May, 24 2025

May, 24 2025

Token Burn Impact Calculator

How Token Burning Affects Supply

Calculate the impact of burning tokens on your token's supply and potential market effects. Select your burn mechanism to see specific impact details.

Results

How to Use

Enter your current token supply and amount to burn to see the potential impact. This calculator uses the burn mechanisms described in the article to show how different approaches might affect market dynamics.

Remember: Token burning reduces supply, which can potentially increase value if demand remains constant, but market factors heavily influence actual price movement.

When a project decides to cut down its Token Burning is a process that permanently removes tokens from circulation, it’s aiming for scarcity, price stability, or simply a cleaner token economy. Over the past few years, burning has moved from a novelty to a core part of tokenomics for more than three‑quarters of the top 100 crypto assets.

Why Burn Tokens?

Burning creates artificial scarcity, which can help lift token value when demand stays steady. It also shows that a project is serious about managing inflation-think of it as a central bank buying back and destroying its own currency. Beyond price, burns can signal commitment, enable deflationary mechanisms (like transaction‑fee burns), or act as a prerequisite for new utility (e.g., burning to unlock premium features).

Common Burn Mechanisms

Projects choose a method that matches their goals, technical stack, and community expectations. Below is a concise rundown of the most popular approaches.

- Scheduled Burn: Pre‑announced burns that happen at regular intervals (quarterly, yearly). Binance’s BNB burns are a textbook case, having slashed supply by over 40% since inception.

- One‑Time Large‑Scale Burn: A single massive transaction that grabs headlines. Vitalik Buterin’s 410trillion SHIB burn in September2021 shocked the market and drove short‑term volatility.

- Protocol‑Driven Burn: Integrated at the consensus layer. Ethereum’s EIP‑1559, activated in August2021, automatically burns the base fee of each transaction, already removing about 2.5millionETH.

- Buyback‑Then‑Burn: A project purchases tokens from the open market and then burns them. MEXC’s LUNA recovery plan allocated $10million for this purpose.

- DAO‑Governed Burn: Community members vote on burn proposals. Shiba Inu’s burn portal lets users trigger burns after on‑chain voting.

- Transaction‑Fee Burn: A fraction of every transaction fee is sent to an irretrievable address. Many DeFi protocols adopt a 2‑% fee that’s burned automatically.

Implementation Blueprint

Regardless of the chosen mechanism, the technical steps share a common backbone. The following six‑step process covers everything from design to production.

- Define Trigger Conditions - Decide when a burn occurs (time‑based, volume‑based, event‑based, or community‑vote).

- Set Access Controls - Limit who can call the burn function (owner, multi‑sig, DAO, or open).

- Write the Smart Contract - Implement the burn logic in the chain’s native language (Solidity for Ethereum, Rust for Solana). Use OpenZeppelin libraries when possible.

- Deploy and Verify - Publish the contract, verify the source on block explorers, and publish the ABI.

- Test Rigorously - Write unit tests covering edge cases, simulate burns on testnets, and run fuzzing tools.

- Audit Security - Engage a reputable auditor (e.g., Trail of Bits, ConsenSys Diligence) to check for re‑entrancy, incorrect address usage, and overflow bugs.

For a simple one‑time burn, steps 1‑3 can be completed in a couple of days by a junior Solidity developer. Complex protocol‑level burns, like modifying EIP‑1559, often need weeks of design, formal verification, and community signaling.

Sample Solidity Burn Function

Here’s a minimal example that follows best‑practice guidelines:

pragma solidity ^0.8.0;

import "@openzeppelin/contracts/token/ERC20/extensions/ERC20Burnable.sol";

import "@openzeppelin/contracts/access/AccessControl.sol";

contract MyToken is ERC20Burnable, AccessControl {

bytes32 public constant BURNER_ROLE = keccak256("BURNER_ROLE");

address public constant BURN_ADDRESS = 0x000000000000000000000000000000000000dEaD;

constructor() ERC20("MyToken", "MTK") {

_setupRole(DEFAULT_ADMIN_ROLE, msg.sender);

_setupRole(BURNER_ROLE, msg.sender);

}

function burn(uint256 amount) external onlyRole(BURNER_ROLE) {

_burn(msg.sender, amount);

// Transfer to burn address to make it unmistakable on‑chain

_transfer(msg.sender, BURN_ADDRESS, amount);

}

}

This contract uses ERC‑20 standards, role‑based access, and a canonical Burn Address (0x…dEaD). The function is auditable, and only accounts with the BURNER_ROLE can invoke it.

