Apr, 28 2025

Apr, 28 2025

Welcoin Verification Tool

Is This a Real Welcoin Platform?

This tool helps you verify if a Welcoin-related platform is legitimate or a scam. Enter the details below to check for key red flags.

Red Flags Detected

Next Steps

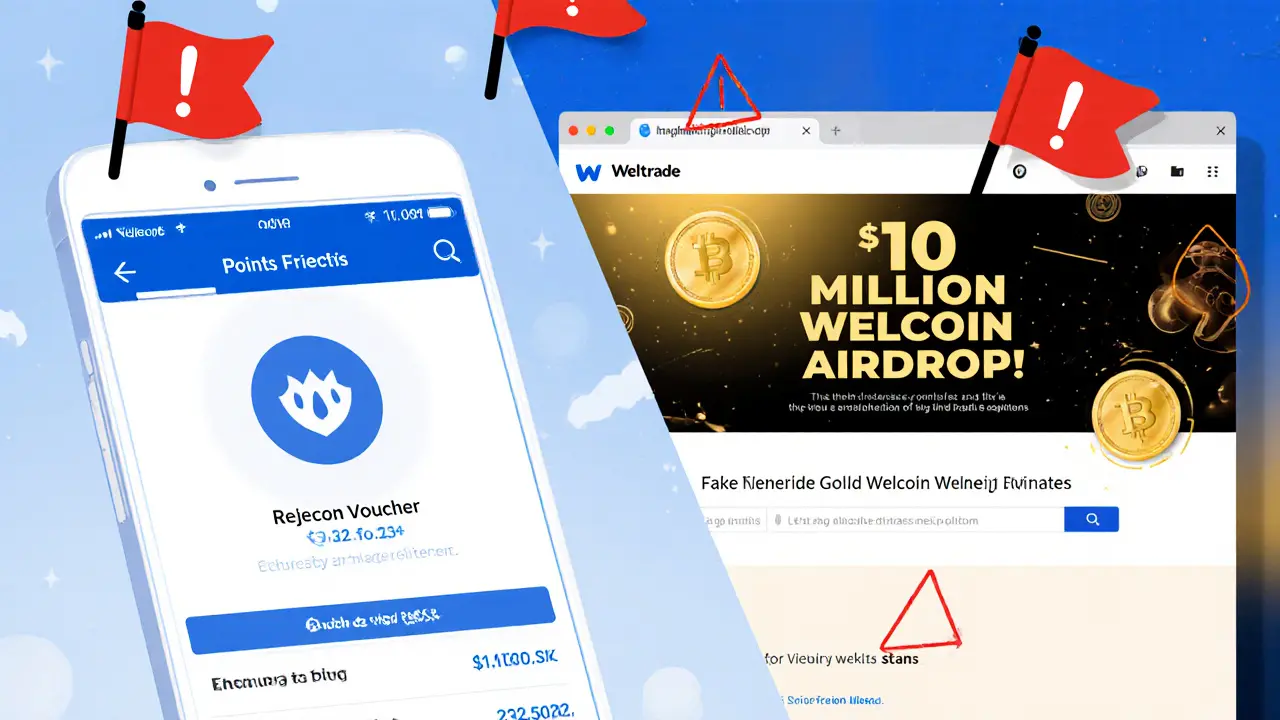

When you type Welcoin review into a search engine, you probably expect to find a new crypto exchange offering low fees and big airdrops. The reality is far different. Welcoin is actually a loyalty points system run by the established forex broker Weltrade, and a wave of fraudsters have been hijacking the name to launch fake "Welcoin Exchange" scams. This article unpacks what Welcoin really is, why the fake exchanges are dangerous, and how you can protect yourself.

Key Takeaways

- Welcoin is a non‑withdrawable loyalty currency inside Weltrade’s forex trading platform, not a tradable cryptocurrency.

- Scammers use the Welcoin name to promote bogus crypto exchanges that promise unrealistic airdrops and instant profits.

