Jan, 31 2026

Jan, 31 2026

Parex (PRX) isn’t another meme coin or copycat blockchain. It’s a niche project built around one specific idea: making it easier to move tokens between different blockchains without high fees or long waits. But while the concept sounds promising, the reality is far more complicated. As of January 2026, PRX trades at around $0.0028 - down 15% in just 24 hours - and sits at #4869 on CoinGecko’s list of cryptocurrencies. That’s not a typo. It’s not even in the top 1,000. So what’s going on? Is this a hidden gem or a fading experiment?

How Parex Actually Works

Parex isn’t built on Ethereum or BSC. It’s its own Layer 1 blockchain with EVM compatibility, meaning developers can use familiar tools like Solidity to build on it. The core innovation is its Proof of Interoperability consensus mechanism. Unlike Proof of Stake or Proof of Work, this system doesn’t just validate transactions - it actively manages how tokens move between networks. When you send PRX from Ethereum to Polygon using the Parex Market, the protocol automatically adjusts token supply across chains to maintain balance. This isn’t just bridging. It’s dynamic token redistribution. The PRX token itself is the fuel. You need it to pay gas fees, vote on network upgrades, and secure the system. Unlike ETH, which is mined or staked, PRX is produced through a burn mechanism. Every time a token is used in a cross-chain transaction, a portion is permanently destroyed. That’s supposed to create scarcity. But here’s the catch: the total supply is capped at 77 million PRX, and only about 13.6 million are currently in circulation. That means over 80% of tokens are still locked up or unissued. If the project grows, those tokens will flood the market - or if it fails, they’ll just sit idle.Where You Can Use PRX

Right now, PRX works on five major chains: Ethereum, Polygon, Binance Smart Chain (BEP20), Polkadot, and Avalanche. The Parex Market lets you swap tokens between them with fees as low as 0.0002 PRX - roughly $0.00000056. Compare that to Ethereum’s average gas fee of $0.45 or even Polkadot’s $0.30. For micro-transactions or small DeFi swaps, that’s unbeatable. But here’s the problem: almost no one uses it. The 24-hour trading volume on MEXC is under $150,000. Cosmos, which also focuses on interoperability, does over $287 million in the same period. Parex’s entire quarterly volume is less than 0.003% of the global cross-chain market. You won’t find PRX on Coinbase, Binance, or Kraken. It’s only listed on smaller exchanges like MEXC and Gate.io. Even then, liquidity is thin. If you try to sell a large amount, you’ll tank the price.Who’s Using It - And Who Isn’t

There are about 8,400 unique wallets holding PRX. Sounds like a lot? Compare that to 1.2 million for Cosmos and 3.7 million for Polkadot. Most users are retail traders trying to exploit short-term price swings. Real users - developers, DeFi protocols, dApps - aren’t building on Parex. GitHub shows only 12 active contributors in the last 90 days. Cosmos has 147. Polkadot has 214. The few people who’ve tried it report mixed results. One Reddit user bridged ETH to Polygon using Parex in 47 seconds with a $0.0003 fee - way cheaper than Uniswap’s $1.27. But they also said the interface felt like a 2018 crypto app. No tooltips, no guidance. You had to watch a YouTube tutorial just to send a token. Worse, 12.7% of bridge transactions fail. That’s high for any blockchain. And when something goes wrong, support takes an average of 72 hours to respond. The official Parex Wallet only supports PRX and PEP20 tokens. It doesn’t connect to MetaMask, Trust Wallet, or any other popular multi-chain wallet. You’re locked into their app - and if it crashes or gets hacked, you’re out of luck.