Comparison of Burn Methodologies

| Mechanism | Typical Use‑Case | Implementation Complexity | Market Impact | Community Involvement |

|---|---|---|---|---|

| Scheduled Burn | Long‑term supply control (e.g., Binance BNB) | Low - simple script + timelock | Predictable, builds trust; short‑term price effect modest | Low - mostly governed by project team |

| One‑Time Large Burn | Marketing shock (e.g., SHIB burn) | Medium - requires liquidity procurement | Immediate volatility; can spark hype | Low - executed by founders or treasury |

| Protocol‑Driven Burn (EIP‑1559) | Base‑fee reduction on every transaction | High - consensus change, network upgrade | Continuous deflation; affects network economics | None - baked into protocol |

| DAO‑Governed Burn | Community‑first tokenomics (e.g., Shiba Inu portal) | Medium - smart‑contract voting + execution | Variable - depends on voter turnout | High - token holders directly decide |

| Buyback‑Then‑Burn | Market‑based supply reduction | Medium - requires treasury funding and DEX interaction | Can boost price if market perceives confidence | Low - team‑initiated |

Pitfalls and Security Risks

Improper burns can be disastrous. A 2022 incident saw $2.3million of user funds disappear because a UI bug sent tokens to a recoverable address instead of the true burn address. Common mistakes include:

- Using a mistyped burn address (e.g., missing “dEaD” suffix).

- Missing access controls, allowing anyone to trigger a burn.

- Failing to emit events, making audits impossible.

- Neglecting overflow checks, which can wrap the supply back up.

Mitigation strategies are straightforward: adopt the standard 0x000…dEaD address, enforce multi‑sig approvals, write exhaustive tests, and run formal verification where possible.

Regulatory Landscape

Regulators are watching burns closely. The SEC warned in early2023 that token burns might be viewed as “unregistered securities transactions” if they’re used to manipulate price. Europe’s ESMA flagged burns as potential market‑manipulation vectors. Projects therefore disclose burn rationales in whitepapers, publish on‑chain logs, and, in some cases, seek legal counsel before launching large‑scale programs.

Future Trends

Burn mechanisms are evolving beyond pure supply reduction. “Burn‑to‑access” models let users destroy tokens to unlock premium services - STEPN’s move to require token burns for advanced features is gaining traction. Chainlink is prototyping a “burn‑and‑mint equilibrium” that dynamically adjusts burn rates based on network usage. By 2025, analysts expect multi‑dimensional burn strategies (combining scheduled, DAO, and utility‑linked burns) to dominate new token launches.

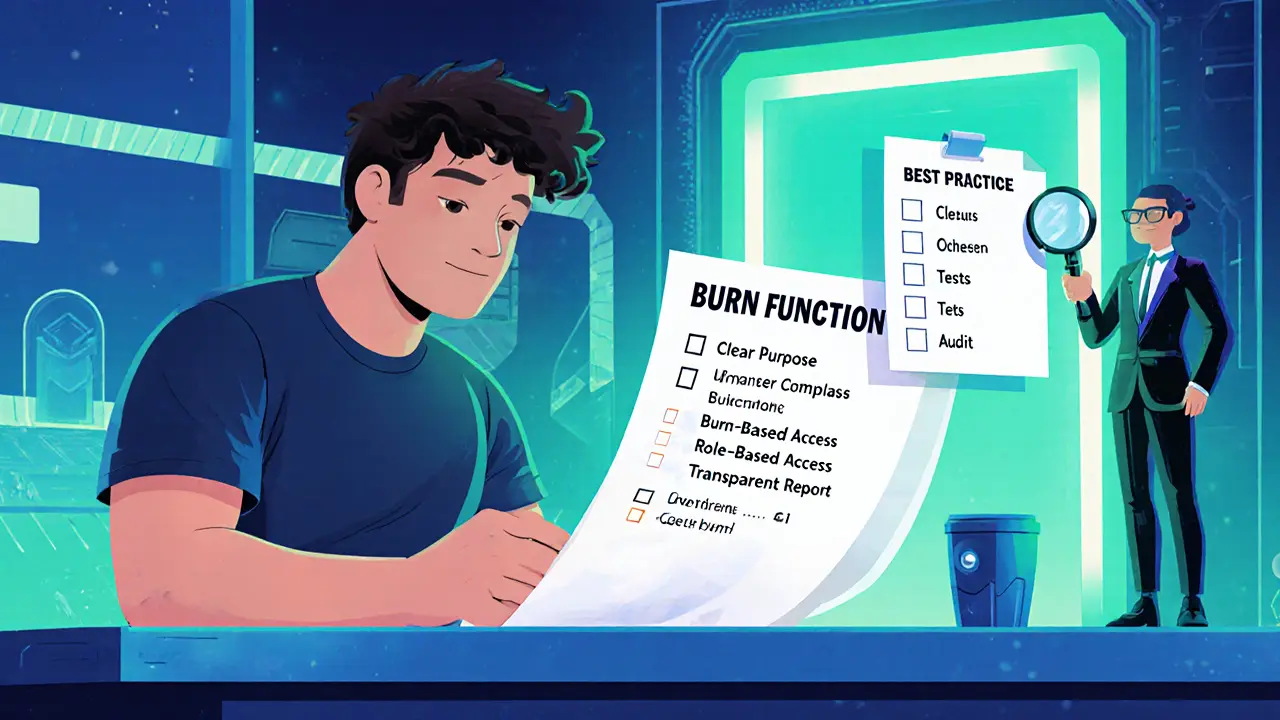

Quick Checklist for a Safe Burn Implementation

- Choose a clear economic purpose (scarcity, fee reduction, utility).

