Unregulated Crypto Exchange: Risks, Real Cases, and What to Avoid

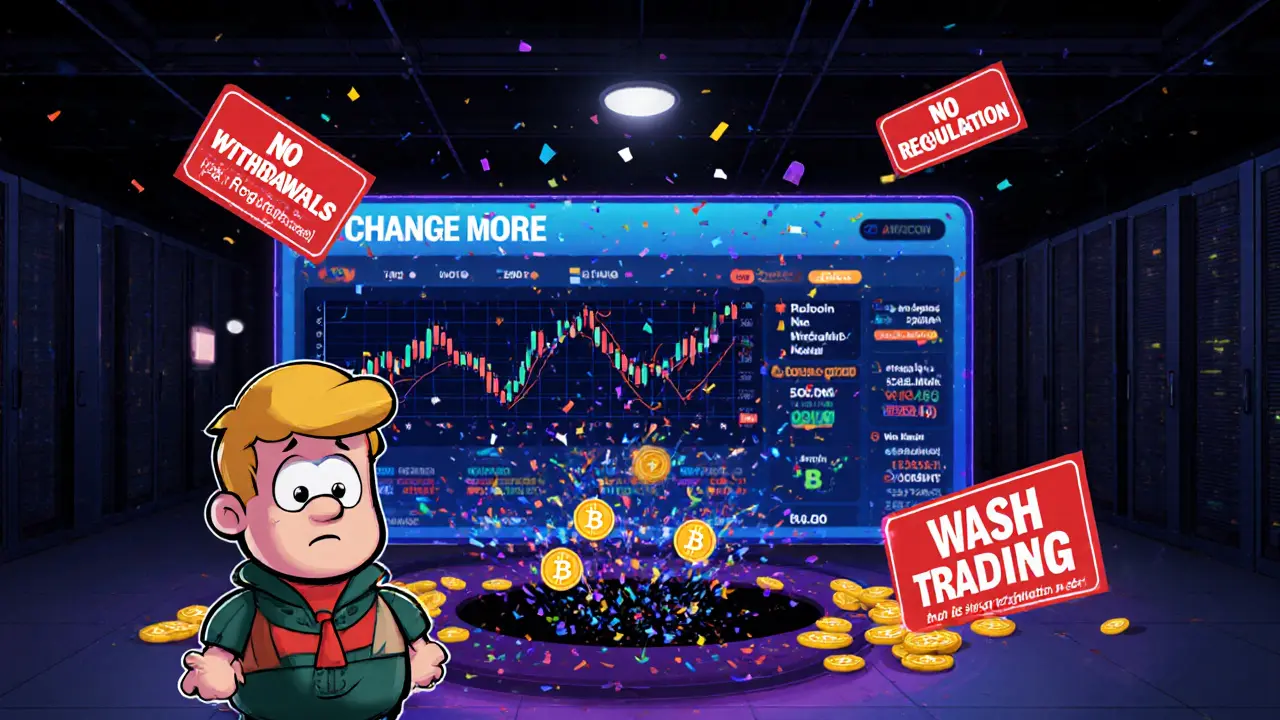

When you trade on an unregulated crypto exchange, a platform that operates without government oversight, licensing, or legal accountability. Also known as unlicensed crypto exchange, it lets you trade without knowing who’s behind the screen—no audits, no insurance, no legal recourse if things go wrong. These platforms pop up fast, promise low fees and high returns, then vanish—sometimes with millions in user funds.

Look at CoinCasso, a once-promoted exchange that claimed Estonian licensing but disappeared in 2025 with users’ money. Or SoupSwap, a DeFi platform with zero trading volume, no audits, and no active team as of 2025. These aren’t outliers—they’re standard. Unregulated exchanges thrive in places where enforcement is weak: Iran’s state-backed mining, Nigeria’s underground P2P networks, or offshore accounts hidden from tax authorities. They don’t need to be legal to attract users—just loud enough to seem real.

Why do people still use them? Because they promise what regulated ones won’t: anonymity, high leverage, or access to tokens banned elsewhere. But that freedom comes at a cost. The SEC, the U.S. agency that cracked down with $4.98 billion in fines in 2024, targets these platforms because they’re where scams grow. And when you lose money on one, there’s no customer service, no refund policy, no lawsuit you can win. Even if you use a crypto mixing, a tool to obscure transaction trails to hide your activity, blockchain tracing still finds you—especially if you’re a U.S. citizen or if sanctions apply, like in Russia or Venezuela.

The truth is simple: if a crypto exchange doesn’t tell you where it’s based, who runs it, or what licenses it holds, it’s not a platform—it’s a gamble. The posts below show you exactly how these failures happen: from Iran’s military-run mining farms draining power grids, to fake meme coins like YOTSUBA that don’t even have a smart contract. You’ll see how offshore accounts get traced, how unlicensed mining fuels sanctions evasion, and why the most dangerous exchanges are the ones no one talks about until it’s too late. What you learn here won’t just save your money—it might save you from a legal nightmare.

Hotbit Crypto Exchange Review: What Happened and Why You Should Avoid It

Hotbit crypto exchange shut down in 2023 after being frozen by law enforcement. With no regulation, $30 withdrawal fees, and no customer support, users lost funds. Recovery services are scams. Avoid unregulated exchanges.

WBF Exchange Crypto Exchange Review: Risks, Red Flags, and Why Most Traders Avoid It

WBF Exchange is an unregulated crypto platform with fake volume, poor support, and withdrawal delays. Learn why it's flagged for wash trading, removed from Google Play, and avoided by serious traders.