- Legitimate Welcoin rewards are earned by trading volume, not by depositing crypto.

- Fake Welcoin exchanges lack regulatory licenses, transparent fee schedules, or verifiable security measures.

- Always verify a platform’s official website and KYC requirements before sending any funds.

What Is Welcoin? (The Real Deal)

Welcoin is Weltrade’s exclusive loyalty currency designed to reward active forex traders. Users earn points for each lot traded, for participating in promotions, and for referrals. The points can be redeemed for cash vouchers, merchandise, or surprise gift boxes through the Welshop. The program is fully integrated into Weltrade’s web and mobile platforms and requires a verified Weltrade account to participate.

Weltrade, founded in 2006 and regulated by the Financial Services Authority of Seychelles (license SD027), serves roughly 1.2 million clients worldwide. Its longevity and regulatory oversight give the Welcoin program credibility that the counterfeit exchanges simply cannot match.

How the Fake Welcoin Exchange Scam Works

Scammers have built a parallel narrative: a brand‑new crypto exchange called "Welcoin" that offers perpetual contracts, staking, and massive airdrops. Their marketing typically includes:

- High‑gloss YouTube ads claiming a "Big Airdrop" of 10 million Welcoins.

- Social media posts on platforms like Binance Square promising instant earnings for crypto deposits.

- Telegram mini‑apps that mimic the look of real exchange dashboards.

Victims are lured into sending Bitcoin, Ethereum, or stablecoins to a wallet address that, once funded, disappears or stops responding. Because Welcoin is not a blockchain token, there is no public ledger to trace these transactions.

Side‑by‑Side Comparison

| Feature | Welcoin Loyalty Program (Weltrade) | Fake Welcoin Exchange |

|---|---|---|

| Entity Type | Non‑withdrawable points within a forex broker | Claimed crypto exchange & token |

| Regulation | Licensed by Seychelles Financial Services Authority | Unregulated; no corporate registration |

| How You Earn | Trade volume, promotions, referrals (no profit requirement) | Deposit crypto, claim airdrops, stake tokens |

| Withdrawal | Not possible - points redeem only for vouchers/merch | Supposedly possible, but withdrawals never process |

| Security Measures | Two‑factor authentication, SSL, regulated KYC | None disclosed; wallet addresses change frequently |

| Customer Support | 24/5 live chat, email, phone - documented response times | Fake tickets; support vanishes after deposit |

| Public Reputation | 4.1/5 on Trustpilot, ForexBrokers.com rank #328 | Zero listings on CoinGecko, Binance, or reputable review sites |

Red Flags to Spot a Welcoin Exchange Scam

Below are warning signs that the platform you’re looking at is not the legitimate Welcoin program:

- Requests for crypto deposits. The real Welcoin never asks for any blockchain assets.

- Promises of guaranteed returns. No exchange can ensure profits; any claim of a 10 million airdrop is a classic bait.

- Lack of regulatory information. Look for license numbers, jurisdiction details, and transparent ownership. Scammers hide these.

- Absent fee schedule. Legitimate exchanges publish maker/taker fees; fake sites stay vague.

- Unprofessional website design. Misspellings, low‑resolution logos, and generic domain names (e.g., .xyz, .info) are common.

How to Verify the Authentic Welcoin Program

To make sure you’re dealing with Weltrade’s genuine loyalty system, follow these steps:

- Visit the official Weltrade website (weltrade.com) and navigate to the "Welcoin" section via the account dashboard - the URL will be under the weltrade.com domain.

- Check your account’s KYC status. A verified account will have a green checkmark next to your name.

- Look for the "Welshop" tab where you can view your balance and redeem rewards. No external wallet address is involved.

- Contact Weltrade support directly through live chat or the official support email. They will never ask you to send crypto to any address.

