Nov, 16 2024

Nov, 16 2024

NFT Bonding Curve Calculator

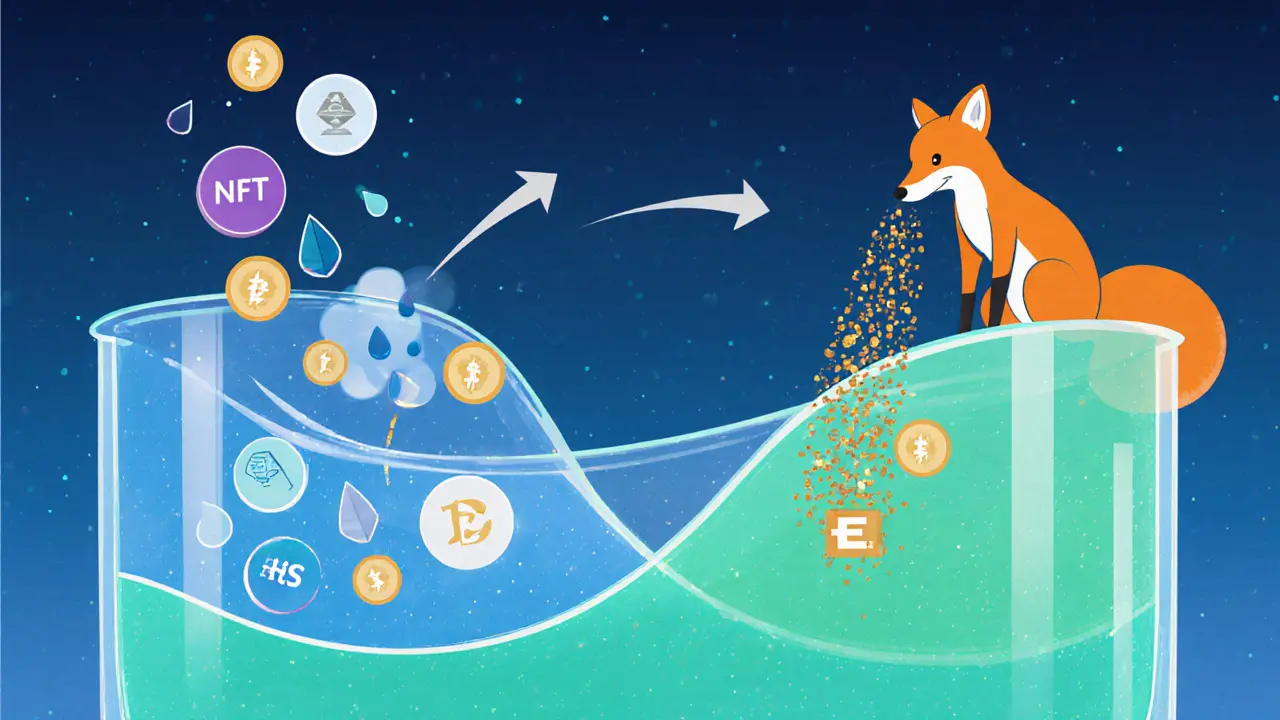

SudoSwap uses bonding curves to automatically adjust NFT prices based on supply and demand. This calculator demonstrates how the price changes as you add or remove NFTs from a liquidity pool.

Calculate Your NFT Pool Price

Current Price Analysis

Price at 10 NFTs: - ETH

Price at 50 NFTs: - ETH

Price at 100 NFTs: - ETH

Key Insights

Key Takeaways

- SudoSwap is the first NFT‑focused automated market maker (AMM) built on Ethereum.

- The SUDO token gives holders voting power over protocol upgrades and fee distribution.

- Liquidity pools use bonding curves, so NFT prices adjust automatically based on supply and demand.

- Unlike OpenSea, SudoSwap removes creator royalties and charges a flat 2.5% swap fee.

- Trading volume for SUDO is modest, and the token shows bearish short‑term momentum.

SudoSwap is a decentralized, non‑custodial NFT marketplace protocol that runs on the Ethereum blockchain and uses an automated market maker model to enable NFT‑to‑ETH swaps. Launched in July 2022 by Owen Shen (known in the community as 0xmons), the protocol introduced a new way to provide liquidity for unique digital assets that traditionally suffered from fragmented markets.

When you hear people talk about the SUDO crypto coin, they are referring to the governance token that sits on top of the SudoSwap protocol. Holders can vote on fee structures, pool parameters, and future upgrades, while also earning a share of the 2.5% swap fees collected from every trade. In short, SUDO is the lever that lets the community steer the platform.

