Oct, 23 2025

Oct, 23 2025

Venezuela Currency Value Calculator

Petro Value Comparison Calculator

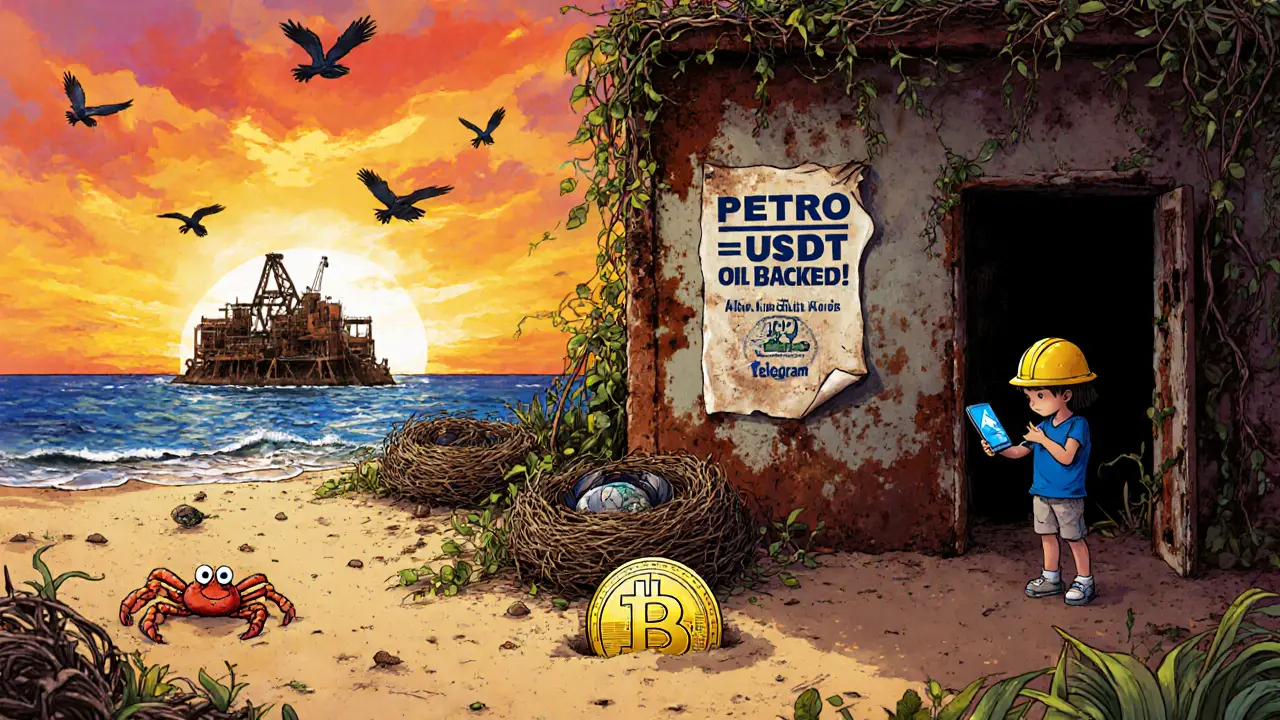

Compare the official Petro value with real-world market rates against USD, Bitcoin, and USDT in Venezuela.

1 =

Your amount:

Official vs. Market Values

| Currency | Official Value | Market Value | Value Difference |

|---|---|---|---|

| Petro | $60 | $6 - $12 | -80% to -90% |

| USD | 1 USD = 1 USD | 1 USD = 1 USD | None |

| Bitcoin | N/A | Approx. $30,000 | N/A |

| USDT | N/A | Approx. $1 | N/A |

Note: The Petro's value is highly volatile and varies significantly based on market conditions. Official government rates don't reflect actual market value. USD, Bitcoin, and USDT are widely used by Venezuelans for daily transactions due to their stability and accessibility.

The Petro was never meant to be a free-market cryptocurrency. It was designed as a tool for survival - a digital lifeline for a government drowning in sanctions, hyperinflation, and debt. Launched in February 2018, the Petro was supposed to replace the collapsing bolívar, bypass U.S. financial blockades, and unlock billions in foreign investment. But five years later, it exists mostly on paper, in government decrees, and inside state-run systems that few ordinary Venezuelans actually use.

