility claim could transform from theory to practice. Even with thin liquidity, early adopters who remain patient may benefit when the ecosystem matures. Let’s stay optimistic, share constructive feedback, and keep an eye on any roadmap updates that signal real‑world integration.

Carolyn Pritchett

August 31, 2025 AT 15:22UBXS is a total scam that pumps hype and then disappears. Anyone buying it is being robbed, and the team is clearly absent. This is a textbook example of a rug‑pull waiting to happen.

Matthew Theuma

August 31, 2025 AT 18:09🤔 The data you shared is spot on, but I noticed a typo in the price figure – it should be $0.0075 not $0.075. Still, the overall assessment feels accurate, and the emoji usage makes it more engaging! 👍

Jason Zila

August 31, 2025 AT 20:55The real risk here isn’t just price volatility; it’s the structural gap between the promised token‑driven marketplace and the current absence of any live property listings. Without that bridge, UBXS remains a speculative token rather than a functional utility.

Chris Morano

August 31, 2025 AT 23:42Summing up, the token offers a clear concept and cheap BSC transfers, yet execution lags behind expectations. Investors should weigh the thin liquidity, stalled development, and regulatory uncertainty before committing funds. Keeping a diversified portfolio and limiting exposure to high‑risk tokens like UBXS is a prudent approach.