Argentine Peso Instability and Its Impact on Crypto Markets

When dealing with Argentine peso instability, the rapid loss of value of Argentina's official currency, marked by soaring inflation and frequent devaluation, you quickly see why many Argentinians turn to alternative assets. Also known as ARS devaluation, this phenomenon pushes people to look for ways to preserve wealth. Alongside this, stablecoins, cryptocurrencies pegged to a stable asset like the US dollar, used as a hedge against local inflation become a natural refuge. crypto adoption, the growing use of digital assets for payments, savings, and investment in Argentina speeds up as trust in the peso erodes. Meanwhile, DeFi platforms, decentralized finance services that let users earn interest, lend, or trade without banks offer higher yields than traditional savings accounts, further attracting cash‑strapped users.

Why does Argentine peso instability matter for anyone watching crypto trends? First, hyperinflation creates a price‑signal that local fiat is unreliable. This drives demand for assets that can store value across borders, and stablecoins fit the bill perfectly. Second, the volatile environment encourages rapid learning—people start using wallets, swapping tokens, and even participating in airdrops to boost their holdings without needing a bank account. Third, the scarcity of reliable local exchanges means traders scout international platforms, which is why our reviews of crypto exchanges, fee structures, and security measures become essential reading.

Key Drivers Behind the Shift to Digital Assets

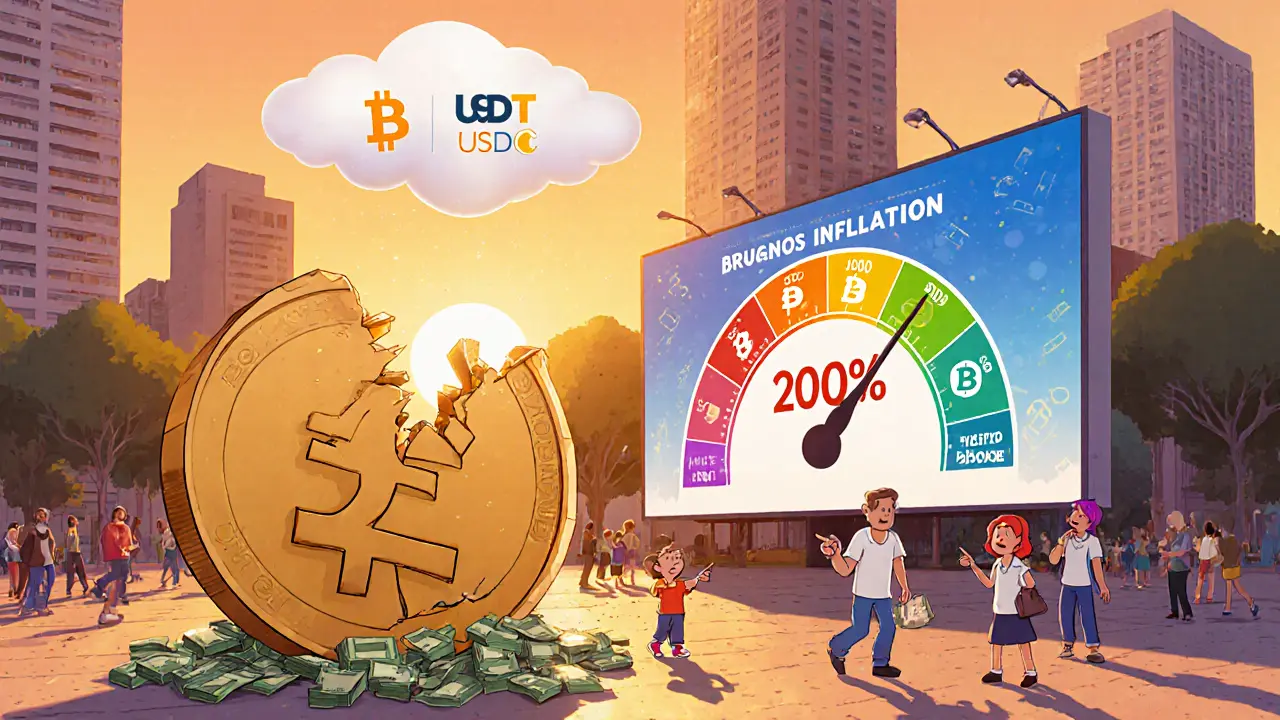

The core driver is the relentless rise in inflation, which regularly tops 200% annually. When grocery prices double in a year, holding pesos feels pointless. That economic pressure creates three clear paths: (1) buying foreign currency on the black market, (2) moving money into crypto, especially stablecoins, and (3) seeking higher returns on DeFi protocols. Each path relies on digital tools—wallet apps, decentralized exchanges, and liquidity pools—that bypass traditional banks.

Stablecoins like USDT, USDC, and local variants such as ARS‑linked tokens become the bridge between the chaotic peso and the global crypto ecosystem. They let users pay for imports, receive remittances, or simply park savings in a unit that doesn’t lose purchasing power overnight. Because stablecoins are built on blockchain, they also provide transparency that the informal dollar market lacks, which builds trust among new adopters.

DeFi adds another layer of appeal. Yield farming, staking, and lending protocols often offer double‑digit APY, dwarfing the meager interest rates (if any) offered by Argentinian banks. For someone watching their salary evaporate, a 10%‑plus return on a stablecoin deposit feels like a lifeline. The risk‑reward calculus changes: users accept smart‑contract risk because the alternative—holding cash that loses value—is even worse.

Our collection of guides covers the practical side of this shift. We break down how to claim safe airdrops, evaluate exchange security, and compare fees across platforms. For example, the Deliondex review helps you spot a reliable venue for swapping stablecoins, while the Barginex analysis warns about unlicensed operators that could disappear with your funds. These resources are tailored for people coping with peso volatility and looking for trustworthy crypto routes.

Beyond individual tools, the broader market reacts to Argentine instability. Global investors monitor peso‑related sentiment as a bellwether for emerging‑market crypto demand. When Argentine traders pour money into Bitcoin or Ethereum, price movements can ripple through low‑liquidity pairs, creating arbitrage opportunities on cross‑chain bridges. Understanding this macro‑dynamic helps traders anticipate short‑term volatility and plan entry points.

Another facet is regulatory uncertainty. While Argentina has not banned crypto outright, tax authorities are tightening reporting requirements. This makes it vital to use platforms that provide clear KYC/AML policies and transparent fee structures. Our exchange reviews rank services not just on price but also on compliance, giving you a safe path to stay on the right side of the law while protecting your assets.

Community knowledge also plays a huge role. Social channels, Discord groups, and local crypto meetups share tips on the best wallets that support offline seed backups—critical when internet access can be spotty. The Argentine breeze of innovation means new projects targeting local pain points emerge regularly, from stablecoin issuers that accept cash deposits to DeFi apps that integrate with popular payment apps.

All of these elements—inflation, stablecoins, DeFi yields, exchange safety, and community support—intersect because of one core phenomenon: Argentine peso instability. By understanding how each piece fits, you can make smarter choices, protect your savings, and possibly profit from the shifting financial landscape.

Below you’ll find a curated list of articles that dive deeper into exchange safety, airdrop strategies, DeFi opportunities, and other topics shaped by the ongoing peso crisis. Explore the collection to arm yourself with the knowledge you need to navigate this turbulent environment confidently.

How Argentine Peso Instability Fuels Rapid Cryptocurrency Adoption

Explore how Argentina's peso crisis drives massive crypto adoption, especially stablecoins, and what it means for everyday users and the wider Latin American market.