Crypto Market Latin America: Growth, Exchanges, and Regulations

When you examine crypto market Latin America, the ecosystem of buying, selling, and using digital assets across Brazil, Mexico, Argentina, Chile and other countries in the region. Also known as LATAM crypto scene, it reflects how local economies, internet access, and cultural habits drive demand for tokens, stablecoins, and DeFi services. The market crypto market Latin America isn’t just a copy of global trends; it blends cross‑border remittances, high inflation pressures and a youthful tech‑savvy audience. That mix creates a unique set of opportunities and challenges that we’ll unpack below.

Key Drivers Shaping the LATAM Crypto Landscape

One of the biggest catalysts is the rise of cryptocurrency exchange, platforms that let users trade, swap and store digital assets, often with local fiat on‑ramps. Exchanges like Binance, Mercado Bitcoin, and Bitso have built deep liquidity pools, low‑fee structures, and mobile‑first apps that match the region’s high mobile penetration. They also launch localized promotions—think lower fees for Argentine pesos or special airdrops for Mexican users—that directly boost adoption rates. When an exchange offers a seamless on‑ramp, users can move money faster than traditional banks, which is why exchange health is a barometer for market growth.

Another essential piece is crypto regulation, the set of laws and guidelines that governments apply to digital assets, covering licensing, AML/KYC, and tax treatment. Countries such as Brazil have introduced clear licensing regimes for exchanges, while Mexico’s Fintech Law outlines specific requirements for crypto service providers. In contrast, nations like Argentina still wrestle with ambiguous tax rules, creating uncertainty for investors. Regulation influences everything from exchange listings to how quickly airdrop campaigns can be advertised legally. A supportive regulatory environment often leads to higher liquidity, more institutional participation, and safer consumer experiences.

Finally, airdrop incentives act as a rapid‑fire growth hack for projects targeting LATAM users. By distributing free tokens to wallets that meet simple eligibility criteria—like holding a certain amount of USDT or completing a KYC step—projects can spark community buzz and seed liquidity on local exchanges. However, the effectiveness of an airdrop depends on clear communication, security measures, and alignment with regional legal frameworks. When done right, an airdrop can amplify exchange volume, introduce new DeFi protocols, and even nudge regulators to take a closer look at emerging token models.

All these forces—exchange innovation, regulatory clarity, and targeted airdrops—interlock to define the current state of the crypto market Latin America. Below you’ll find a curated collection of articles that dive deep into exchange reviews, regulatory updates, airdrop guides, and more, giving you actionable insights to navigate this fast‑moving space.

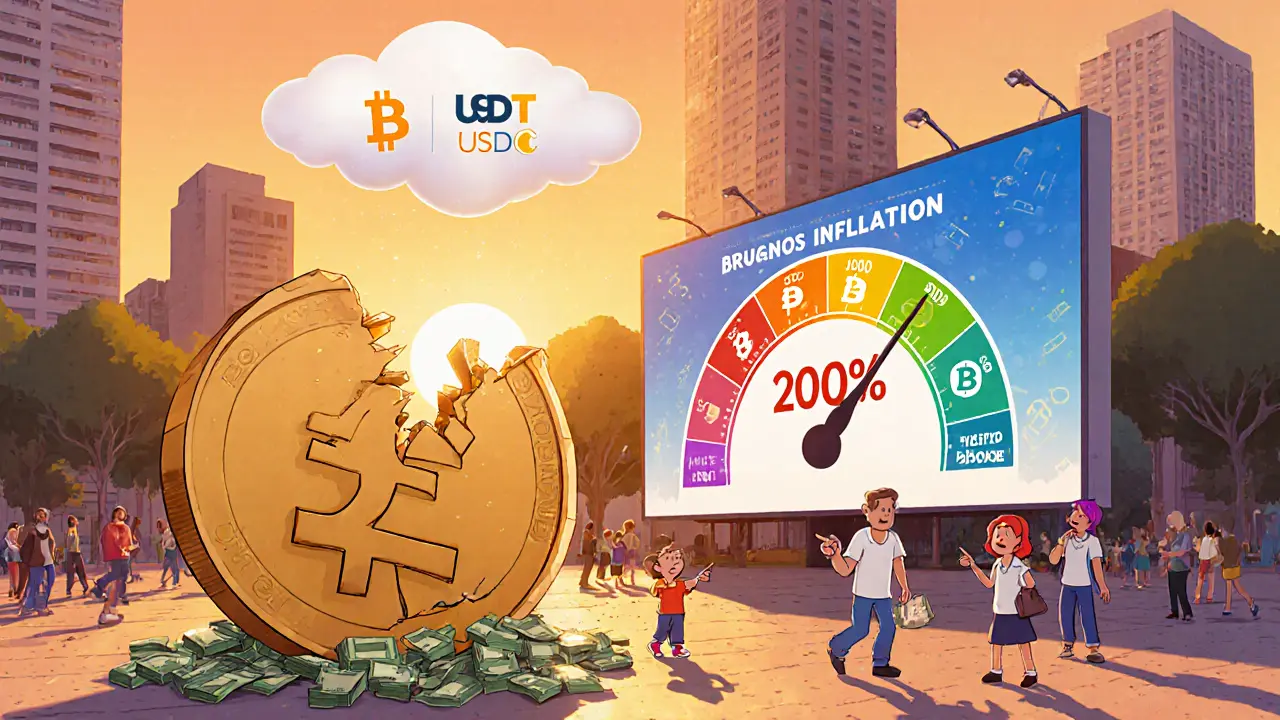

How Argentine Peso Instability Fuels Rapid Cryptocurrency Adoption

Explore how Argentina's peso crisis drives massive crypto adoption, especially stablecoins, and what it means for everyday users and the wider Latin American market.