Mar, 14 2025

Mar, 14 2025

WLBO Reward Calculator

How WLBO Reflection Rewards Work

The WLBO token automatically distributes 4% of every transaction back to all holders. This creates a passive income stream. Your rewards are proportional to your holdings.

Your Estimated Rewards

Important Note: WLBO's trading volume appears extremely low according to the article. This calculator assumes active market activity, which may not reflect current reality. The actual rewards could be significantly lower than estimated due to low liquidity. Treat any allocation as money you can afford to lose.

Ever wondered why some meme‑coins keep handing out free tokens while others stay silent? WLBO (WENLAMBO) is a deflationary BEP‑20 token on the Binance Smart Chain that claims to reward every holder through a built‑in fee redistribution system. In plain English, every time someone moves WLBO, a slice of that trade is sliced off and shared with the community - effectively an automatic airdrop that never stops.

What Exactly Is WLBO (WENLAMBO)?

The project bills itself as a community‑first meme token with a charitable twist. It lives on Binance Smart Chain (BSC), a high‑throughput blockchain known for cheap gas fees compared with Ethereum. WLBO follows the BEP‑20 token standard, which means it can be stored in any BSC‑compatible wallet and traded on multiple decentralized exchanges.

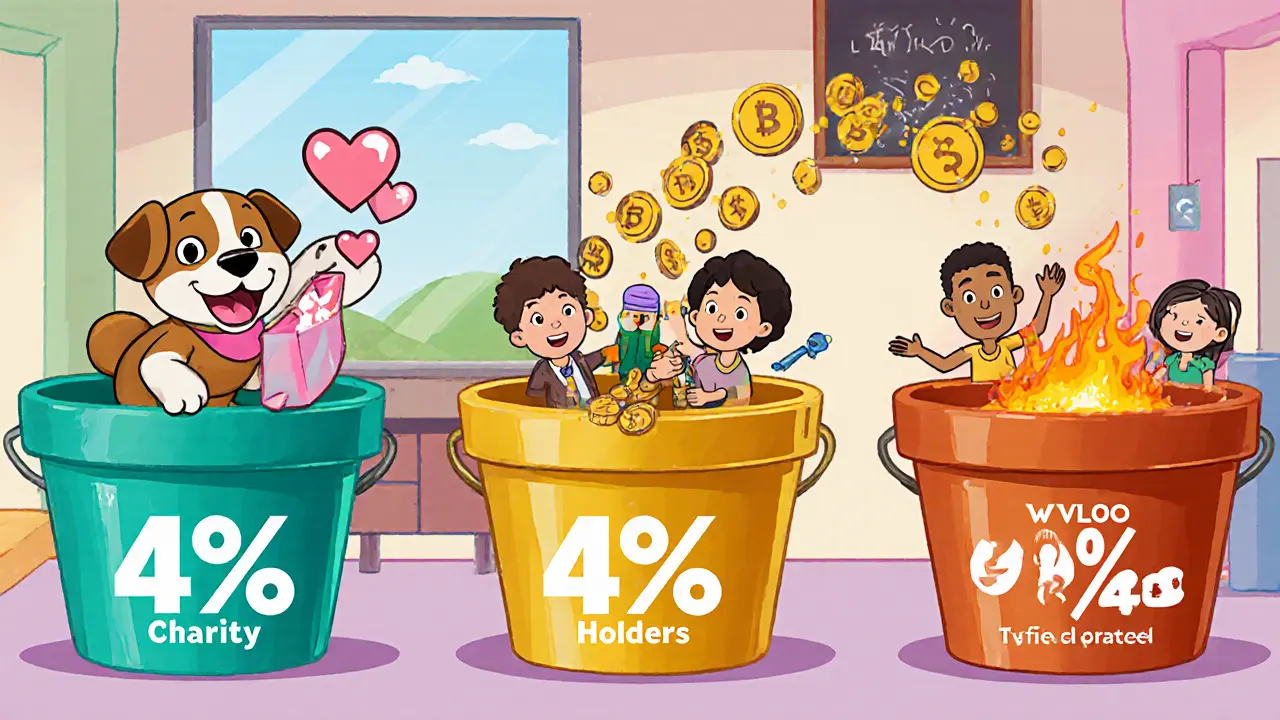

Tokenomics in a Nutshell

Understanding the numbers helps you decide if the token’s reward model makes sense for you.

- Total supply: 100 million WLBO tokens.

- Circulating supply (as of Oct 2025): about 56 million, according to the project’s own tracker.

- Transaction fee: 10 % of each swap.

The 10 % fee is split into three buckets:

- 4 % goes to a dedicated charity wallet (quarterly donations).

- 4 % is reflected back to every holder - this is the WLBO airdrop you hear about.