How the Petro Was Supposed to Work

The Venezuelan government claimed the Petro was backed by the country’s oil, gold, diamonds, and gas reserves. Each token was supposedly worth the price of one barrel of oil - around $60 at launch. The plan was simple: sell 100 million Petros, raise $6 billion, and use that money to stabilize the economy. President Nicolás Maduro said it would let Venezuela trade with other nations without using the U.S. dollar.

To make it official, Decree 3196 created the Petro as a legal tender. The government set up SUPCACVEN - the Superintendence of Crypto Assets and Related Activities - to control everything: who could mine it, where it could be traded, and how taxes were paid. They even created four special economic zones - Margarita Island, Los Roques, Paraguaná, and Ureña-San Antonio - where mining equipment was tax-free and Petros could be used to buy fuel, food, and services.

At first glance, it looked like a bold move. But the structure was already flawed. Unlike Bitcoin or Ethereum, the Petro runs on a federated blockchain - meaning only government-approved nodes can validate transactions. There’s no decentralization. No public ledger anyone can check. Just a closed system controlled by the state.

Why the World Rejected It

The U.S. didn’t wait long to respond. In March 2018, the Treasury Department banned American citizens and companies from dealing with the Petro. By 2019, sanctions under Executive Order 13827 made it illegal for any U.S.-based exchange to list it. Congress later passed S.37, a law meant to permanently freeze any Venezuelan crypto activity tied to the government.

International banks refused to touch it. Major exchanges like Binance, Coinbase, and Kraken never listed the Petro. Why? Because there was no proof of reserves. No independent audit. No transparency. A leaked document from VIBE - Venezuela’s crypto advisory group - revealed the government planned to sell Petros at 60% discounts just to get anyone to buy them. That’s not a currency. That’s a bailout disguised as a blockchain.

Even Venezuela’s own opposition called it illegal. The National Assembly, controlled by anti-Maduro parties, declared the Petro an unconstitutional debt issuance. They argued it was just another way for the government to print money - except this time, it was digital.

Forced Adoption, Not Real Use

By January 2020, the government made Petros mandatory for certain services: buying airplane fuel, paying for passports, renewing driver’s licenses. You couldn’t get a government document unless you paid in Petros.

But here’s the catch: most Venezuelans don’t have Petros. And even if they did, they can’t spend them outside government systems. There are no stores that accept Petros for groceries. No apps that let you pay your electric bill in them. No ATMs where you can cash them out.

Instead, people use Bitcoin, USDT (Tether), and other stablecoins. Why? Because those actually hold value. Because they can be traded on global platforms. Because they’re not tied to a collapsing economy and a regime under global sanctions.

The Petro Zones? They exist on maps, but not in practice. Mining equipment was imported tax-free - but there’s no data showing how much mining actually happened. No reports on how many miners are active. No proof that the electricity used for mining came from anything other than state-subsidized power grids.

The Real Cost: Economic Distortion

The Petro didn’t fix Venezuela’s economy. It made it worse.

By forcing people to use a currency no one trusts, the government created confusion. Businesses had to track two values: the official Petro rate and the real market rate. Salaries paid in Petros were worth less than half of what they were advertised as. Tax incentives for mining attracted shell companies - not miners. Some firms imported mining rigs, claimed tax breaks, then sold the equipment for profit.

Meanwhile, the bolívar kept crashing. Inflation hit 1,000,000% in 2019. The government responded by redenominating the currency - cutting six zeros - but that didn’t change the fact that people lost faith in every version of their money.

The Petro became a symbol of control, not innovation. It was never about financial freedom. It was about avoiding accountability. The state could claim it had a digital currency, use it to report fake economic growth, and pretend it wasn’t starving its people.

Who Still Uses the Petro Today?

As of 2025, the Petro is used in three main ways:

- Government payments - For passports, permits, fuel, and public services. If you need a document from the state, you pay in Petros.

- State-owned enterprises - PDVSA, Venezuela’s oil company, accepts Petros for some international contracts, though mostly as a front to bypass sanctions.

- Foreign actors under sanctions - Some entities in Russia, China, Iran, and Turkey have used Petros in barter deals, often trading oil for goods or services in exchange for tokens they can’t easily cash out.

That’s it. No retail use. No peer-to-peer trading. No international liquidity. The Petro isn’t a currency. It’s a state ledger.

The Bigger Picture: Sanctions and Survival

The Petro was born out of desperation. Venezuela’s economy had collapsed. Banks were frozen. The dollar was the only thing keeping people alive. The government needed an alternative - fast.