How SudoSwap Works: The NFT AMM Model

The core innovation is the adaptation of AMM mechanics-originally designed for fungible tokens like ETH or USDC-to non‑fungible tokens. Instead of an order book, each NFT collection can have its own liquidity pool. A single liquidity provider deposits a set of NFTs and a matching amount of ETH. The pool then follows a mathematical bonding curve that defines how the price of an NFT changes as tokens are bought or sold. The more NFTs in the pool, the lower the price per token, and vice‑versa.

Because the price is derived from a formula, there is always a counter‑party ready to trade-no need to wait for a buyer or seller to list an item. This eliminates the “liquidity iceberg” problem that plagues most NFT marketplaces.

Getting Started: Wallets, Gas, and Basic Steps

Using SudoSwap is straightforward if you’re comfortable with Ethereum basics. Here’s a quick checklist:

- Install an Ethereum‑compatible wallet such as MetaMask or any wallet that supports Web3.

- Fund the wallet with enough ETH to cover both the trade amount and gas fees (gas can spike during network congestion).

- Navigate to the official SudoSwap UI (the URL is published on the project’s Discord and Twitter).

- Connect your wallet and browse existing pools, or click “Create Pool” if you own NFTs you want to provide liquidity for.

- Set the bonding curve parameters-most users stick with the default linear curve, which keeps pricing simple.

After you confirm the transaction, the smart contract locks your NFTs and ETH. From that point, anyone can swap against your pool, and you’ll earn a portion of the 2.5% fee each time a trade happens.

What the SUDO Token Does

SUDO is more than a price ticker; it’s the governance layer. Token holders can propose and vote on changes like:

- Adjusting the flat swap fee (currently 2.5%).

- Introducing new fee distribution models for liquidity providers.

- Updating the smart‑contract code to fix bugs or add features.

The token also acts as a reward mechanism. When the protocol collects fees, a small slice is routed back to SUDO stakers, giving an incentive to hold the token even if you don’t provide liquidity yourself.

Comparison with Other NFT Marketplaces

To see where SudoSwap shines-or falls short-let’s line it up against the two biggest players: OpenSea and LooksRare.

| Feature | SudoSwap | OpenSea | LooksRare |

|---|---|---|---|

| Pricing Model | Automated AMM via bonding curves | Order‑book listings (manual pricing) | Order‑book listings (manual pricing) |

| Creator Fees | None (platform fee only) | 2.5% platform fee + 0‑10% royalty | 2% platform fee + royalties |

| Liquidity Guarantee | Continuous pool liquidity | Dependent on existing listings | Dependent on existing listings |

| Gas Efficiency | Gas‑optimized contracts, but AMM swaps can be costly on busy networks | Higher gas for order creation & execution | Similar to OpenSea |

| Governance | Token‑based (SUDO) | Centralized team decisions | Token‑based (LOOKS) |

In a nutshell, SudoSwap beats the competition on automated liquidity and fee‑free creator experience, but it lags on user‑friendly discovery tools and social features that attract casual collectors.

Pros, Cons, and Risks

- Pros: Instant liquidity, no creator royalties, transparent governance, low barrier to create niche pools.

- Cons: Steeper learning curve, limited marketplace UI, reliance on a single liquidity provider per pool (centralization risk), modest SUDO token liquidity.

- Risks: Ethereum gas spikes can make swaps expensive; if a pool’s liquidity provider withdraws funds, the pool becomes inactive; regulatory uncertainty around NFTs may affect the protocol’s long‑term status.

Current Market Data and Outlook (2025)

As of October 2025, the SUDO token trades around $0.026 USD with a 24‑hour volume of roughly $12,000 (per CoinMarketCap). The token sits near the bottom of the market‑cap leaderboard, indicating limited speculative interest.

Technical analysis from TradingView labels SUDO with a “strong sell” stance across most indicators, reflecting bearish short‑term momentum. However, the protocol itself remains live, with active pools for collections like Azuki, Bored Ape Yacht Club, and newer projects.

The broader NFT market has steadied after the 2022 boom, hovering around $2 billion in annual volume. If the market recovers, liquidity‑focused solutions like SudoSwap could see renewed interest, especially from institutional collectors who need predictable pricing.

For now, most investors treat SUDO as a niche governance token rather than a high‑growth asset. Its real value may lie in the ideas it introduced-bonding‑curve AMMs for NFTs-which larger platforms may adopt in future upgrades.

Frequently Asked Questions

What is the main difference between SudoSwap and OpenSea?

SudoSwap uses an automated market maker with bonding curves, giving each NFT pool continuous liquidity, while OpenSea relies on a traditional order‑book where buyers and sellers must match manually.

Do I need to hold SUDO tokens to trade on SudoSwap?

No. Anyone with an Ethereum wallet can swap NFTs on the platform. Holding SUDO only gives you voting rights and a share of protocol fees.

How are fees distributed?