- 2 % is burned forever, reducing the overall supply and creating scarcity.

Because the reflection portion is automatic, you never need to claim anything; the smart contract updates balances behind the scenes.

How the Built‑In Airdrop Works

When a user swaps WLBO on a DEX, the contract calculates the 10 % fee. The 4 % holder share is then distributed proportionally based on each wallet’s current balance. For example, if you own 1 % of the circulating supply, you’ll receive roughly 1 % of the 4 % pool each transaction.

Over time, this creates a passive income stream - similar to staking but without locking up your tokens. The more active the market, the larger the weekly “airdrop” you’ll see appear in your wallet.

Charity & Lamborghini Meme - The Unique Hooks

Beyond the fee split, WLBO promotes a quarterly charity donation. The project claims to allocate the collected 4 % to non‑profit organizations, although independent verification is thin. This charitable angle distinguishes it from many other reflection tokens that focus solely on profit sharing.

On the branding side, WLBO rides the “when Lambo” meme. Weekly giveaways promise lucky holders a chance to win Lamborghini‑related experiences - from virtual track days to, in theory, real‑world rides. The hype fuels community chatter, but remember that giveaways are promotional, not a core part of the tokenomics.

WLBO vs. Other Reflection Tokens

Reflection tokens are a crowded niche on BSC. Let’s see how WLBO stacks up against three popular peers: SafeMoon, EverGrow and BabyDoge.

| Token | Chain | Total Supply | Holder Fee | Burn Rate | Charity Component |

|---|---|---|---|---|---|

| WLBO (WENLAMBO) | BSC | 100 M | 4 % | 2 % | Yes (4 % quarterly) |

| SafeMoon | BSC | 1 T | 5 % | 1 % | No |

| EverGrow | BSC | 1 B | 3 % | 2 % | No |

| BabyDoge | BSC | 420 B | 5 % | 5 % | No |

WLBO’s standout is the charity wallet; otherwise its fee structure mirrors the typical 10 % split found in many reflection tokens. The lower total supply (100 M vs. billions) could make each token feel more valuable, but it also means the absolute reward per transaction is smaller compared with massive‑supply projects.

Getting Started - Buying, Storing, and Claiming Rewards

Here’s a quick checklist for newbies who want to hop on the WLBO train.

- Set up a BSC‑compatible wallet. Trust Wallet, MetaMask (configured for BSC), or Binance Chain Wallet work fine.

- Buy BNB on a major exchange (Binance, Kraken, etc.) and transfer it to your wallet.

- Swap BNB for WLBO on PancakeSwap or a listed DEX. Use the contract address from the official WLBO site to avoid scams.

- Hold the tokens. The reflection mechanism updates balances automatically - no extra steps needed.

- Watch the charity wallet announcements (usually posted on the project’s Telegram). Some weeks feature extra giveaway entries for active holders.

Safety tip: always double‑check the contract address and verify the token on CoinMarketCap or CoinGecko before swapping. Scammers frequently clone meme token names.

Risks, Red Flags, and Final Thoughts

While the automatic airdrop sounds sweet, remember these caveats:

- Low liquidity. WLBO’s price chart shows near‑zero trading volume, making large trades slippage‑prone.

- Unverified charity claims. No third‑party audit has confirmed where the donations go.

- Community size. Social media follower counts are modest, suggesting limited organic growth.

- Deflation isn’t a guarantee of price rise. Burning tokens reduces supply, but without demand the price may stay flat.

If you’re comfortable with high‑risk, meme‑driven projects and you like the idea of passive token rewards, WLBO could be a fun pocket‑size experiment. Treat any allocation as money you can afford to lose.

Current Market Snapshot (Oct 2025)

According to the latest data, WLBO is listed on a handful of BSC‑centric trackers with a quoted price of effectively $0 and 0 % 24‑hour change - a sign of negligible trading activity. The token appears on Binance’s “Other Coins” list but without a robust market depth.

In the broader airdrop landscape, projects like Snowball’s “Buzzdrop” dominate attention, offering multi‑million‑dollar payouts across multiple platforms. Compared to those, WLBO’s reward mechanism is modest but constant.

How do I claim the WLBO reflection rewards?

You don’t need to claim anything. The smart contract automatically updates each wallet’s balance after every transaction.

Is the charity wallet audited?

Public audits have not been released. The project states quarterly donations, but third‑party verification is lacking.

Can I sell WLBO on centralized exchanges?

Currently WLBO is primarily on decentralized platforms like PancakeSwap. Some smaller DEX aggregators list it, but major CEXs have not added the pair.

What wallets support WLBO?

Any BSC‑compatible wallet works - Trust Wallet, MetaMask (BSC network), Binance Chain Wallet, and the official WENLAMBO web wallet (if released).