But instead of building trust, they built control. They didn’t open the system to the world. They locked it down. They didn’t let users verify the blockchain. They made it opaque. They didn’t invite competition. They made it mandatory.

The result? The world saw it for what it was: a political tool, not a financial one.

Compare that to El Salvador’s Bitcoin experiment. They didn’t force it. They educated people. They built wallets. They allowed businesses to opt in. And even then, adoption was mixed. Venezuela didn’t even try. They just issued a decree and called it done.

What’s Next for the Petro?

Unless Venezuela’s political situation changes - and sanctions are lifted - the Petro will remain a footnote in crypto history.

It won’t become a global currency. It won’t be listed on major exchanges. It won’t be used by ordinary people for daily purchases.

Its only future is as a bureaucratic relic - a digital monument to a failed attempt to outsmart the global financial system with a blockchain that no one trusts.

For Venezuelans, the real crypto revolution isn’t the Petro. It’s the Bitcoin wallets hidden in phones. The USDT transfers sent through Telegram. The remittances that keep families fed. Those aren’t government projects. They’re grassroots survival.

Is the Petro cryptocurrency still active in Venezuela?

Yes, but only in government-controlled systems. It’s still required for certain services like passports, fuel, and official documents. Outside of those uses, it’s largely unused by the public. No major exchanges list it, and most Venezuelans rely on Bitcoin or stablecoins instead.

Can you buy Petro cryptocurrency on Coinbase or Binance?

No. Major exchanges like Coinbase, Binance, and Kraken do not list the Petro. It’s blocked due to U.S. sanctions and lack of transparency. There’s no public market to trade it, and its value is set by the Venezuelan government, not supply and demand.

Is the Petro backed by real oil reserves?

There’s no verifiable proof. The government claims each Petro is backed by one barrel of oil, but independent audits have never confirmed this. Venezuela’s oil production has collapsed since 2018, and the state oil company, PDVSA, has been under sanctions for years. Experts consider the backing to be symbolic, not real.

Why did Venezuela create the Petro?

Venezuela created the Petro to bypass U.S. financial sanctions, raise foreign currency without borrowing, and stabilize its collapsing economy. It was meant to replace the bolívar and allow international trade without using the U.S. dollar. But it failed to gain trust, both domestically and globally.

Are Petro Zones still operational in 2025?

The four Petro Zones - Margarita Island, Los Roques, Paraguaná, and Ureña-San Antonio - still exist on paper with tax exemptions for mining equipment. But there’s no public data showing active mining or widespread use of Petros in these areas. Most reports suggest the zones are more about political symbolism than economic function.

Can Venezuelans use Petro to buy groceries or pay rent?

Almost never. While the government mandates Petro use for official services, private businesses - including grocery stores, landlords, and service providers - do not accept it. Most Venezuelans use U.S. dollars, Bitcoin, or stablecoins like USDT for daily transactions because those have real, stable value.

What’s the current value of one Petro?

There is no official market price. The government pegs it to $60 (based on oil), but there’s no open trading. In private deals, Petros are sometimes traded at a fraction of that - as low as 10-20% of the official rate - because no one trusts the value. It’s essentially a non-convertible token with no real market.

Is the Petro legal under Venezuelan law?

Legally, yes - the government created it by decree. But the opposition-controlled National Assembly declared it illegal in 2018, calling it an unauthorized debt issuance. This creates ongoing legal conflict. While the executive branch enforces it, the legislative branch denies its legitimacy, leaving its status in legal limbo.

Cherbey Gift

November 15, 2025 AT 07:30Anthony Forsythe

November 16, 2025 AT 03:13Kandice Dondona

November 17, 2025 AT 11:24Becky Shea Cafouros

November 18, 2025 AT 21:44Vanshika Bahiya

November 20, 2025 AT 17:51Albert Melkonian

November 20, 2025 AT 19:49Kelly McSwiggan

November 21, 2025 AT 19:56Byron Kelleher

November 22, 2025 AT 01:04Cody Leach

November 23, 2025 AT 03:53sandeep honey

November 24, 2025 AT 16:50Mandy Hunt

November 26, 2025 AT 10:02anthony silva

November 27, 2025 AT 08:14David Cameron

November 27, 2025 AT 23:28Sara Lindsey

November 27, 2025 AT 23:29