Impact of Scams on the Crypto Community

According to the Anti‑Phishing Working Group, fake exchange scams surged 37 % in Q1 2024, with names mimicking established financial brands accounting for 83 % of those incidents. CipherBlade’s July 2024 threat report estimated average victim losses of US$1,250 per case, and over 15 000 - 20 000 crypto users fell prey to similar scams in the same period.

Experts like Dr. David Gerard warn that these “branding‑theft” scams disappear within three to six months after hoarding deposits. The rapid rise of Telegram mini‑apps that pretend to be exchange interfaces makes it even harder for newcomers to tell real from fake.

Real Users Share Their Experiences

Weltrade client Victoria Holodniak says, "I earned $320 in cash vouchers over six months just by trading the usual lots. Redemption through Welshop is instant and transparent." By contrast, Reddit user u/CryptoSafe2024 posted on r/CryptoScams, "I sent 0.5 ETH to a so‑called Welcoin Exchange after seeing a YouTube ad. Within three days the support vanished and I couldn’t withdraw anything. I lost over $1,500." These anecdotes highlight the stark contrast between a trusted loyalty program and a fraudulent exchange scheme.

What Regulators Say

Weltrade’s Seychelles license obliges the broker to follow anti‑money‑laundering (AML) standards, periodic audits, and client fund segregation. No regulatory body has approved or listed a "Welcoin Exchange" as a licensed crypto service provider. The lack of oversight means users have little recourse if funds disappear.

Steps to Take If You’ve Been Targeted

If you suspect you’ve deposited funds into a fake Welcoin exchange, act quickly:

- Document every transaction: wallet address, amount, timestamps, and screenshots of the platform.

- Report the incident to your local financial crime unit and to the Anti‑Phishing Working Group.

- File a complaint with the exchange’s alleged jurisdiction, if known, but understand the chances of recovery are low.

- Alert the crypto community by posting on forums like r/CryptoScams or the CryptoScamAlert Telegram group - sharing details helps protect others.

Future Outlook

Weltrade announced in June 2024 that the Welcoin dashboard now shows real‑time balance tracking in its mobile app, making the legitimate program even more transparent. Meanwhile, Deloitte’s 2024 Crypto Fraud Report predicts a 40 % rise in fake exchange scams through 2025 as regulators tighten rules on legitimate platforms. Staying educated and double‑checking any “new exchange” that uses familiar brand names is the best defense.

Is Welcoin a real cryptocurrency I can trade?

No. Welcoin is a loyalty points system inside the Weltrade forex broker. It cannot be withdrawn, transferred, or traded on any blockchain.

How do I earn Welcoins?

You earn Welcoins automatically for each lot you trade, for participating in promotions, and for referring new traders. The points accumulate in your Weltrade account.

Can I withdraw Welcoins as crypto?

No. The points can only be redeemed for cash vouchers, merchandise, or gift boxes through the Welshop. There is no blockchain wallet involved.

What should I do if I’ve sent crypto to a "Welcoin Exchange"?

Gather transaction details, report the scam to your local authority and the Anti‑Phishing Working Group, and warn the community on forums. Recovery is unlikely, but reporting helps prevent further victims.

How can I verify I’m on the official Weltrade site?

Check that the URL ends with weltrade.com, look for the SSL padlock, and navigate to the Welcoin page from within your logged‑in account dashboard.

Katharine Sipio

April 28, 2025 AT 16:20Stay vigilant and double‑check before you trust any exchange.

Deepak Kumar

April 28, 2025 AT 17:43The Welcoin ecosystem is often misunderstood, so it’s crucial to separate fact from fiction.

First, remember that Welcoin is strictly a loyalty point within the Weltrade platform.

It cannot be transferred to an external wallet or traded on any blockchain.

The points you earn are tied to your trading volume, promotions, or referrals.

Because they are non‑withdrawable, they are safe from the typical market volatility.

However, scammers exploit the name by creating fake exchanges that promise unrealistic airdrops.

