Capital Controls and Crypto: What You Need to Know

When you hear the term capital controls, government policies that limit the movement of money across borders, often extending to digital assets. Also known as currency restrictions, they can reshape how value flows on blockchain networks and directly impact traders, developers, and investors.

Understanding capital controls is the first step, but the story doesn’t end there. Crypto regulation, the set of rules that governments apply to digital currencies and related services often dictates whether an exchange can operate legally. That’s why exchange licensing, the official permission a platform needs to offer trading services in a jurisdiction becomes a cornerstone for safe crypto activity. In places with strict capital controls, regulators may demand tighter licensing, higher reporting standards, and more robust AML procedures. The result? Traders might see higher fees, slower withdrawals, or even blocked access to certain assets. Those constraints push users to look for platforms that can navigate the regulatory maze while still offering decent liquidity.

How Capital Controls Touch Liquidity and Airdrops

Beyond licensing, capital controls also play a big role in cross-chain liquidity, the ability to move value between different blockchain networks quickly and cheaply. When a country tightens its borders on fiat outflows, crypto projects often turn to bridges, wrapped tokens, or decentralized exchanges to keep users active. But those workarounds can introduce new risks, such as bridge hacks or higher slippage. At the same time, many airdrop campaigns promise free tokens to global participants. If a user lives under strict capital controls, claiming an airdrop might trigger tax reporting, customs scrutiny, or even legal penalties. That’s why airdrop compliance—knowing the local rules before you click “claim”—is essential for anyone wanting to keep their crypto safe and legal.

All these pieces—government limits, regulatory frameworks, licensing requirements, liquidity solutions, and airdrop rules—interlock to shape the real‑world flow of crypto value. Below you’ll find a hand‑picked collection of reviews, guides, and deep dives that unpack each of these angles. From exchange risk assessments to country‑specific regulation breakdowns, the articles give you practical tools to navigate capital controls without getting stuck.

Ready to see how the concepts play out in actual platforms and projects? Explore the posts below for detailed analysis, step‑by‑step guides, and up‑to‑date insights that help you trade, invest, and stay compliant despite any capital control hurdles.

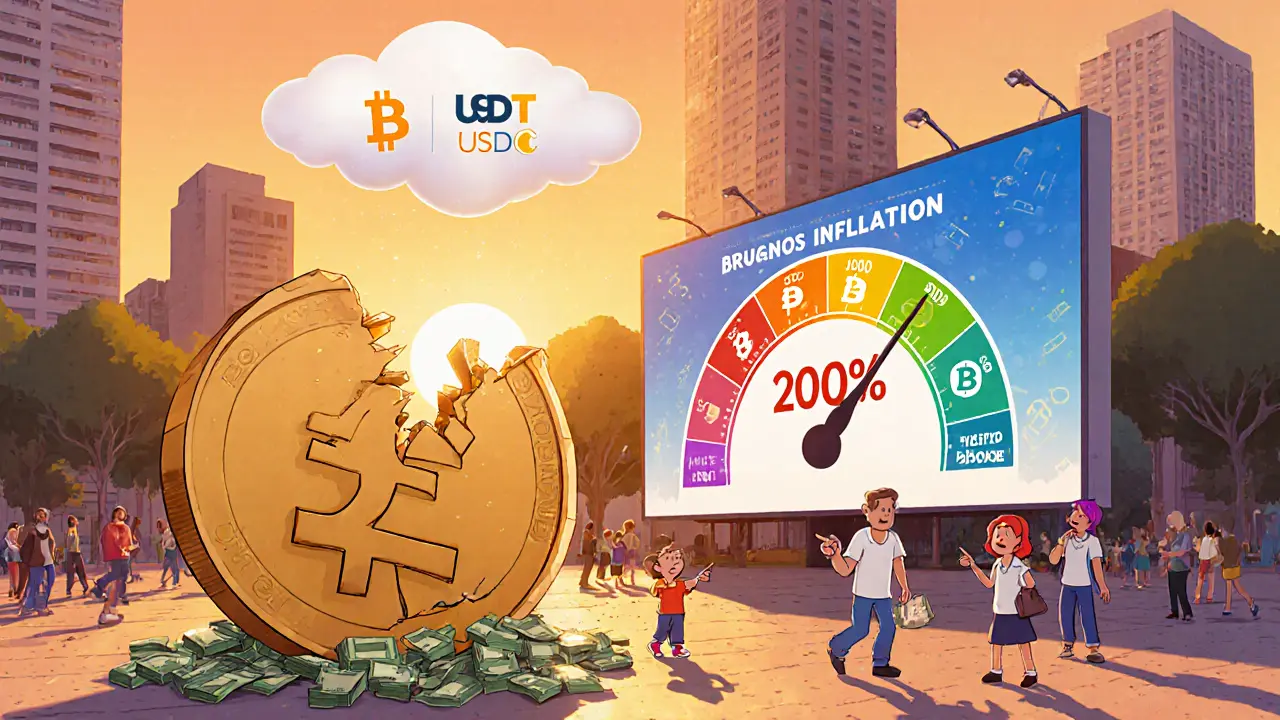

How Argentine Peso Instability Fuels Rapid Cryptocurrency Adoption

Explore how Argentina's peso crisis drives massive crypto adoption, especially stablecoins, and what it means for everyday users and the wider Latin American market.