Why Experts Are Divided

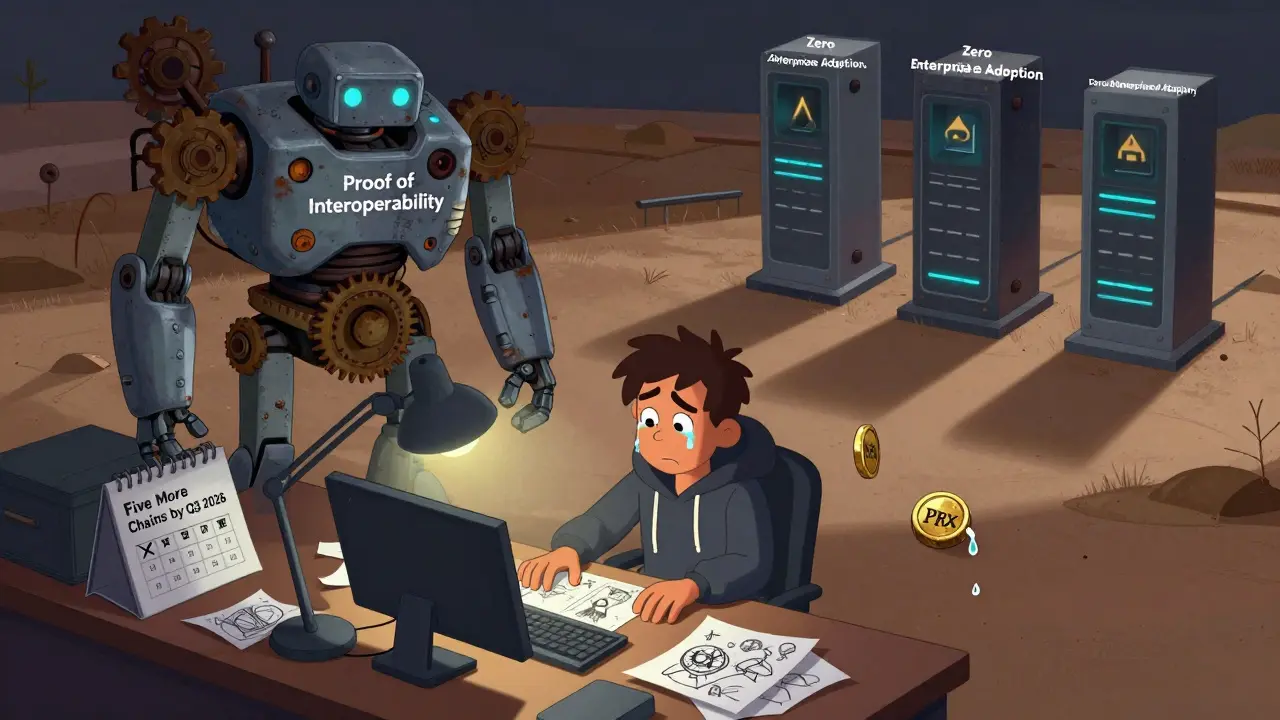

Some analysts see potential. Michael Chen from Interop Labs called Parex “the most underappreciated interoperability solution” in late 2025. He believes its token-burning model could work if integrated into major wallets or IoT platforms. That’s a big if. Others are skeptical. Dr. Elena Rodriguez at Delphi Digital warned that the deflationary pressure from burning tokens could destabilize the ecosystem if adoption grows. Too few users, too much burning - and the token’s value could collapse. CoinDesk gave it a 6.8/10, praising the documentation but criticizing centralization: 78% of cross-chain traffic flows through just three validator nodes. That’s not decentralized. That’s a single point of failure. The biggest red flag? No enterprise adoption. Zero Fortune 500 companies use Parex. Compare that to Polkadot, which has partnerships with banks, logistics firms, and government agencies. Parex has no institutional backing. No venture capital. No roadmap updates beyond vague promises of “five more chains by Q3 2026.”The Bigger Picture: Is Parex Even Needed?

The cross-chain space is crowded. Chainlink CCIP, Wormhole, and LayerZero dominate with over 78% of the market. They’re backed by big names, have millions of users, and are integrated into top DeFi apps. Parex doesn’t compete with them - it competes with their leftovers. Its low fees are attractive, but no one cares about cheap fees if the system is unreliable, hard to use, and lacks liquidity. The real question isn’t whether Parex works technically - it does. The question is: why would anyone choose it over LayerZero, which works across 50+ chains, has 100x the volume, and is trusted by institutions?

What’s Next for PRX?

The Parex team claims they’re working on a decentralized governance system for Q4 2026. That’s a good sign - if it happens. But GitHub commits have dropped 63% since last quarter. The Telegram group has lost over 3,000 members since September. The team hasn’t posted a meaningful update in months. The token’s price has underperformed the broader market by over 8% in the last week. That’s not a blip. It’s a trend. Investors are losing confidence. If Parex wants to survive, it needs three things: a major exchange listing, a partnership with a wallet provider, and a surge in developer activity. Right now, it has none.Should You Buy PRX?

If you’re looking for a long-term investment, the answer is no. The market cap is under $400K. The team is quiet. The ecosystem is tiny. The risks far outweigh the potential rewards. If you’re a speculator with a small amount of money you’re willing to lose, and you believe in the Proof of Interoperability model - then maybe. But treat it like a lottery ticket. Not an asset. The only real use case for PRX today is testing the Parex bridge for fun - and even then, you’ll likely spend more time troubleshooting than transacting. Parex isn’t dead. But it’s barely breathing. And unless something changes fast - a big partnership, a surprise upgrade, a sudden surge in adoption - it won’t survive 2026.What is Parex (PRX) used for?

PRX is the native token of the Parex blockchain, used to pay for transaction fees, participate in network governance, and secure the system through its Proof of Interoperability mechanism. It’s also required to perform cross-chain transfers between supported blockchains like Ethereum, Polygon, and Avalanche using the Parex Market.

Can I buy Parex on Coinbase or Binance?

No, Parex (PRX) is not listed on major exchanges like Coinbase, Binance, or Kraken. As of January 2026, it’s only available on smaller platforms such as MEXC and Gate.io, where liquidity is low and price volatility is high.

Is Parex safe to use?

Technically, the Parex network functions as designed, but safety concerns exist. 12.7% of cross-chain transactions fail, support response times average 72 hours, and 78% of traffic flows through just three validator nodes - raising centralization risks. The wallet doesn’t integrate with MetaMask or Trust Wallet, forcing users into a single, untested app.

Why is PRX’s price so low?

PRX’s price is low because of minimal demand. With only 8,400 active wallets, near-zero developer activity, no institutional backing, and listings on only two small exchanges, there’s little reason for buyers to enter the market. The token’s burn mechanism also creates uncertainty - if adoption doesn’t grow, the supply reduction could hurt liquidity.

Does Parex have a future?

Its future is uncertain. Parex has a technically sound model, but it lacks the network effects needed to compete. Without a major exchange listing, wallet integration, or developer adoption by mid-2026, it’s unlikely to survive. Experts estimate only a 28% chance it remains relevant beyond 2028.

Gavin Francis

February 1, 2026 AT 22:48Jack Petty

February 2, 2026 AT 15:31Richard Kemp

February 4, 2026 AT 11:59Freddy Wiryadi

February 5, 2026 AT 03:39Tressie Trezza

February 5, 2026 AT 08:44