Is there a risk of rug‑pull?

The contract is immutable, but the team controls the charity wallet and future token minting. Without an audited code audit, the risk cannot be fully dismissed.

Kaitlyn Zimmerman

March 14, 2025 AT 07:05WLBO’s 10% fee split is pretty clear – 4% goes straight to holders, another 4% feeds the charity wallet and 2% is burned. The auto‑reflection means you don’t have to do anything, the balance just grows as people trade. If you’re already on BSC, adding WLBO to your portfolio is as easy as swapping on PancakeSwap with the official contract address. Keep an eye on the charity announcements on their Telegram if you want to see where the donations end up. As always, only allocate what you can afford to lose.

Chris Morano

March 16, 2025 AT 14:38The reflection mechanism works without any claim steps, which is handy for passive holders. Just make sure the token’s contract address matches the official site to avoid scams. Low liquidity can bite you on big sells, so consider that before moving large amounts.

Bobby Lind

March 18, 2025 AT 22:11Wow, WLDO really leans into the meme culture, the Lamborghini hype adds a fun twist, the charity angle tries to give back, and the burn reduces supply, which could spark some price movement, but the real test is the trading volume, because without liquidity the rewards stay small, and the auto‑airdrop feels like staking without locking, so it’s worth a peek if you enjoy meme tokens.

Marina Campenni

March 20, 2025 AT 15:51I can see why the community appreciates the charitable component, even though verification is thin. It’s nice to have a token that attempts to do some good while rewarding holders.

Schuyler Whetstone

March 22, 2025 AT 01:11This whole WLBO thing is just a scam yo, they talk big about charity but where’s the proof, the token is probably a rug pull waiting to happen, dont trust the hype.

David Moss

March 23, 2025 AT 04:58Look, the lack of an audit on the charity wallet is a red flag, and the fact that the team can mint tokens at any time suggests a potential backdoor, plus the ultra‑low liquidity could be a manipulation tool, so be very careful before you get involved.

Pierce O'Donnell

March 24, 2025 AT 02:38Sounds like a meme project with more hype than substance.

Matthew Theuma

March 25, 2025 AT 03:38Nice summary of WLBO! 👍 If you’re already using MetaMask on BSC, just add the token and watch the reflections roll in. Just double‑check the contract address – a typo can cost you big. 🚀

Miguel Terán

March 27, 2025 AT 11:11WLBO positions itself as a community‑first meme token that tries to blend charitable giving with passive income. The core mechanic relies on a 10 percent transaction fee that is automatically divided among holders, a charity wallet, and a burn pool. Because the fee is taken on every trade, even small transactions contribute to the reflection pool, which in theory creates a steady drip of tokens to every wallet. The 4 percent allocated to holders is distributed proportionally, so larger holders see a larger absolute amount of tokens added to their balance after each swap. The charity portion, also 4 percent, is meant to be transferred quarterly to nonprofit organizations, although the project has not released independent audit reports to verify the flow of funds. The remaining 2 percent is burned forever, reducing the overall supply and potentially increasing scarcity over time. On the technical side the token follows the BEP‑20 standard, meaning it can be stored in any Binance Smart Chain compatible wallet and traded on most DEXs that support BSC. For new users the onboarding steps are simple: set up a BSC wallet, acquire BNB, and swap it for WLBO on PancakeSwap using the official contract address. The auto‑reflection feature updates balances silently in the background, so there is no need to claim rewards manually, which lowers the friction for casual holders. However the market data shows that WLBO suffers from extremely low liquidity, a condition that can cause severe price slippage on even modest trades. Low liquidity also makes it easier for large holders to manipulate the price, especially when the reflection rewards are tied directly to transaction volume. The lack of a verified audit for the charity wallet adds another layer of uncertainty, as investors cannot be certain how the donated funds are being allocated. Despite these concerns the token’s lower total supply of 100 million compared to billions of tokens in other reflection projects could make each token feel more valuable on paper. The meme‑driven branding around “when Lambo” and periodic giveaway contests help keep the community engaged, though such promotions are more about hype than tangible value. In summary WLBO offers an interesting blend of passive token rewards and charitable ambition, but prospective investors should weigh the risks of low liquidity, unaudited charity mechanisms, and potential price manipulation before committing funds.

Vinoth Raja

March 28, 2025 AT 20:31From a philosophical angle the token’s design reflects a kind of emergent commons where individual trades generate collective benefits, but the jargon around “reflection” can mask the underlying market dynamics that still favor early adopters.

Shivani Chauhan

March 30, 2025 AT 00:18I get the point about emergent value, yet the practical side still demands vigilance, especially with unaudited contracts. It would be great if the team released transparent reports on the charity disbursements. Until then, treat WLBO as a high‑risk experiment.