Those sites usually ask for crypto deposits, which the real program never does.

Always verify the URL ends with weltrade.com and look for the SSL padlock.

If you see a site with a .xyz or .info domain advertising “Welcoin Exchange,” treat it as a red flag.

Check the KYC status in your account; a green checkmark means you are on the legitimate platform.

Contact Weltrade support through the official live chat if anything feels off.

Document every transaction you consider making and keep screenshots of the interface.

Report any suspicious platform to your local financial authority and the Anti‑Phishing Working Group.

Sharing your experience on forums helps protect other traders from falling prey.

By staying informed and double‑checking details, you can safely enjoy the real Welcoin rewards.

lida norman

April 28, 2025 AT 18:33Wow, reading that feels like a roller‑coaster 🎢! I totally get the panic when you spot a “big airdrop” ad, only to realize it’s a trap. The heartbreak of losing your crypto is real, and the emptiness after the support disappears hits hard 😔. That’s why it’s so important to keep all the proof – screenshots, transaction IDs, everything. When you share those details, you become a beacon for others, showing the dark corners where scammers lurk. I’ve seen friends cry over lost ETH, and it’s a painful reminder that vigilance is our best armor.

Deborah de Beurs

April 28, 2025 AT 19:40Let’s cut the nonsense – any site dangling a “Welcoin Exchange” promise is pure trash. They slap on glittery graphics, speak in hype, and expect you to hand over your hard‑earned crypto without a second thought. It’s a classic bait‑and‑switch, and it’s infuriating how fast people fall for it. If the platform can’t prove a legit license or a real corporate address, it’s a scam waiting to explode. Stop trusting glossy ads and start demanding real proof before you click that “Deposit” button.

Sara Stewart

April 28, 2025 AT 20:30Exactly, the red‑flag indicators line up like a perfect alignment of the risk matrix. Lack of a verifiable license, absence of a transparent fee schedule, and the use of generic TLDs are all high‑severity signals in compliance terms. When you factor in the missing AML/KYC framework, the risk exposure skyrockets. In practice, this means the platform fails all the essential due‑diligence checkpoints we champion in fintech risk assessments. Bottom line: steer clear unless they provide full regulatory documentation.

Laura Hoch

April 28, 2025 AT 21:53When we examine the phenomenon of brand‑theft in the crypto sphere, we encounter a mirror reflecting deeper societal anxieties about trust and legitimacy. The allure of a quick windfall blinds many, yet the philosophical underpinnings remind us that true value is earned through consistent effort, not fleeting promises. By interrogating the motives behind these counterfeit exchanges, we uncover a narrative of desperation, where impostors seek validation through the veneer of established names. The antidote lies not only in vigilance but also in cultivating a community that rewards transparency and discourages opportunistic deception.

DeAnna Brown

April 28, 2025 AT 23:16Seriously, folks, if you think you can just swoop in with a fake Welcoin Exchange and pull the wool over everyone's eyes, think again! I’ve lived through enough scams to know that the second you mention “instant profits,” the money is already out the door. My advice? Trust the real Weltrade, ignore the flash‑in‑the‑pan hype, and keep your crypto where it belongs – under your own secure wallet.

Jessica Cadis

April 29, 2025 AT 00:40From a cultural standpoint, the fascination with quick gains mirrors a broader narrative we see across many societies where instant success is glorified. However, in communities that value long‑term stability, the emphasis is on steady growth and due diligence. Sharing these stories helps bridge the gap between hype‑driven mentalities and the disciplined approach that traditional financial cultures advocate.

Shikhar Shukla

April 29, 2025 AT 02:03It is incumbent upon any prudent investor to conduct exhaustive verification of a platform's regulatory credentials before committing assets. The absence of a recognized license, coupled with opaque operational structures, inevitably classifies the entity as non‑compliant under prevailing financial statutes. Consequently, any engagement with such an unregistered exchange is tantamount to willful negligence.