A flat 2.5% fee is taken from each swap. The bulk goes to the liquidity provider who funded the pool, while a small portion is funneled to SUDO stakers.

Is SudoSwap safe to use?

The contracts are open‑source and have been audited, but because it’s non‑custodial you bear full responsibility for any mistakes. Always test with a small amount first.

Can I create my own NFT pool?

Yes. After connecting your wallet, click “Create Pool,” deposit the NFTs and ETH you want to back them, and the platform will generate a bonding‑curve‑based price curve automatically.

Hailey M.

November 16, 2024 AT 21:11Wow, another AMM for NFTs – because the world obviously needed *more* math to price art. 🙃 The bonding curve stuff sounds brilliant until you realize you’re basically betting on how many bored apes people will hoard. 😂

Nick O'Connor

November 19, 2024 AT 04:45SudoSwap, as an Ethereum‑based protocol, introduces a novel bonding‑curve mechanism, which, in theory, provides continuous liquidity, yet, in practice, demands careful gas management, especially during network congestion, so users should be aware.

Irish Mae Lariosa

November 21, 2024 AT 12:18SudoSwap represents a significant departure from traditional NFT marketplaces by employing an automated market maker model. The core idea is to replace order‑books with bonding curves that price each token based on pool composition. This design eliminates the need for a matching buyer or seller at any given moment. Liquidity providers deposit both NFTs and ETH, locking them in a smart contract that algorithmically adjusts prices. As the pool’s inventory grows, the marginal cost of each additional NFT decreases, encouraging further contributions. Conversely, when the pool is depleted, the price escalates, protecting providers from excessive slippage. The SUDO governance token serves to align incentives, granting holders voting rights over fee structures and protocol upgrades. Stakers also receive a share of the flat 2.5 % swap fee, which, while modest, offers a passive income stream. However, the token’s market performance remains weak, with volume hovering around twelve thousand dollars daily. Technical analysis consistently signals bearish momentum, suggesting limited speculative upside. From a user‑experience perspective, the interface is functional but lacks the polish and discovery tools found on OpenSea. Gas costs on Ethereum can render small swaps uneconomical, especially during periods of network congestion. Moreover, each pool relies on a single liquidity provider, introducing a centralization risk if that party withdraws assets. In the broader NFT ecosystem, the protocol’s liquidity‑first approach may attract institutional players seeking predictable pricing. Ultimately, SudoSwap’s success hinges on whether the market values continuous liquidity enough to offset its operational drawbacks.

Cynthia Chiang

November 23, 2024 AT 19:51Hey, just wanted to add that if you’re new to this, start with a tiny pool-maybe just one NFT and a little ETH. It’ll let you see how the bonding curve reacts without risking too much. Also, don’t forget to double‑check gas fees, they can sneak up on you!

Hari Chamlagai

November 26, 2024 AT 03:25The SudoSwap model, while ingeniously engineered, embodies the paradox of decentralization: it promises open markets yet demands sophisticated understanding, thereby creating a barrier that only the initiated can surmount.

Isabelle Graf

November 28, 2024 AT 10:58No royalties, just a 2.5% fee, end of story.

Jessica Cadis

November 30, 2024 AT 18:31From an American collector's viewpoint, the removal of creator royalties feels like a betrayal of artistic labor, even if the platform touts democratized pricing.

Carolyn Pritchett

December 3, 2024 AT 02:05If you think creators care about a few percentage points, you’re living in a fantasy world-most of them cash out early anyway.

Jason Zila

December 5, 2024 AT 09:38The bonding‑curve mechanism essentially tokenizes scarcity, turning rarity into a dynamic variable that the market can constantly rebalance.

Cecilia Cecilia

December 7, 2024 AT 17:11While SudoSwap introduces innovative liquidity solutions, potential users should conduct thorough due diligence before committing capital.

Deborah de Beurs

December 10, 2024 AT 00:45Listen up, fellow degens-SudoSwap is the wild west of NFT swaps, where every trade feels like a roller‑coaster ride through a neon‑lit canyon of endless possibilities!

Devi Jaga

December 12, 2024 AT 08:18Oh great, another psychedelic ride, because what we truly needed was more hype‑driven volatility masquerading as 'innovation'.

DeAnna Brown

December 14, 2024 AT 15:51Let me break it down for you, patriots: SudoSwap is the American‑engineered answer to the European‑centric OpenSea monopoly, delivering pure, unfiltered market efficiency!

Ikenna Okonkwo

December 16, 2024 AT 23:25In the grand tapestry of decentralized finance, SudoSwap is a bright thread, weaving together community governance and accessible liquidity for the next generation of creators.

Bobby Lind

December 19, 2024 AT 06:58Nice overview, really comprehensive, and I appreciate the balanced perspective on both strengths and weaknesses.