- Document the trigger logic and publish it on‑chain.

- Use the canonical burn address (0x000…dEaD) or a vetted contract that forwards to it.

- Apply role‑based or multi‑sig access controls.

- Write unit tests covering zero‑amount, max‑supply, and re‑entrancy.

- Obtain an independent security audit.

- Publish a transparent burn report after execution (tx hash, amount, timestamp).

Frequently Asked Questions

Frequently Asked Questions

What is the difference between a burn address and a dead wallet?

A burn address is a publicly known address with no known private key (e.g., 0x000…dEaD). Sending tokens there makes them irretrievable. A “dead wallet” is a generic term for any address no longer controlled, but it might still have a private key somewhere.

Can token burning increase a coin’s price?

Burning reduces supply, which can boost price if demand stays the same. However, studies show only about 32% of burns lead to statistically significant price gains within a week. Market sentiment, utility, and broader conditions matter more.

How do I verify that a burn actually happened?

Check the transaction hash on a block explorer. The token transfer should show the destination as the burn address, and the contract’s totalSupply variable must decrease accordingly.

Is it safe to let anyone burn tokens?

Generally not. Open burning can be exploited to destroy user balances unintentionally or maliciously. Most projects restrict burns to a multi‑sig wallet or a DAO vote.

What audit findings should I look for in a burn contract?

Key findings include proper address validation, correct arithmetic (no underflows/overflows), event emission for transparency, and robust access‑control checks. Any missing checks are red flags.

Bobby Lind

May 24, 2025 AT 14:33Token burns are a neat way to trim supply, they can boost scarcity, and they’re more than hype, they actually impact market dynamics, especially when combined with clear economic incentives, so projects should think strategically, and communicate transparently!

Deborah de Beurs

June 10, 2025 AT 23:13Listen, if you’re still playing with vague burn schedules, you’re basically tossing spaghetti at a wall, hoping something sticks! That’s sloppy, chaotic, and it damages credibility.

Sara Stewart

June 28, 2025 AT 07:53From a tokenomics perspective, integrating a burn hook directly into the transfer function reduces gas overhead and aligns incentives across the ecosystem, while emitting proper events ensures auditability and community trust.

Vinoth Raja

July 15, 2025 AT 16:33One could argue that burning is the digital equivalent of alchemy, turning value into void to preserve the remaining essence of the token; it’s a philosophical act as much as a technical one.

DeAnna Brown

August 2, 2025 AT 01:13Let me set the record straight: token burns are not just a gimmick, they are a cornerstone of American crypto innovation, and anyone who downplays their importance is ignoring the very fabric of market dynamics; the history of BNB’s quarterly burns shows how disciplined supply reduction builds investor confidence, and that should be a lesson for every project; the psychology of scarcity drives demand, and when the community sees a transparent, DAO‑governed burn, they feel ownership, which in turn fuels participation; meanwhile, reckless one‑time burns can cause volatility, but when executed with a clear utility purpose-like unlocking premium features-they add real value; don’t forget the regulatory angle, the SEC is watching, and a well‑documented burn process can preempt accusations of market manipulation; on the technical side, using the canonical 0x000…dEaD address eliminates the risk of accidental recoverability, and implementing role‑based access mitigates unauthorized burns; thorough testing on testnets, coupled with formal verification, ensures that the burn logic cannot be exploited, and that’s non‑negotiable; auditors will flag any missing event emissions, because transparency is a must‑have for accountability; community education is also critical, because a misinformed holder might panic during a scheduled burn, not understanding its long‑term benefits; the future trends point toward multi‑dimensional burn strategies, blending scheduled, DAO, and utility‑linked burns, which will set a new standard; so, to sum up, burns are a powerful tool when used responsibly, with clear economic purpose, rigorous security, and open communication, and that is the roadmap for sustainable tokenomics.

Chris Morano

August 19, 2025 AT 09:53A multi‑sig timelock is essential for secure scheduled burns.

Ikenna Okonkwo

September 5, 2025 AT 18:33Optimistically, a well‑documented burn roadmap can foster community trust while safeguarding against regulatory scrutiny, and it also provides a clear signal to investors about the project’s long‑term commitment to scarcity.

lida norman

September 23, 2025 AT 03:13I feel the excitement whenever a burn event hits the chain 😊 it feels like a fresh start!

Miguel Terán

October 10, 2025 AT 11:53Delving into the cultural tapestry of token burns reveals a fascinating interplay between economic theory and communal narratives, where each incinerated token becomes a story told across block explorers and social feeds, underscoring the collective belief in scarcity as a driver of value; this symbiotic relationship is further enriched by artistic representations, memes, and even music that celebrate the act of burning, thereby embedding the technical process into the fabric of crypto culture; as a result, the burn mechanism transcends mere code and evolves into a shared ritual that reinforces identity and purpose within the ecosystem.